The day before Netflix (NASDAQ:NFLX) is set to release the second season of its hit original series Stranger Things, let’s take a look at why the streaming service is still a great growth investment despite already soaring over the last few years.

As many investors already know, growth stocks can be a ton of fun because they present the opportunity for potentially massive returns. With that said, investors can’t just pick stocks at random and hope they turn into the next Amazon (NASDAQ:AMZN) . What they can do, however, is look for companies that currently present the possibility for hefty gains based on real growth opportunities within a business.

Based on these criteria, growth-minded investors might think about taking a long look at Netflix.

Last quarter, Netflix revenues jumped 33% in its all-important streaming sector. On top of that, the video-streaming powerhouse added 5.3 million subscribers—pushing the company’s total to 109.3 million worldwide. The company projects that it will add another 6.3 million subscriptions this quarter. Netflix also announced plans to spend up to $8 billion on content in 2018.

Looking ahead, Netflix’s revenues are projected to climb over 32% next quarter, based on our current consensus estimates. The company’s full-year revenues are also expected to leap around 30% to hit an upward estimate of $11.72 billion.

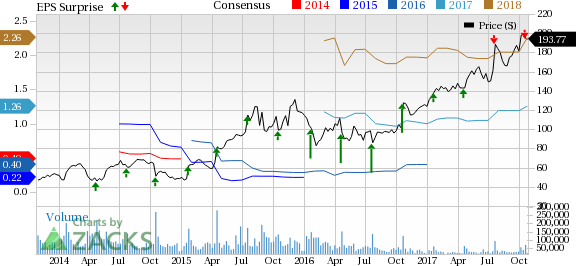

Netflix is currently a Zacks Rank #2 (Buy) and also sports an “A” for Momentum in our Style Scores system. And within the last 60 days, the company has received 13 upward earnings estimate revisions for its Q4 along with no downward revisions. During this same time frame, Netflix earned 13 upward revisions for its full-year.

Netflix is expected to see its earnings skyrocket more than 173% in its fourth-quarter. What’s more, Netflix’s full-year earnings are projected to soar over 192% to $1.26 per share.

Shares of Netflix have already gained over 56% this year, which blows away the S&P 500 average. This positive movement has been driven by the success of its original content, along with the ability to add users at an extremely fast rate amid shifting consumer habits that favor its streaming service model.

In addition to its other growth-based metrics, Netflix’s stock price currently rests 5% below its 52-week high.

The internet hype surrounding Friday’s release of one of its biggest shows to date could help Netflix shares climb. Therefore, now might be a good time for investors looking to capitalize on its outsized growth potential to jump on Netflix.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

Netflix, Inc. (NFLX): Free Stock Analysis Report

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Original post

Zacks Investment Research