At one point on Thursday, it appeared that markets were falling and the dollar was on its way to a corrective upswing. However, buyers took the upper hand. By the end of the day, demand for risk assets had returned to the market as key U.S. indexes closed in the green zone. The Nasdaq 100 updates historical highs again, rising to 11500 on Friday morning.

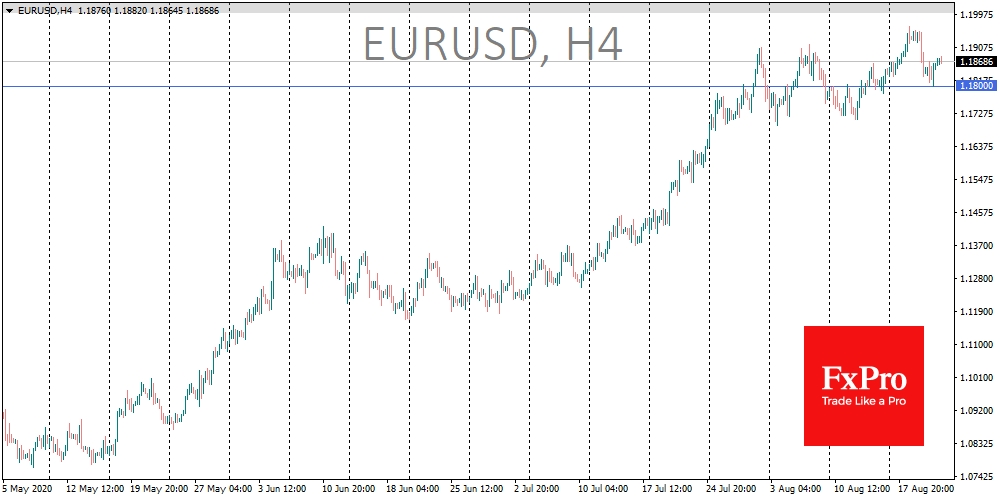

In the FX market, EUR/USD has managed to hold above 1.1800. The pair turned to growth after touching this level, and by the beginning of the European session, it reached 1.1880. The decline from 1.1965 to 1.1800 can be considered as a break for the bulls before another attempt to rewrite the multi-month highs and go above 1.2000.

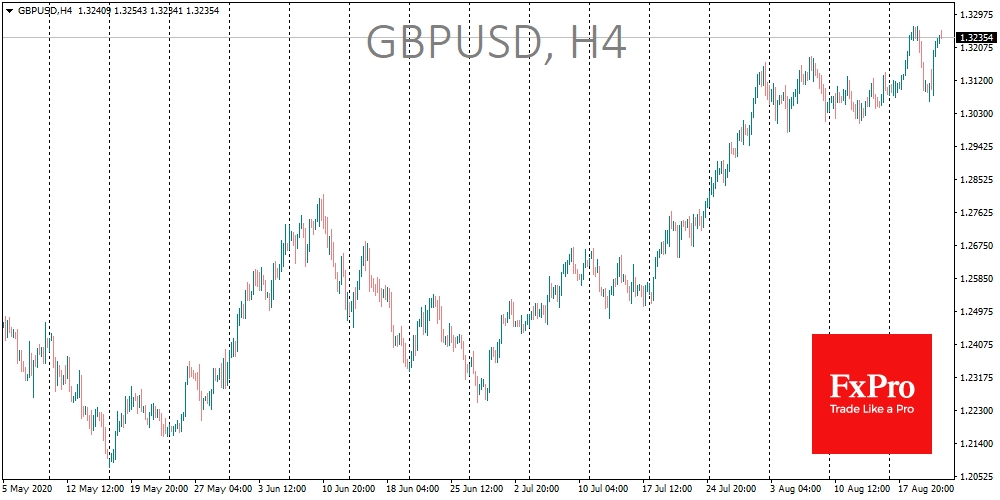

The British pound is gaining even more actively, with GBP/USD pair managing to reach 1.3240, this year highs area.

A separate driver for the pound this morning was the upbeat retail sales report. It showed a 3.6% increase in July against 2.0% expected 2.0%, adding 1.4% to the same month last year.

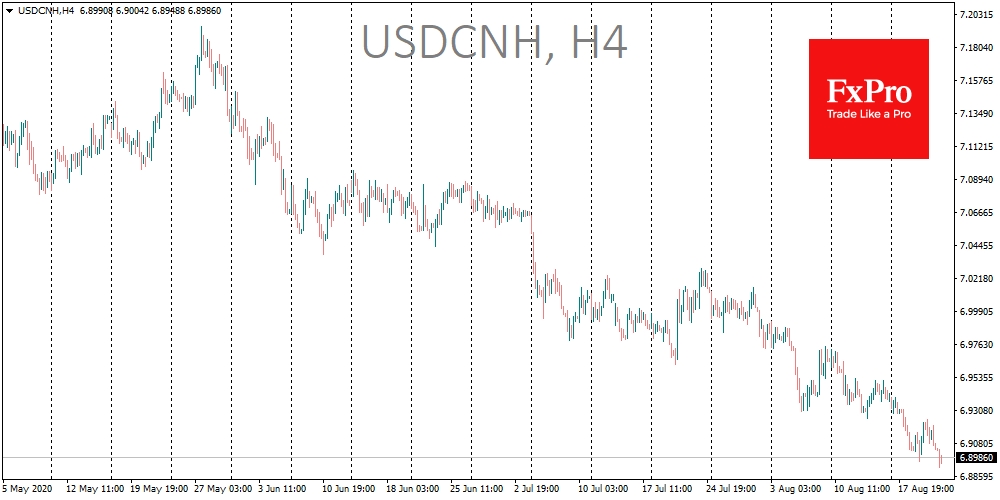

It is worth noting the rise of the yuan. Despite the slippage of Chinese markets, the exchange rate has been showing steady growth since July, taking USD/CNH to its lows since January.

The current situation has shown that investors are ready to buy back even small drawdowns. Positive economic reports encourage purchases, while negative ones are mostly ignored.

The optimism of buyers looking ahead will be tested again today along with the publication of preliminary PMI estimates for August. This indicator has proven to be a reliable assessment of business conditions in the coming months. In the morning, the Japanese manufacturing PMI exceeded expectations, rising from 45.2 to 46.6 but remained below 50, indicating an activity contraction.

If the Eurozone data turns out to be better than predicted, it may cause EUR/USD to test 1.2000. At the same time, negative results of the indicators may return the corrective mood to the markets.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Will Data From Europe Support Market Optimism?

Published 08/21/2020, 05:43 AM

Will Data From Europe Support Market Optimism?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.