Arch Capital Group Ltd. (NASDAQ:ACGL) has effectively confirmed to evolving demands and expectations of clients for years, building up a solid product and service portfolio in the process. Keeping this performance intact, the company continues to push the envelope only to grow from strength to strength in the future.

Arch Capital has evidently maintained an exemplary track record of net premiums written over a considerable period of time. A continued rise in premiums has been driving better results, enabling the company to show sustained revenue growth for the past few years. Thus, we expect this positive trend to carry on, driven by the company’s diverse product and service portfolio.

The company also has been making some substantial efforts in expanding its U.S. Mortgage Insurance Business. To that end, the acquisition of United Guaranty, completed on Dec 31, 2016, will help Arch Capital significantly increase its U.S. market share. The extension of the mortgage insurance business complements the company’s forte in specialty insurance and reinsurance businesses, a key element to global operations.

The company’s robust inorganic portfolio through strategic acquisitions, have in turn not only helped the company to widen its footprint internationally but have also added capabilities and boosted operations. To that end, on Jul 1, 2017, Arch Capital closed the AIG United Guaranty Insurance (Asia) Limited buyout from American International Group (NYSE:AIG), Inc. This buyout will enhance the company’s private mortgage insurance businesses, operating in the United States, Europe and Australia. Hence, we believe the company to continue uplifting its inorganic portfolio via such acquisitions, thereby accelerating overall growth.

The Zacks Rank #3 (Hold) property and casualty (P&C) insurer boasts a solid capital position, backed by strong liquidity. The company props up shareholders’ value, courtesy share buybacks and dividend payments. A powerful capital and liquidity status shields it from market volatility and enables it to retain financial strength and flexibility to pursue new opportunities in keeping with long-term strategies.

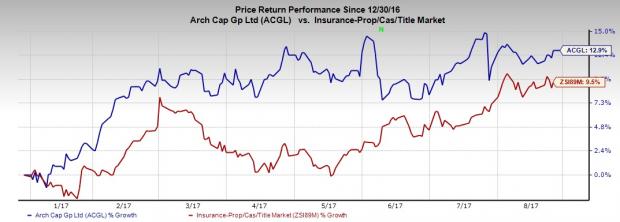

Shares of Arch Capital have rallied 12.89% year to date, outperforming the industry’s 9.46% increase. We expect bottom-line and continued premium growth, apart from better underwriting results and a stable capital position to drive the stock higher in the near term.

However, the company’s escalating expenses are a headwind as it might restrict the operating margin expansion. Also, exposure to catastrophe losses is a challenge.

Nonetheless, the company has a trailing 12-month return on equity (ROE) of 8.8%, higher than the industry average of 6.2%. Also, the company’s expected long-term earnings growth is pegged at a decent 11.00%, somewhat better than the 10.40% industry average.

Stocks to Consider

Some better-ranked stocks from the insurance industry are First American Corporation (NYSE:FAF) , CNO Financial Group, Inc. (NYSE:CNO) and Argo Group International Holdings, Ltd. (NASDAQ:AGII) , each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

First American Corporation provides financial services. The company delivered positive surprises in all the last four quarters with an average beat of 12.64%.

CNO Financial develops, markets and administers health insurance, annuity, individual life insurance and other insurance products for senior and middle-income markets in the United States. The company delivered positive surprises in three of the last four quarters with an average beat of 6.69%.

Argo Group underwrites specialty insurance and reinsurance products in the property and casualty market worldwide. The company delivered positive surprises in all the last four quarters with an average beat of 26.51%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

CNO Financial Group, Inc. (CNO): Free Stock Analysis Report

First American Corporation (The) (FAF): Free Stock Analysis Report

Arch Capital Group Ltd. (ACGL): Free Stock Analysis Report

Argo Group International Holdings, Ltd. (AGII): Free Stock Analysis Report

Original post

Zacks Investment Research