“Selling cash-secured puts is the exact same strategy as covered call writing”. We hear that over and over…except that it’s not. These two strategies have the same risk/reward profiles and that is why the claim is made so frequently. On page 214 of my book, Selling Cash-Secured Puts, I highlight a comparison chart showing similarities and differences between the two strategies. In this article, I will add another distinction as it relates to position management in a bear market environment and specifically when our underlying security is declining in value. A declining stock is not our friend whether we are selling calls or puts.

How to we manage a declining underlying security?

All exit strategies start the same way…we buy back the option. In covered call writing, we have a series of “next-steps” based on several parameters including overall market assessment, chart technicals and time frame within a contract. When selling puts and our 3% guideline is reached, we generally use the cash freed up by closing the original short position to secure another put on a better-performing underlying. It’s the cost to close our short positions that will underscore another contrast between the two strategies.

Delta and option premiums

Delta is the amount an option premium value will change when share price moves up or down by $1.00. It is the likelihood a strike price will end up in-the-money by expiration. Since the moneyness of calls and puts are inversely related, option premiums take different roads when share prices declines…call value moves down while put value accelerates. therefore, the cost to close a short position will be greater for puts than for calls.

Real-life example

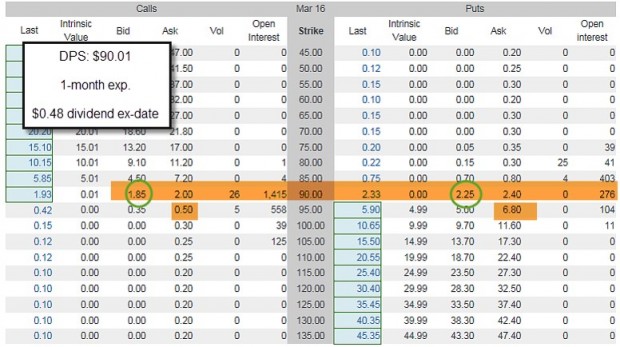

On 2/19/2016, Dr. Pepper Snapple Group (NYSE:DPS) was trading at $90.01, right at a strike price and perfect for our analysis. Here is a screenshot of the options chain highlighting the $90.00 and $95.00 strikes for the March 18, 2016 1-month expirations:

This is also a great learning tool because there is an ex-dividend date projected prior to contract expiration. This will reduce the call value and increase the put value but the call seller (share owner) will capture the $0.48 dividend. Without the ex-date, the two premiums are expected to be quite close. The call seller will generate the bid premium of $1.85 plus the dividend of $0.48 for a total credit of $2.33. The put-seller generates a bid premium of $2.25. The initial returns on both calculate to a 2.6% 1-month, initial return.

What if share price declines $5.00 to $85.00?

The $90.00 call strike moves deep out-of-the-money causing option value to decline. The current $95.00 call strike ($5.00 out-of-the-money) shows an “ask” premium of $0.50, much lower than the premium generated from the original call sale. As share value declines the cost to buy back the call option becomes less expensive. Of course, we must keep an eye on the debit created by share devaluation.

The $90.00 put strike moves deep in-the-money causing the premium value to accelerate substantially. The current $95.00 put strike ($5.00 in-the-money) shows an “ask” premium of $6.80, much higher than the premium generated from the original put sale. As share price declines, the cost to buy back the put option gets more expensive.

Closing our positions when share price is $85.00 for covered call writing

Let’s assume the “ask” prices are in play when we close. We have a share loss of $5.01 and an option and dividend credit of $2.33 ($1.85 + $0.48). This nets to a debit of $3.17 on a cost basis of $90.01 = a loss of 3.5%. This assumes no position management along the way, something that would never happen to us…right?

Closing our positions when share price is $85.00 for put-selling

We have an option debit of $4.55 ($6.80 – $2.25) on a cost basis of $87.75 ($90.00 – $2.25) = 5.2%, almost 50% worse than the covered call writing scenario (share value decline should also be factored in). This assumes no position management along the way, something that would never happen to us…right?

Discussion

In bear markets, we must be aware of the fact that the cost to buy back a put option on a declining stock will be more expensive than closing a short call. This does not eliminate put-selling from our arsenal in bear markets but does highlight the need to use deeper out-of-the-money puts for downside protection. In addition, we must be diligent about employing our 3% guideline and not allow share value to decline to the extent discussed in this article. In this scenario, we would have closed our short put when share value reached $87.30, cutting our losses approximately in half. We also must have a higher cash reserve to buy back options when share value decreases after selling puts.

Market tone

I am devoting this week’s market tone segment entirely to Brexit.

On Thursday the United Kingdom voted to leave the European Union (EU). The UK is the world’s fifth largest economy representing 3% of the world’s economy. This decision was unexpected by most experts. The vote itself is not a binding decision and the full impact may not be clear for a few years. The results will be incorporated into an Act of Parliament in the UK which will be passed on to the EU. This will take place in a few months which is why Prime Minister Cameron has announced that he will resign in October so a new prime minister can take the lead from there. This will then start a two-year process of negotiating the UK exit from the EU. Suffice it to say that the period of uncertainty will last longer than a few days or even weeks or months.

Much of the concern relates to the favorable trade agreements the UK currently has with the EU which will change in context, the UK’s sovereign credit rating being downgraded and how changes in UK’s immigration policy will impact the job market in the EU…nobody knows for sure. Despite all the experts weighing in (and I don’t consider myself an expert in this area), as always, half will be right and half will be wrong. Remember, these are the same folks who predicted a “stay vote”

There is also concern of a domino effect with other countries currently in the EU expressing similar dissatisfaction with the globalization of their economies and politics.

When markets have days like we had on Friday or huge up days after unexpected positive news, we know from past history that the “real stock market” lies somewhere in between the two. So from all the ugliness that we experienced on Friday were there any positives to be gleaned?

To start, the central banks made it clear that they would work together to suppress volatility and provide liquidity to the financial institutions. A rate cut by the Bank of England in July is more likely and a rate increase by the US Federal Reserve has now become extremely unlikely for this calendar year. Friday’s market action was surely nothing to smile about but it could have been a lot worse and perhaps certain buying opportunities were created. Even in bearish and volatile markets there are always best-performers and it is our job to find them. For example, from our latest Premium Member ETF Report dated 6/22/2016, here are five exchange-traded funds results from yesterday’s market decline:

- VanEck Vectors Gold Miners (NYSE:GDX): +5.91%

- VanEck Vectors Junior Gold Miners (NYSE:GDXJ): +4.98%

- Utilities Select Sector SPDR (NYSE:XLU): +0.56%

- iShares Silver (NYSE:SLV): +2.43%

- iShares 20+ Year Treasury Bond (NYSE:TLT): +2.68%

From there, how we enter our positions can be crafted to an uncertain market environment (using in-the-money calls, out-of-the-money puts, low-implied volatility ETFs, low-beta stocks to name a few approaches). Not all investors are comfortable trading in volatile and uncertain markets and only you can make that decision but if we do, let’s do it smart, non-emotional and base our decisions on sound fundamental, technical and common sense principles. Many corporations are run by brilliant and experienced board members who seem to find ways to readjust and flourish even in challenging environments. My expectation is that Brexit will not be an exception to this observation…just one man’s opinion.

For the week, the S&P 500 declined by 1.64% for a year-to-date return of (-)0.32%.

Summary

IBD: Uptrend under pressure

GMI: 5/6- Buy signal since market close of May 25th (published prior to Brexit vote)

BCI: Not entering new positions or investing unused cash until the dust settles from the Brexit vote. Any new positions taken will be defensive in nature.

WHAT THE BROAD MARKET INDICATORS (S&P 500 AND VIX) ARE TELLING US

The charts are demonstrating signs of a bearish short-term outlook although this 100% due to the Brexit vote. In the past six months the S&P 500 is flat and the VIX has increased by 65% to 25.76. I like to see the VIX under 20.