The semiconductor industry is killing it right now. And if you’ve been paying attention to what’s happening in the broad tech market, you may be wondering why.

Indeed, just about everything with a screen is full of these tiny metalloids. Yet the PC and smartphone industries aren’t doing so hot right now. They’re struggling to maintain sales growth - and competition is only getting more intense.

So how are some semiconductor ETFs beating the S&P by more than 15%?

Two reasons...

VR and the Cloud: New Technologies, Same Old Semiconductors

First, you should know that sluggish PC sales and growth in semiconductor demand are actually related.

Lots of consumers are choosing to run cloud-based computing services on cheaper devices. That cuts into the demand for high-end computers. But it’s actually a boon for semiconductors - because they’re being used in corporate infrastructure (i.e., server farms that make “the cloud” possible).

Another source of fuel for the rally is virtual reality.

Right now, VR is the hottest thing in tech research and development. Industry pioneers like HTC and Oculus Innovative Sciences Inc (NASDAQ:OCLS) are awash in media buzz. And their VR headsets depend on advanced graphics cards - which use lots of semiconductors.

How to Profit From the Semiconductor Industry

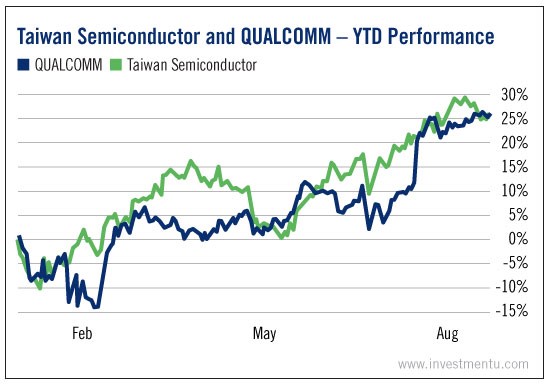

There are a variety of ways you could cash in on this silicon surge. More scrupulous investors may be interested in individual company stocks. Taiwan Semiconductor Manufacturing (NYSE:TSM) and Qualcomm Incorporated (NASDAQ:QCOM) are major players in the semiconductor market. And they’re both up 25% this year.

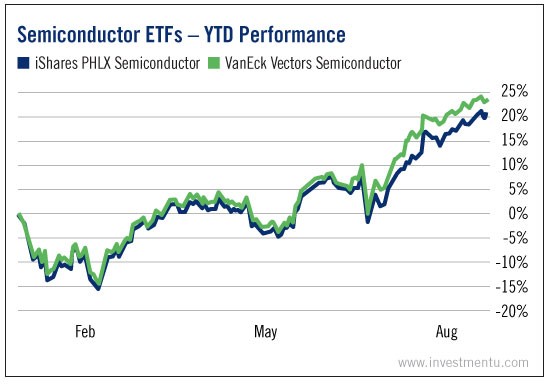

There are plenty of ETFs, too. (The benefit of an ETF is that it provides more diversification and, along with it, lower risk than individual stocks.)

Two big names are iShares PHLX Semiconductor (NASDAQ:SOXX) and VanEck Vectors Semiconductor (NYSE:SMH). Again, both have made impressive gains this year.

This rally is no fluke. Semiconductors are in everything. And demand shouldn’t wane anytime soon. Whether you’re a techie or a tech novice, your portfolio should have some exposure to the companies behind today’s biggest innovations.