The S&P 500 fell 1.5% on Thursday. In all fairness, we have seen one-day sharp drops in the market many times before. Every past drop has been an amazing buying opportunity. However, Thursday's sharp decline is very different. Let me go over the reasons.

1. Volume was big. This implies institutional investors and hedge funds were selling.

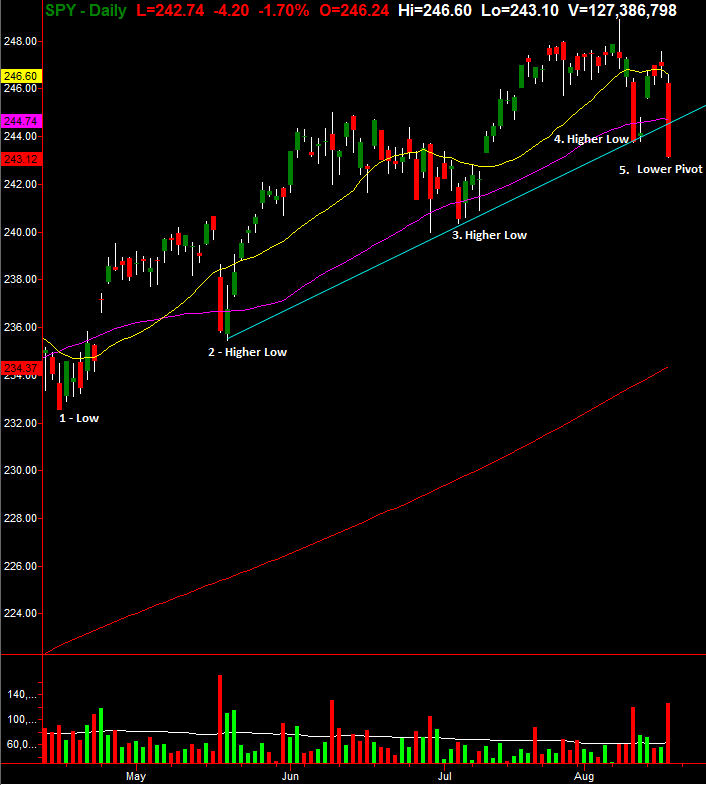

2. This is the first drop in recent history that has taken out a previous drops low. This means on a technical basis, there is a lower-low in place, a bearish sign.

3. A trend line connecting the previous pivot lows throughout 2017 has been broken to the downside. This implies a key technical break.

4. CEOs abandoning Trump is a huge negative for moving forward business friendly objectives. Whether it is infrastructure spending, tax cuts or a corporate repatriation holiday.

The bottom line is, this may be different than past buy-the-dip opportunities.