Stocks declined, but will they run higher next? Tuesday‘s downswing changed precious little, and the Congressional testimony was a non-event. The key happening was in long-dated Treasuries, which rose yet again – the much awaited rebound is here, and brings consequences to quite a few S&P 500 sectors.

The index is likely to advance, but the engine is going to be tech this time – not value stocks. I view this as a deceptive, fake strength in the bull market leadership passing over to value inevitably next. That‘s why I expect the S&P 500 advance to unfold still, a bit rockier than it could have been otherwise. This will hold true for as long as TLT is at least somewhat rising:

(…) technology would recover some of the lost ground on rates stabilization. ...the $UST10Y move has been a very sharp one, more than tripling from the August 2020 lows.

Technology declined yesterday, and so did value stocks. Many markets went through selloffs yesterday, among commodities most notably oil. While nothing has substantially changed, we got a serious whiff of risk-off environment, pertaining precious metals too.

Especially concerning was the miners underperformance, given that none of the moves indicated accumulation within the sector. Reason number two to expect precious metals short-term vulnerability was ignorance of retreating yields that stretches a bit further below what can be viewed as a run of the mill precious metals upswing correction. A short-term crack in the iShares 20+ Year Treasury Bond ETF (NASDAQ:TLT) decoupling dam that can still be reversed even though it doesn't look likely at the moment.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

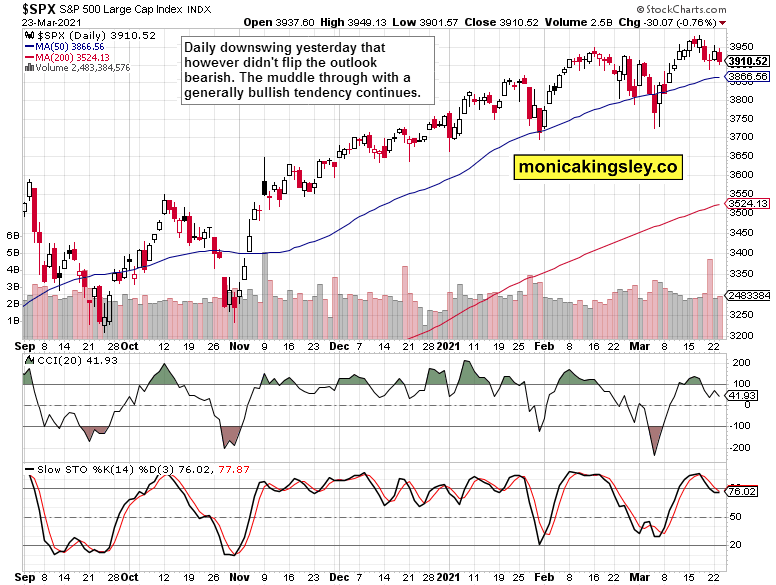

S&P 500 Outlook

Regardless of yesterday‘s setback, the outlook in stocks hasn't changed. Once the current corrective move is over and value reassumes leadership, expect the gains to be more pronounced than what we would experience rather shortly.

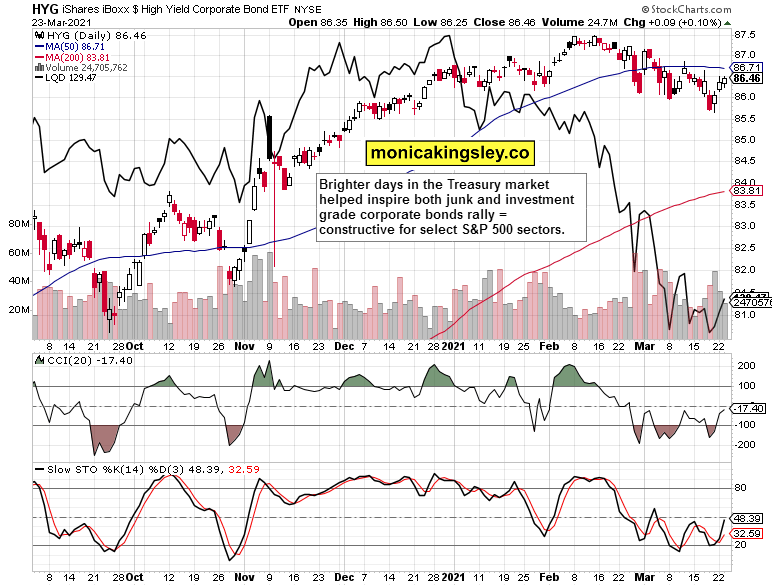

Credit Markets

Both high-yield corporate bonds (iShares iBoxx $ High Yield Corporate Bond ETF (NYSE:HYG)) and investment grade corporate bonds (iShares iBoxx $ Investment Grade Corporate Bond ETF (NYSE:LQD)) moved higher. LQD's upswing was backed by a rising volume. The bond markets are coming back into favor, taking a little lustre off the stock market appeal on the daily basis.

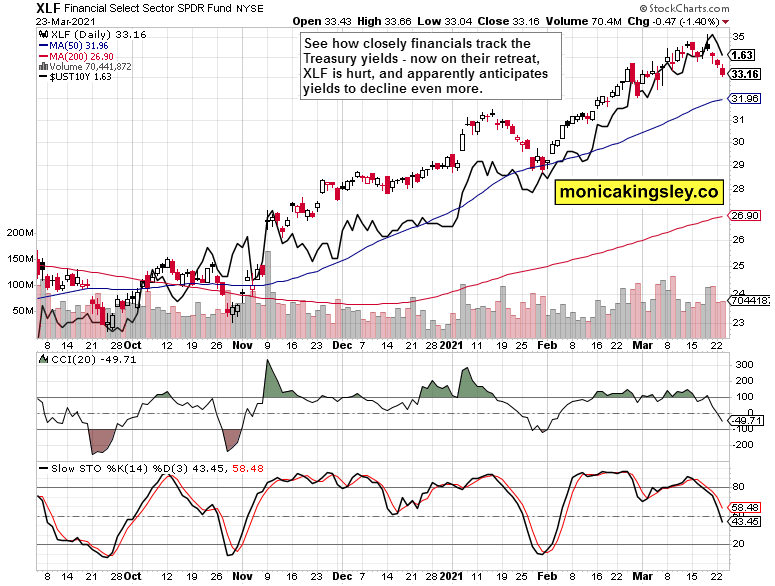

Nowhere is yields influence better seen than in financials (Financial Select Sector SPDR® Fund (NYSE:XLF) ETF), which give the impression of expecting further retreat in yields, and haven't thus far reached any meaningful support. That would provide headwinds to the S&P 500 advance, especially as it translates into other cyclicals.

Summary

S&P 500 upswing has better prospects of continuing than not, and the volatility and put/call ratio readings confirm we aren't in for a true setback really. The stock bull market is far from having made a top, and will continue grinding higher.

Gold and silver declined hand in hand with weaker miners/ This means that the upswing has effectively ended. The only thing that can bring it back is renewed miners outperformance and expected alignment of the yellow metal to Treasury yield moves, which is absent at the moment.