I have said for a long time, that I see the S&P 500 breaking out of this recent period of consolidation and moving significantly higher from current levels. However, I have been growing increasingly more cautious over this past week. Mostly because I am beginning to believe that we have one more pullback in store before that next rally finally occurs.

Over the next month, we could see a rather sharp 3 to 5% pullback. The reason for that is the index is at least for the moment is showing some signs topping out.

First, off the S&P 500 was rising with a very nice uptrend since the August lows of 2825. It appears that uptrend may have finally been broken. Additionally, there is a pretty sizeable gap that needs to be filled around the 2935 region. Which when measured from the intraday high on September 19 of around 3,022 is just about 3%.

Additionally, the number of stock trading above their 200-day moving average has now reached the peak of the recent range and is already starting to give back some.

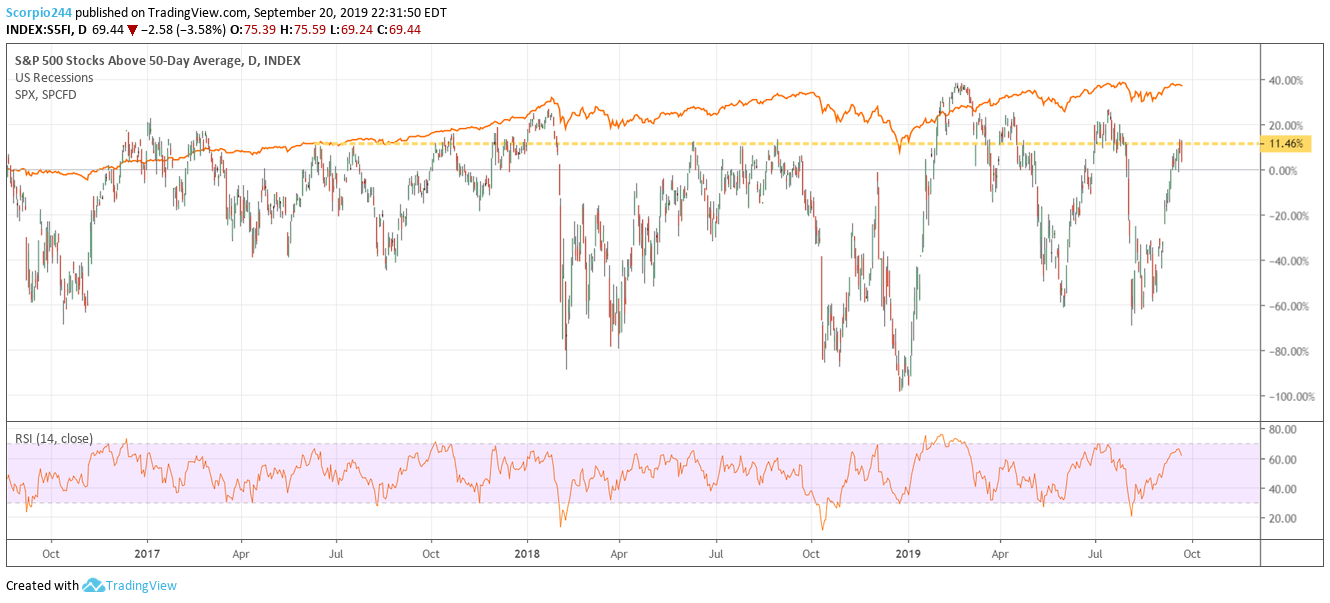

The number of stock trading above their 50day moving average has climbed to the peak of the range.

The comparison between the 50day and the S&P 500 is pretty clear.

The Next Leg Higher

What is also becoming clear is that the index is likely to rise significantly in the months to come. Below is a new chart I have been working on, and I find it rather interesting.

The chart goes back to 2011 and shows that there have been three periods since that time that saw at least one pullback of 15%, and a period of sideways consolidation of roughly 20 months.

In both 2012 and 2016, once the index broke above its resistance level, it then proceeded to test that resistance level for 4 months. It was on the 5th month that the index advanced higher by 50% starting in 2012, and by 35% in 2016.

If the pattern continues this year, it indicates that the next big leg higher has started with the index testing support. It would also suggest that the big break out start towards the end of October or the beginning of November.

Overall, a period of short-term volatility may prove the last and final drawdown of this cycle before the next big up begins.