The technology space continues to be investors’ favorite due to its dynamic nature. This field is expected to grow faster than ever before. Therefore, if you invest right, you can reap the benefits over time..

Below we have evaluated one technology company that has demonstrated remarkable share price performance so far. Micron Technology, Inc. (NASDAQ:MU) has generated significant returns for investors in the last year and has the potential to exceed expectations in the days ahead.

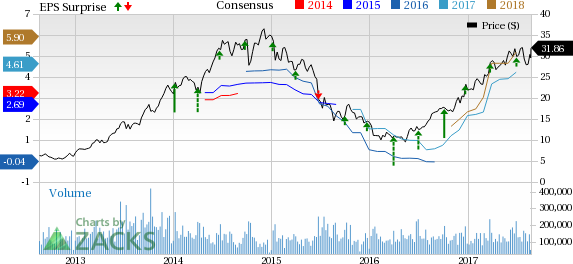

The stock has returned approximately 82.6% in the last year, significantly outperforming the S&P 500’s gain of just 10.9%.

Let’s look at the reasons behind Micron’s solid momentum.

What’s Driving the Stock?

The main reason behind the optimism surrounding the stock is improving prices for DRAM and NAND chips. Per various sources, DRAM and NAND prices have improved primarily due to a better product mix optimization and higher-than-expected demand for PCs, servers and mobiles.

The benefit from improved pricing was well reflected in the company’s last quarterly results. Its fiscal third-quarter 2017 revenues not only increased 92.1% on a year-over-year basis but also surpassed the Zacks Consensus Estimate. Most importantly, the company’s DRAM product category witnessed a 5% increase in bit shipment and 14% rise in average selling prices (ASP) during the quarter.

The company’s third-quarter non-GAAP earnings per share of $1.62 came ahead of the Zacks Consensus Estimate of $1.49. Also, it marked a significant improvement from the year-ago quarter’s loss of 3 cents.

An encouraging top- and bottom-line guidance for the fourth quarter, way above the respective Zacks Consensus Estimate, also helped in boosting investors’ confidence about the company’s future prospects.

Upward Estimate Revisions

In the last 60 days, the Zacks Consensus Estimate for the fourth quarter and fiscal 2017 witnessed upward movement. For the fiscal fourth quarter, the Zacks Consensus Estimate is currently pegged at $1.81 per share, up 30 cents from earnings of $1.51 projected 60 days ago. The Zacks Consensus Estimate for fiscal 2017 is currently pegged at $4.61 per share compared with $4.11 projected 60 days ago.

Other Driving Factors

It should be noted that Micron has been expanding in the SSD storage market due to the decline in the PC market. Notably, SSDs are faster and more energy efficient than traditional hard drives. These are also used in servers due to lower latency, thereby facilitating faster response to real-time applications.

Notably, the company has an interesting partnership with Seagate (NASDAQ:STX) . Per the agreement, Micron supplies a significant portion of Seagate’s NAND requirement. In return, Seagate shares its SAS SSD technology with Micron, a key technology that the latter lacks in the enterprise SSD market. We believe that this deal will expand Micron’s high-value enterprise SSD portfolio.

Additionally, the acquisition of Inotera in 2016 is anticipated to be accretive to Micron’s DRAM gross margin, earnings per share and free cash flow. According to the company, the acquisition will also have some operational benefits, leading to efficient management of investment levels and cadence followed by alignment with global manufacturing operations.

The company anticipates the aforementioned factors to also have a positive impact on its fiscal fourth-quarter results.

Bottom Line

Looking at the improving selling prices for DRAM and strategic initiatives of expanding in the SSD market, we consider that Micron is one technology stock which is worthy of remaining in investors’ portfolio.

On the valuation front too, the stock looks attractive. The company currently trades at a forward P/E multiple of 6.4x, significantly lower than the S&P 500 average of 19.2x. The ratio, which is obtained by dividing a stock’s current market price with its historical or estimated earnings, measures how much an investor needs to shell out per dollar of earnings. Therefore, lower the P/E of a stock, the better for a value investor.

Hence, we believe that there is still much momentum left in this Zacks Rank #1 (Strong Buy) stock, which is quite evident from its VGM Style Score of A and long-term earnings growth rate of 10%.

The stock has grabbed the spotlight with striking performances on the back of solid earnings and robust growth projections. Keeping this in mind, we believe that investing in this stock will yield strong returns in the near term.

A couple of other stocks worth considering in the broader technology sector are Applied Optoelectronics, Inc. (NASDAQ:AAOI) and FormFactor Inc. (NASDAQ:FORM) , both sporting a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Applied Optoelectronics and FormFactor have an expected long-term EPS growth rate of 17.5% and 16%, respectively.

Zacks' 10-Minute Stock-Picking Secret

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

But here's something even more remarkable: You can master this proven system without going to a single class or seminar. And then you can apply it to your portfolio in as little as 10 minutes a month.

Seagate Technology PLC (STX): Free Stock Analysis Report

FormFactor, Inc. (FORM): Free Stock Analysis Report

Applied Optoelectronics, Inc. (AAOI): Free Stock Analysis Report

Micron Technology, Inc. (MU): Free Stock Analysis Report

Original post

Zacks Investment Research