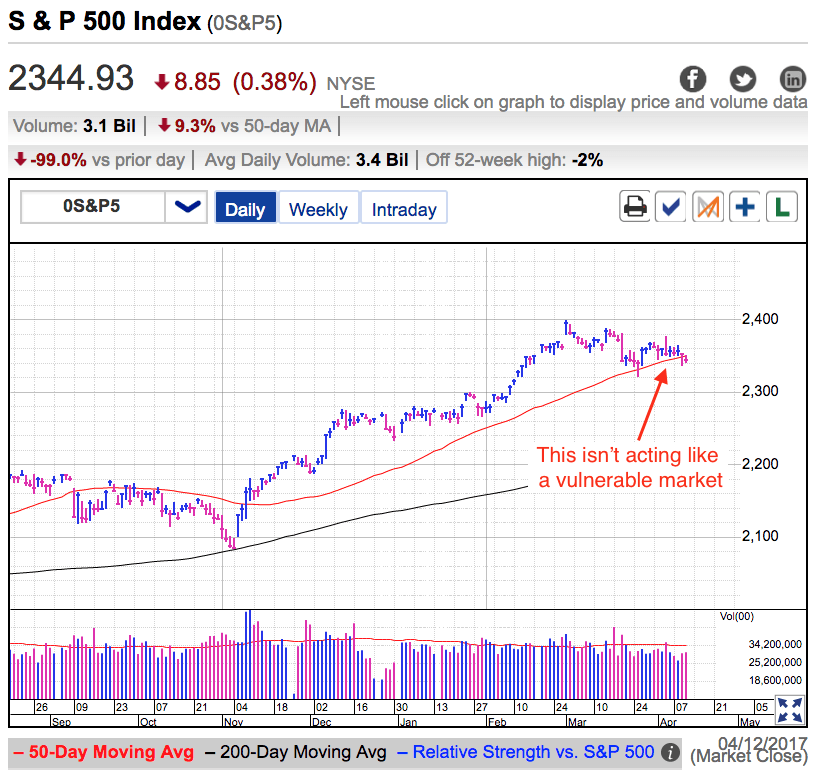

The S&P 500 slipped for the sixth time over the last two weeks and finds itself under the 50DMA. But as bad as this sounds, this “selloff” hasn’t even given up one-percent over this period. The reason we slipped under the 50DMA is because it came up to meet us, rather than that we dipped down to find it. Clearly the Trump Trade is cooling off, but this is hardly panic material.

The interesting thing is the mood in the market has changed from unbridled optimism to reservation and caution. Trump’s had his share of missteps, the health care repeal blew up, and there is simmering tension with Russia, Syria, and North Korea. Add to this the negative price-action we’ve seen recently and the market has plenty of excuses to sell off. That leaves us with the question, why is this dip so modest?

One of the most useful ways I found for analyzing the market is looking at what it is NOT doing. We have all the excuses I listed, plus we can add “too-high, too-fast” and stretched valuations to the list too. With all of these reasons, why aren’t we dramatically lower? Why aren’t more people selling and taking profits? Why isn’t anyone panicking?

When we ask, “what is the market not doing?” Clearly it’s not selling off in a meaningful way. While some people will tell us to be patient, one of the things I learned during my two decades in the market is: big selloffs are breathtakingly fast. They happen before you know what hit you. Not this slow motion stuff we find ourselves in the middle of. If we were extended and vulnerable to a breakdown, it would have happened by now.

No matter how good the reasons the bears have, it doesn’t matter when owners refuse to sell. As long as stubbornly confident owners continue keeping supply tight, the market will keep finding support and defying the skeptics. Clearly this cannot last forever, but it will last far longer than anyone thinks possible.

This market will crack and break down because every bull market eventually ends, but we are not there yet. As long as these dips fail to attract follow-on selling, expect them to be modest and bounce. That means this is a better place to be buying stocks than selling them. As long as we keep recycling the same old headlines, we don’t have anything to worry about. If the healthcare dud and launching missiles at Syria didn’t faze owners, it is hard to imagine a headline that will convince them to change their minds.

Over the near-term I will keep buying the dip, but I will keep an eye out for that new and unexpected headline that sends chills through this market. That will be the one we have to watch out for. But until then, approach this rangebound market by buying weakness and selling strength.