Key Points:

- Effective OPEC production cuts unlikely.

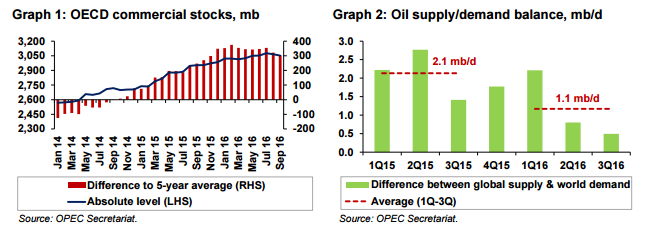

- Crude oil rebalancing still ongoing.

- Expect further jawboning from the cartel.

Crude oil prices marched higher through most of last week as global futures markets reacted to news emanating from OPEC that production cuts could be looming. This has seen the commodity catch a bid and rise convincingly back above the $48.00 handle in a move that will be sure to please the bulls. However, some cracks are starting to appear in the cartel’s rhetoric as Iran, Iraq, and Indonesia express concerns about their level of participation in any form of production cut. Subsequently, WTI prices slipped overnight to around $47.88/barrel as uncertainty continues to rain supreme over OPEC’s future direction.

At this stage, the market has been left with some relatively unclear intentions from the pre-eminent cartel. Despite a string of OPEC pundits suggesting that a deal on production “cuts” is all but done, the reality is that nothing is set in stone. In fact, there are plenty of reasons to suggest that any potential deal could fall over before it even starts with the building economic pressures within the few dissenting countries.

In particular, Iran is unlikely to countenance any such deal given their recent return to the international markets and need for foreign currency in-flows. Subsequently, the coming OPEC meeting could be significantly more acrimonious than some of the market pundits would have you believe.

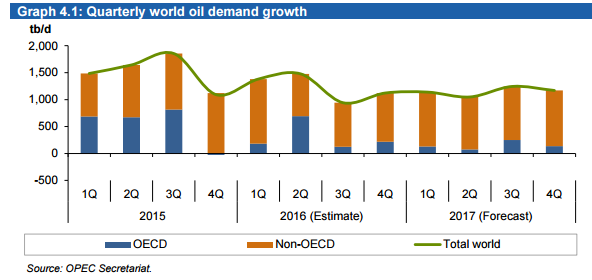

The reality is that OPEC’s relevance as a trade cartel has diminished over the past few years given the rise in prominence of shale oil and the removal of the U.S. export restrictions. Subsequently, OPEC doesn’t exercise the same level of market control that they once did. In addition, world demand has continued to slump since late 2015 and we are most definitely facing declining demand for crude oil.

Subsequently, this environment is one in which sharp production cuts are simply not enough to rebalance the oil industry. This is clearly evidenced by the fairly rapid uptick in the U.S. rig count over the past few weeks as the price of oil has ticked higher. The fact is that crude oil is fungible and operates within a global integrated market which means that OPEC doesn’t necessarily have a free hand to balance things, as in the past. This alone almost guarantees that the route to the needed production cuts is a difficult one.

Ultimately, the most likely outcome is one of inaction from the cartel members as their economic self-interests fail to align. Subsequently, don’t believe the current hype surrounding production cuts as the only way forward for the oil sector.