Columbia Sportswear Company (NASDAQ:COLM) is slated to report second-quarter 2017 financial results on Jul 27, after the markets close.

The question lingering in investors’ minds is whether this leading distributor of outdoor and active lifestyle apparel, footwear, accessories and equipment, will be able to maintain its positive earnings streak in the to-be-reported quarter.

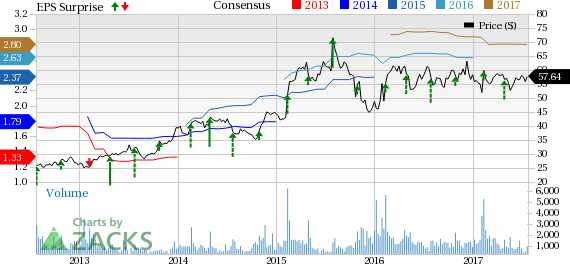

Notably, the company has delivered an average positive surprise of 16.9% in the past trailing four-quarters. In fact, its earnings have outpaced the Zacks Consensus Estimate in 17 straight quarters now.

Let’s now have a closer look at how things are shaping up prior to this announcement.

What Does the Zacks Model Say?

Our proven model does not conclusively show that Columbia Sportswear is likely to beat earnings estimates this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. Columbia Sportswear has an Earnings ESP of -10.00% as the Most Accurate estimate pegged at a loss of 22 cents, while the Zacks Consensus Estimate is at a loss of 20 cents.

Moreover, the company carries a Zacks Rank #4 (Sell). We caution against stocks with a Zacks Rank #4 or 5 (Sell-rated stocks) going into the earnings announcement, especially when the company is witnessing negative estimate revisions.

Columbia Sportswear Company Price, Consensus and EPS Surprise

Which Way are Estimates Treading?

A look into the estimate revisions gives us an idea regarding what analysts are expecting from the company right before the earnings release. The Zacks Consensus Estimate for the second quarter and 2017 has been stable over the last 30 days. The current loss of 22 cents reflects a 66.7% year-over-year decline. Estimate earnings of $2.80 for the year 2017 reflect a year-over-year growth of 2.9%.

Analysts polled by Zacks expect revenues of $394.1 million, in the said quarter, up 1.3% from the year-ago quarter. Also, revenues for 2017 are projected to grow 2.9% to $2.45 billion.

Factors at Play

Despite a robust earnings history, Columbia Sportswear has been facing challenges in the U.S. region, mainly on its wholesale front. This has led to lower-than-expected advance orders during fall 2017 from wholesale customers. This along with tough geopolitical conditions in Korea is hampering the overall sales of the company. Columbia and prAna brands are suffering setbacks in Korea due to a general shift of consumer preference away from outdoor sector in the region. The company anticipates the industry’s glut to persist which makes a recovery very unlikely in 2017.

Moreover, higher excise duties may put pressure on margin and mar the overall profitability. Also, currency headwind remains a major concern for the company and is expected to have a negative impact in 2017.

The impacts of the aforementioned headwinds are visible on the company’s stock that has declined 2.8% over the past three months, compared to the industry’s growth of 6.9%.

Overall Columbia Sportswear has a strong brand portfolio and has been taking several initiatives including strategic joint ventures and acquisitions, to strengthen its presence in the apparel industry. The company has been focusing on further strengthening its SOREL brand, which delivered solid sales results during the first quarter of 2017. Columbia Sportswear, with a strong international presence, is striving towards improving productivity of its distribution channels in China. However, these initiatives are less likely to provide much advantage to the company in the near term.

Still Interested in Consumer Discretionary Stocks? Check these

Here are some companies in the broader sector you may want to consider as our model shows that these have the right combination of elements to post an earnings beat.

Time Warner Inc. (NYSE:TWX) has an Earnings ESP of +3.39% and carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Lululemon Athletica Inc. (NASDAQ:LULU) has an Earnings ESP of +2.86% and carries a Zacks Rank #2.

Cedar Fair, L.P. (NYSE:FUN) has an Earnings ESP of +8.74% and carries a Zacks Rank #2.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020. Click here for the 6 trades >>.

Time Warner Inc. (TWX): Free Stock Analysis Report

Cedar Fair, L.P. (FUN): Free Stock Analysis Report

lululemon athletica inc. (LULU): Free Stock Analysis Report

Columbia Sportswear Company (COLM): Free Stock Analysis Report

Original post