The discount store industry continues to enjoy a favorable spot within the Retail sector, which is evident from solid performance of its players, including Ross Stores Inc. (NASDAQ:ROST) . The company is among few in the space that has been consistent with earnings performance and is also gaining momentum from store expansion and merchandising initiatives. Additionally, a robust forward outlook and strong financials anchor its fundamental strengths.

Not only this, the company is benefiting from the favorable response of value-focused customers to its extensive collection of brand bargains and solid cost controls. These factors have helped the stock attain the Zacks Rank #2 (Buy), with a VGM Score of A. The company also possesses a long-term EPS growth rate of 10.4%.

Stock Has No Looking Back

Ross Stores has achieved a marked 5.6% growth in the past month, outperforming the industry’s 0.3% decline. The momentum in the stock price can largely be attributed to its solid past performances as well as growth initiatives.

Strong Earnings Trend Underscores Future Potential

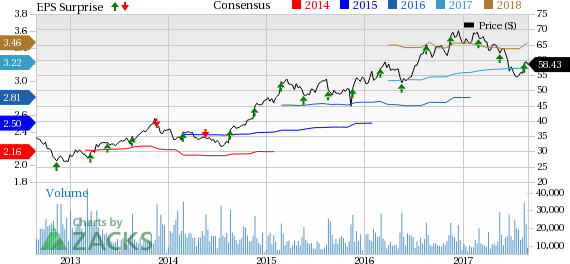

Ross Stores reported strong second-quarter fiscal 2017 results, wherein both the top and bottom lines beat the Zacks Consensus Estimate and improved year over year. Further, earnings topped the company’s projection. Notably, it has delivered positive earnings surprise in 12 of the last 13 quarters. Moreover, the company’s average positive surprise in the trailing four quarters is pegged at 6.3%.

Second-quarter results gained from solid top-line growth that was backed by broad-based growth across all merchandise categories and regions. Further, better-than-expected sales and operating profits at dd's DISCOUNTS aided results.

Raised FY17 View Drives Estimates

Concluding first-half fiscal 2017 on a strong note, the company provided guidance for the second half and accordingly raised earnings view for fiscal 2017. The company now projects earnings per share for fiscal 2017 in the range of $3.16-$3.23, reflecting a 12-14% growth year over year. Earlier, the company had forecasted earnings per share in the range of $3.07-$3.17 for fiscal 2017.

This led to an uptrend in the Zacks Consensus Estimates in the last 30 days. The Zacks Consensus Estimate for fiscal 2017 and fiscal 2018 rose to $3.22 per share and $3.46 per share, respectively, from $3.15 and $3.39.

Splendid Growth Strategies

Ross Stores’ continued focus on enhancing merchandise through investments in workforce, processes and technology, remains a key strategy to keep itself on the growth trajectory. The company continually fine-tunes and upgrades its systems and processes to enhance productivity. Further, it is particularly committed to improving assortments in the ladies’ apparel business. We also applaud Ross Store’s ability to run the business with leaner inventory levels and faster inventory turnover. The company remains focused on cutting down inventories at stores to the optimum level as well as making the right assortments available at the right store at the right time. This is likely to help the company to continue boosting margins. All these endeavors, combined with Ross Stores’ robust store expansion program hint at superb ongoing prospects for the company.

Shareholder-Friendly Moves

Ross Stores’ commitment toward enhancing shareholders value is evident from its dividend payment history and share repurchase programs. In fiscal second-quarter, the company bought back 3.6 million shares for about $215 million. Further, it remains on track to repurchase $875 million worth shares in fiscal 2017 under its two-year $1.75 billion share repurchase program approved in February 2017. The company paid dividends worth nearly $124 million in first-half fiscal 2017. Other than its focus on shareholders, these moves also underscore the company’s financial flexibility.

Bottom Line

Though none in the sector are safe from the ongoing challenging backdrop, we believe that this California-based company is moving in the right direction and is likely to sustain its overall performance in going ahead.

Looking for More? Check these 3 Trending Stocks from the Same Industry

A few other top-ranked stocks in the same industry are Big Lots, Inc. (NYSE:BIG) , Burlington Stores, Inc. (NYSE:BURL) and Dollar General Corporation (NYSE:DG) , carrying the same Rank as Ross Stores. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Big Lots, with a long-term EPS growth rate of 13.5%, has a spectacular earnings surprise history. Further, the company’s estimates for the current fiscal have witnessed an uptrend in the last seven days.

Burlington Stores has a long-term EPS growth rate of 16.2%. The stock also has a sturdy earnings surprise history and has gained nearly 4% in the past year.

Dollar General has a long-term growth rate of 10.9%. Also, the stock delivered back-to-back positive earnings surprises in the last two quarters and returned about 4.6% in the last three months.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

Learn more >>

Dollar General Corporation (DG): Free Stock Analysis Report

Ross Stores, Inc. (ROST): Free Stock Analysis Report

Big Lots, Inc. (BIG): Free Stock Analysis Report

Burlington Stores, Inc. (BURL): Free Stock Analysis Report

Original post

Zacks Investment Research