On Aug 11, 2017, we issued an updated report on Conatus Pharmaceuticals Inc. (NASDAQ:CNAT) .

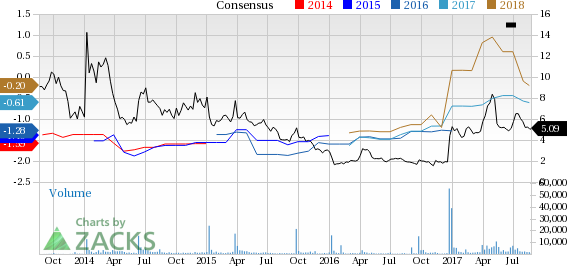

Conatus’s shares have significantly underperformed the industry so far this year, having lost 4.9% as against the industry’s 17.5% increase.

With no approved product in Conatus’s portfolio at the moment, the company has yet to generate revenues. However, it is focused on developing the lead candidate emricasan, an orally active pan-caspase protease inhibitor.

Emricasan is being evaluated through various phase IIb studies for treatment of chronic liver disease, including NASH fibrosis. Ongoing studies include ENCORE-PH and ENCORE-NF, evaluating emricasan on patients with compensated or early decompensated NASH cirrhosis and for potential improvements in fibrosis and steatohepatitis, respectively. Data from ENCORE-PH trial is expected in 2018 and from ENCORE-NF, in 2019.

In May, Conatus initiated another study — ENCORE-LF — a phase IIb trial, examining emricasan as a monotherapy on patients with decompensated NASH cirrhosis. The company also plans to soon initiate an additional study called ENCORE-XT, on emricasan under the ENCORE program.

Conatus is also conducting another phase IIb study — POLT-HCV-SVR — evaluating emricasan on patients with liver fibrosis or cirrhosis, post liver transplant. Top-line data from the study is anticipated next year.

Results of the combined ENCORE studies are expected to support the undertrial candidate’s efficacy and safety in phase III. Further, the strength of this outcome would determine discussions with regulatory agencies to secure a potential accelerated approval for the candidate.

With no treatments currently sanctioned for NASH fibrosis, the market opportunity for emricasan seems significant. NASH is predicted to be the leading cause for liver transplantation by 2020.

However, emricasan is still quite a few years away from entering the market, if at all. Any setback in developing emricasan will pull the stock down substantially.

Notably, several companies are working to develop treatments for NASH namely, Allergan plc (NYSE:AGN) , Intercept Pharmaceuticals (NASDAQ:ICPT) , Galectin Therapeutics and Enanta Pharmaceuticals (NASDAQ:ENTA) among others. Hence, emricasan is expected to face some intense competition once approved.

Zacks Rank

Conatus currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Allergan PLC. (AGN): Free Stock Analysis Report

Conatus Pharmaceuticals Inc. (CNAT): Free Stock Analysis Report

Intercept Pharmaceuticals, Inc. (ICPT): Free Stock Analysis Report

Enanta Pharmaceuticals, Inc. (ENTA): Free Stock Analysis Report

Original post

Zacks Investment Research