S&P 500: Tuesday was one of the most volatile sessions in months. A small opening loss rebounded into a breakout to record highs. But the good times didn’t last long before Trump announced to the world he was willing to go to war with North Korea. That threw a bucket of cold water on the bulls’ party and we finished well off the midday highs.

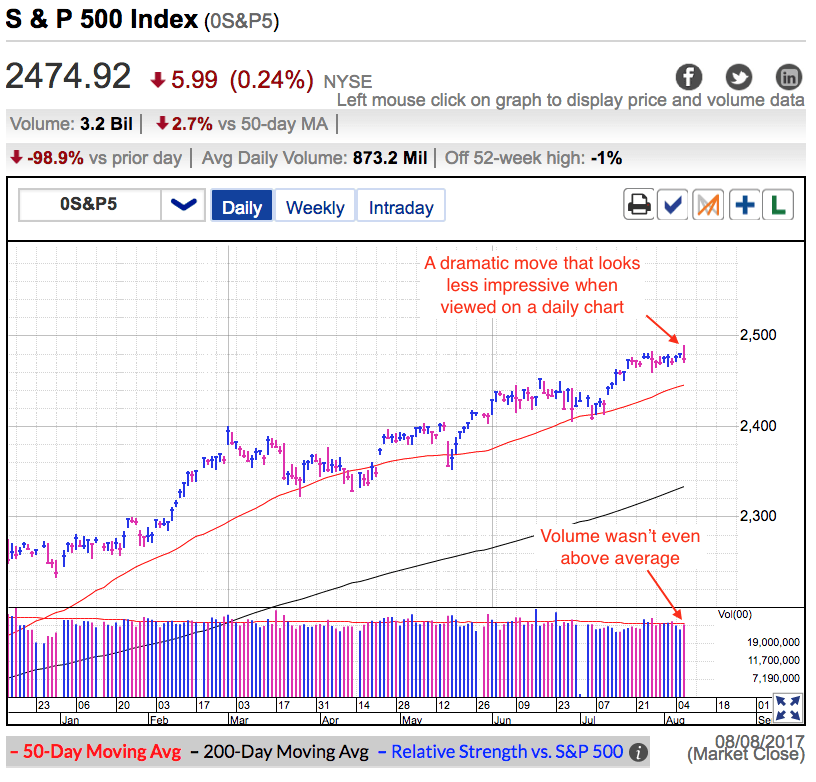

As dramatic as that description sounds, the actual price moves were not all that impressive. At our highest we were up 0.4%, and after the “big” selloff we end up closing down 0.24%. The only reason it felt so volatility is the market has been hovering lifelessly between 2,470 and 2,480 for the last three-weeks.

This war of words with North Korea is certainly something new and unexpected. For a while I’ve been saying that the summer’s slow drift higher will continue until something new and unexpected happened. Is this war of words between Trump and Kim Jong Un that thing? Probably not. While consequences could be quite dire, the odds of this grudge match escalating to a nuclear war are almost non-existent. Neither side can afford to let it go that far.

This will keep the talking heads on TV busy for weeks, but I doubt many stock owners will take this seriously and even fewer will sell the news. So while it is new and unexpected, it isn’t really material and unlikely to derail this bull rally. Any near-term weakness should be viewed as a buying opportunity. But given how modest today’s dip was, I wouldn’t expect this to go much further unless the threats from both sides escalate significantly.

Until further notice, expect the path of least resistance to remain higher. Stock owners are stubbornly reluctant to sell their stocks and that tight supply is propping up prices. Of course their stubbornness is only matched by the reluctance of those with cash to chase record highs. But keep in mind any gains will be slow coming, it took us three weeks to rally from 2,470 to 2,480. Don’t expect that rate to increase any time soon. This is a buy-and-hold market and keep doing what is working.

That said, things will get more interesting in a few weeks when big money managers return from vacation. They have the firepower to move us out of these summer doldrums and most likely their buying or selling will drive the market’s next move. Most likely we will see underperforming managers chase record prices into year-end as they desperately try to catch up. But there is a small chance air could come out of the Trump rally if Congress fails to deliver the promised tax reform.

The best part about being an independent investor is we can buy and sell full positions with the click of a mouse. That means we don’t need to decide ahead of time what will happen. Instead we can wait for the market to reveal its intentions and then we hop on the band wagon and enjoy the ride. Enjoy the slow climb higher over the next few weeks, but start looking for a bigger trade to come along in September or October.