There’s a very easy (and costly) mistake you can make when picking funds. And plenty of folks make it every day.

These investors run up on the rocks because this error looks like a good idea, until you dig just a little bit deeper.

Today I’m going to show you exactly what this mistake is and reveal three laggard funds that just might tempt you into making it. The worst part? They don’t even pay you a dividend for your trouble!

First, the mistake itself: I’m talking about choosing a fund because it has one big winner in its portfolio.

Sound like nonsense? That’s what many people say when I warn them that just because a fund has one killer stock in it, that doesn’t mean it’s a good fund. But the truth is, this is a useful piece of advice that can help you avoid a big mistake now and in the future.

The Big Winner

To show you what I mean, let’s look at the best non-penny-stock performer of 2019, a company you’ve probably never heard of: Axsome Therapeutics (AXSM).

757% Returns in 6 Months!

Who wouldn’t want a return like that in half a year? The problem, of course, is finding those winners before everyone else does.

AXSM is a development-stage biotech company mainly working on drugs to battle Alzheimer’s, depression and other common ailments. It has three treatments in Phase 3 trials (for Alzheimer’s, depression and migraines) and four others in Phase 1 or Phase 2 trials.

Great—and even better if these drugs get final approval, come to market and help future patients. But for now, investors simply can’t know whether Axsome will become a multi-billion-dollar company (it’s closing in on a $1-billion market cap already) or become worthless as its drugs fail to get approval.

To mitigate the risk of buying a bunch of hopeful drug companies that end up producing nothing, many investors choose a fund with biotech exposure. But that raises a question: would you have done well by investing in a fund holding Axsome in 2019?

The answer is no.

In fact, the top three funds holding this stock have had lackluster returns when we compare them to the SPDR S&P 500 ETF (NYSE:SPY). To explain why, let me first introduce you to our cast of characters.

The three funds that have the heaviest exposure to AXSM are:

- Invesco DWA SmallCap Momentum ETF (DWAS)

- Royce Low-Priced Stock Fund (RLPHX)

- Bridgeway Ultra-Small Company Market (BRSIX)

DWAS is a so-called “smart beta” ETF with fixed rules computers use to buy and sell stocks with minimal human intervention. As such, it only got into AXSM after the stock started to soar—so we can’t rely on it to “pick” big winners before the market has woken up to them.

That leaves the two mutual funds, which focus on high-potential micro-cap companies picked by the funds’ managers. These funds are designed to identify the best companies before the rest of the market does.

Has this strategy worked in 2019? Not really.

A Mixed Bag

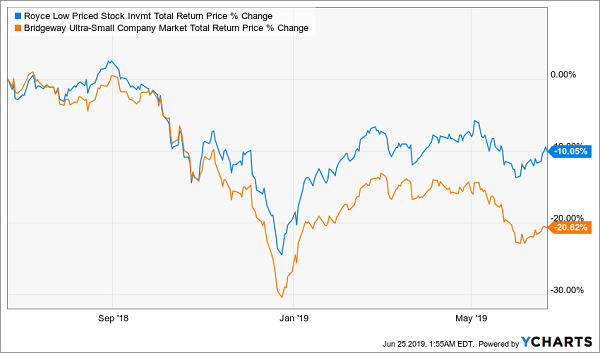

Neither fund has beaten the S&P 500’s 18% total return for 2019, which means just choosing the winning AXSM wasn’t enough.

The reason? One 750% return wasn’t enough to offset each fund’s losers. If we look at the performance of both funds’ top holdings in the last year, we see that neither held a ton of big winners like AXSM. Instead, their holdings included duds that have gone down, which explains this chart:

Losing Picks Offset Big Winners

The takeaway? When looking at a fund’s portfolio, we need to go deeper than management’s best pick. That’s because these home runs can be a matter of luck, and they can hide many lackluster (or worse) selections.

Alert: This 7.2% Dividend Could Soar Double Digits

The jaw-dropping dividend play I’ll reveal tomorrow morning simply should not exist.

This mind-blowing fund pays a 7.2% dividend now.

That’s a game-changer on its own. But there’s more. Because this fund is showing every sign its about to drop a big dividend hike on its investors. Its last increase was stunning: a 36% “pay raise”!

Add it all up with the price gains I’m forecasting, and you’re looking at a 20%+ total return in the next 12 months here.

I’ll release full details in my CEF Insider publication tomorrow morning, and I want you to be among the first to get it. It’s just one of the many wealth-building benefits you get when you try CEF Insider for 60 days risk-free.

I’ll also share with you:

- The most reliable profit indicator in ALL of investing. Buy when it flashes and get set for quick DOUBLE-DIGIT profits!

- 4 incredible fund picks with yields 5 TIMES HIGHER than the S&P 500 average! I’m talking about an unbelievable 8.7% average cash payout.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."