Apple Inc.’s (NASDAQ:AAPL) flagship offering, iPhone could surpass $1 trillion in sales by the end of 2018 bolstered by iPhone X, per a report by TheStreet, which quoted research firm Strategy Analytics.

The revolutionary iPhone, released first in June 2007, had changed the world forever and catapulted Apple to new highs. Apple co-founder and the then CEO Steve Jobs had said that iPhone was a blend of three devices, namely, a "widescreen iPod with touch controls", a "revolutionary mobile phone" and a "breakthrough Internet communicator". The original iPhone was powered by an ARM-based 1176JZ (F)-S processor and had a PowerVR MBX Lite 3D graphics chip. It had a 1400mAH battery.

Upon release, the phone received terrific response. The success of iPhone over the last decade is well chronicled. Reportedly, Apple has sold over 1.2 billion iPhones across the globe earning over $760 billion in revenues.

Valuation Could Also Hit $1 Trillion

Since the first iPhone release, Apple shares have skyrocketed compared with the industry to which it belongs. Over the last decade, Apple stock has returned 826% while the industry witnessed a rally of 387%.

The new iPhone is widely considered to be a super cycle. The edition is expected to be far better than its predecessors with features like a glass body, a dual curved edge-to-edge OLED (organic light-emitting diode) display with wireless charging (USB-C), higher storage options and a far superior camera.

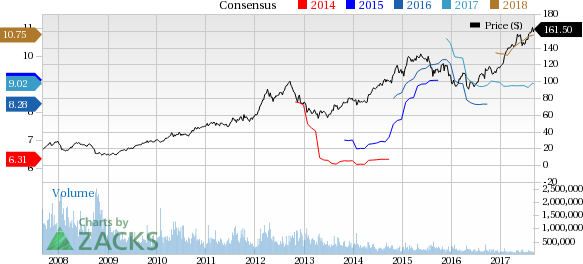

There are also speculations that robust iPhone X sales will make Apple the first company to touch the $1 trillion valuation mark. Currently, Apple’s market cap is $834 billion. Its shares have increased about 36% year over year and hit a 52-week high of $165. Shares are currently trading at $161.50.

Per a Fortune report, an analyst with Canaccord Genuity Michael Walkley said that if Apple can sell 46.5 million and 84 million units in the third and fourth quarters of 2017, it will represent a 5% gain from the same period last year. Consequently, he expects share price to hit $180. Apple shares need to add another $15 to reach the magical market cap figure, observe analysts.

Is the Price Point an Impediment?

However, it is the price point that has been considered by many as an impediment to sales. The new phone is likely to carry a price tag of more than $1000. Many analysts observe that consumers may not be willing to spend that much on a phone whose features aren’t exactly exclusive. For instance, Samsung (KS:005930) phones have OLED display and wireless charging options.

The debate over the exorbitant price has been raging on for some time now. iPhone 7 and 7 Plus editions with 256GB storage carry price tags of $849 and $969, respectively. So a price tag north of $1000 should not be considered unreasonable for a fully redesigned OLED iPhone 8.

iPhone (4GB model) was priced at $499 way back in 2007, which was unheard of back then. Yet, Apple scored a home run with the device. The power of Apple’s fan base though cannot be undermined but with this edition, their loyalty will be tested strongly.

Per a Reuters report, iPhone sales in the United States aren’t likely to be badly disrupted because of the price point. An analyst with Loup Ventures was quoted saying that four out of five consumers who have earlier bought a new iPhone are likely to buy iPhone X. Plus, discounts offered by carriers will also make the price tag affordable.

However, the Reuters report adds that price point could dim iPhone X’s China prospects. The $1000 price tag is double the average Chinese monthly salary. Following the roaring response to iPhone 6, the next edition saw a much subdued response in Greater China, which is Apple’s third biggest market as it was widely perceived that the new edition does not have much new to offer compared with its predecessors, adds the report further.

In the last reported quarter, sales declined 10% year over year to $8 billion. Over the past few quarters, Apple’s iPhone sales have been marred, especially in China, by increasing competition from cheaper handsets like Oppo and Vivo. With iPhone X, Apple is looking to reverse that trend.

Reuters quoted Mo Jia, a Shanghai-based analyst at Canalys, “Apple really needs to launch a very innovative product this time around. However, the rising clout of local rivals would nevertheless make life tough for the U.S. firm, he said. It has its work cut out."

At present, Apple carries a Zacks Rank #3 (Hold).

Stocks to Consider

Better-ranked stocks in the broader technology sector include Applied Materials (NASDAQ:AMAT) , Activision Blizzard (NASDAQ:ATVI) and FormFactor Inc (NASDAQ:FORM) , all sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Applied Materials, Activision and Applied Optoelectronics is currently projected to be 17.1%, 13.6% and 16%, respectively.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Apple Inc. (AAPL): Free Stock Analysis Report

FormFactor, Inc. (FORM): Free Stock Analysis Report

Activision Blizzard, Inc (ATVI): Free Stock Analysis Report

Applied Materials, Inc. (AMAT): Free Stock Analysis Report

Original post

Zacks Investment Research