More than a month has gone by since the last earnings report for Cirrus Logic, Inc. (NASDAQ:CRUS) . Shares have lost about 10.5% in that time frame, underperforming the market.

Will the recent negative trend continue leading up to the stock's next earnings release, or is it due for a breakout? Before we dive into how investors and analysts have reacted of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important catalysts.

Cirrus Logic Beats On Q1 Earnings & Revenues

Cirrus Logic reported better-than-expected first-quarter 2018 results. The company’s revenues and earnings also marked year-over-year improvement.

The company reported non-GAAP earnings per share of 81 cents per share, which surpassed the Zacks Consensus Estimate of $0.66 per share and increased 84.1% year over year.

Quarter Details

Total revenue increased approximately 23.6% year over year to $320.7 million and also marginally surpassed the Zacks Consensus Estimate of $320 million. The year-over-year increase was primarily owing to higher adoption of its products and strength in customer relationships.

Segment wise, Portable audio product revenues (88% of the total revenues) came in at $280.7 million, up 29.9% year over year. Meanwhile non-portable audio and other products (12%) decreased 7.6% year over year and came in at $40 million. Cirrus Logic generates a significant portion of its revenues from Apple Inc (NASDAQ:AAPL).

Non-GAAP gross profit was $162.1 million, up approximately 27.7% from the year-ago period. Further, as a percentage of revenues, it expanded 160 basis points (bps) from the year-ago quarter to 50.5%.

Non-GAAP operating expenses increased 10.1% on a year-over-year basis to $95.8 million, primarily due to higher research and development expenses and selling, general and administrative. As a percentage of revenues, the same decreased 360 bps from the year-ago quarter to 29.9%.

Cirrus Logic’s non-GAAP operating income was up from $39.9 million reported in the year-ago quarter and came in at $66.3 million. Also, operating margin expanded 600 bps on year-over-year basis and came in at 21%.

On a non-GAAP basis, Cirrus Logic reported net income of $54.6 million compared with $28.9 million reported in the year-ago quarter.

Balance Sheet & Cash Flow

Cirrus Logic exited the quarter with cash, cash equivalents and marketable securities of $175.3 million compared with $450.9 million at the end of the previous quarter. Accounts receivables were $162.4 million compared with $119.9 million in the last quarter. The company did not have any long-term debt during the quarter.

Guidance

Cirrus Logic provided guidance for second-quarter fiscal 2018. For the second quarter, the company expects revenues in the range of $390-$430 million (mid-point $410 million). The company expects GAAP gross margin to be in the range of 48-50%. Combined GAAP R&D and SG&A expenses are anticipated within $119 million and $125 million.

How Have Estimates Been Moving Since Then?

Following the release, investors have witnessed an upward trend in fresh estimates. There has been one revision higher for the current quarter. While looking back an additional 30 days, we can see even more upward momentum. There have been three moves higher in the last two months. In the past month, the consensus estimate has shifted by 5.5% due to these changes.

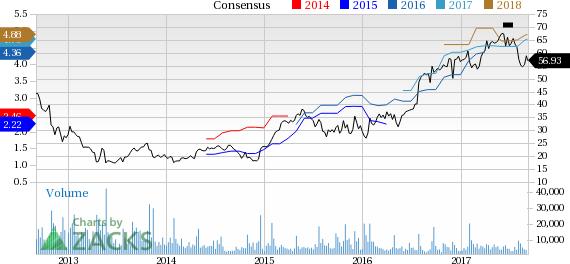

Cirrus Logic, Inc. Price and Consensus

VGM Scores

Currently, Cirrus Logic's stock has a great Growth Score of A, though it is lagging a bit on the momentum front with a B. The stock was allocated a grade of A on the value side, putting it in the top quintile for this investment strategy.

Overall, the stock has an aggregte VGM Score of A. If you aren't focused on one strategy, this score is the one you should be interested in.

Based on our scores, the stock is equally suitable for value and growth investors.

Outlook

Estimates have been trending upward for the stock. The magnitude of these revisions also looks promising. Notably, the stock has a Zacks Rank #3 (Hold). We expect in-line returns from the stock in the next few months.

Cirrus Logic, Inc. (CRUS): Free Stock Analysis Report

Original post

Zacks Investment Research