Introduction

Investing in great companies sits at the core of my investment philosophy. In this regard, I reject the idea that I invest in the stock market. To me, the stock market is simply the store I shop in to purchase interests in fine businesses. In the final analysis, my investment objective is to become a long-term shareholder/partner in a business that I believe can make me money over time.

On the other hand, no matter how great I think the business is, I am also very focused on only investing in it at a fair price. When looking for great businesses, this can at times be a problem. Great businesses attract investors, and since stocks are liquid instruments, the forces of supply and demand can have a significant impact on valuation over the short run. In other words, the demand for great businesses is typically high.

Nevertheless, time is the equalizer where in the long run a company’s stock price will be driven by its business success. When dealing with stocks, the common measuring sticks are earnings, cash flows and dividends - if a company pays one. Consequently, because of the supply/demand dynamics over the short run, a company’s valuation can be temporarily out-of-sync with its business success.

Therefore, to my way of thinking, the trick to long-term investment success is to identify a great business and then invest in it only when the market offers it at a fair or attractive valuation. You can overpay for even the greatest company, and if you’re diligent you can also find times when it is fairly valued or even undervalued. I am content to buy a great business at fair value, and I get quite excited when given the opportunity to invest at a low valuation. I have recently become interested in CVS Health Corporation (NYSE:CVS) because I believe the market has recently provided an opportunity to invest in it at a fair price.

CVS Health Corporation a Great Business at a Fair Price

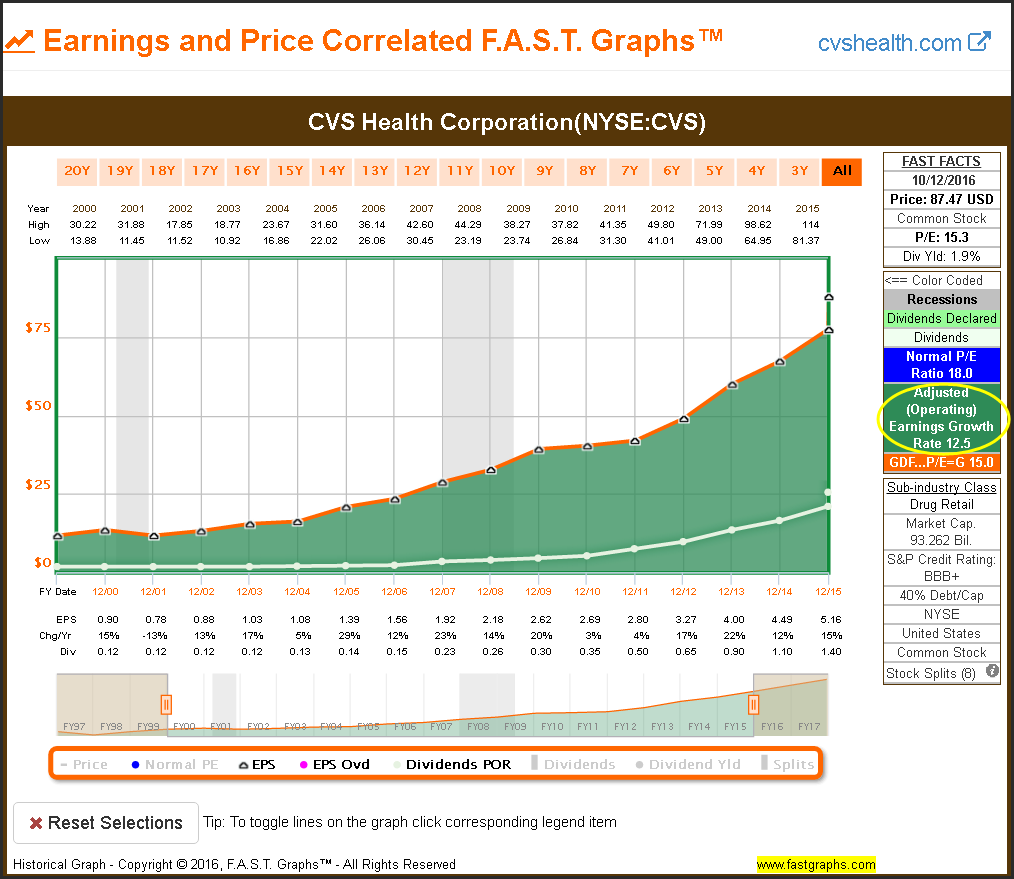

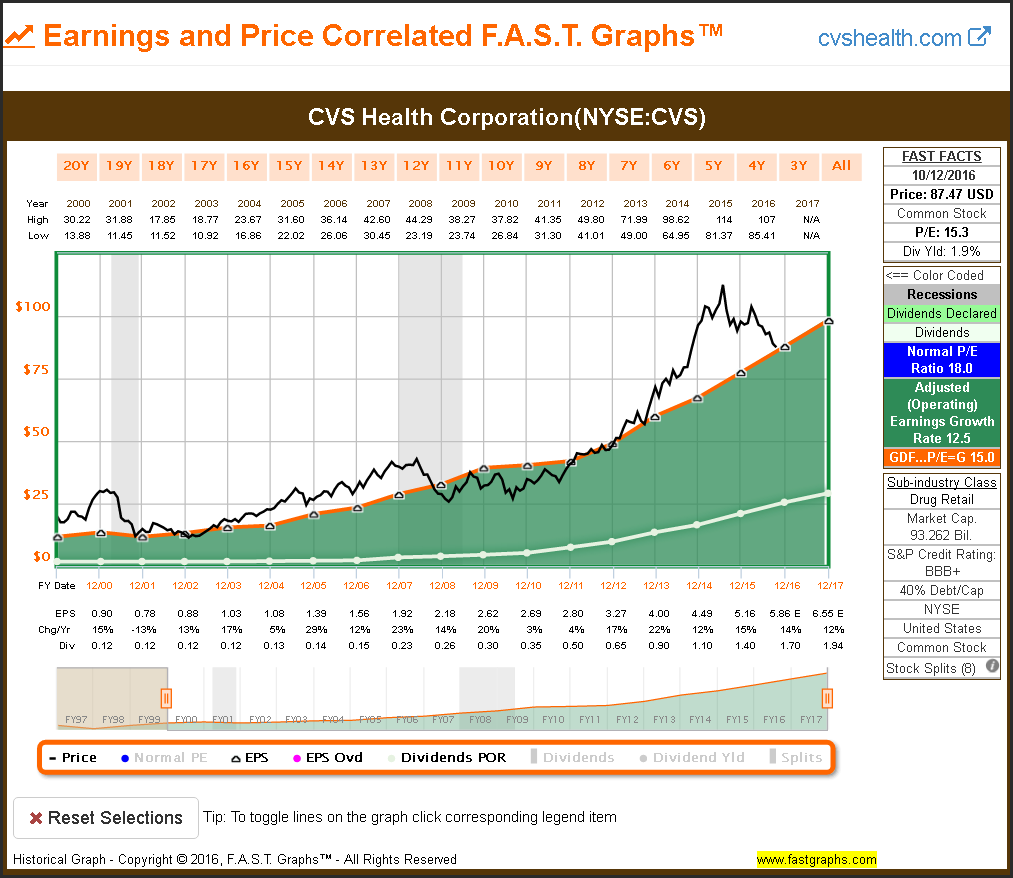

Before I delve into CVS Health Corporation’s valuation, I would like to establish why I consider it a great business from a shareholder’s perspective. For starters, I really admire the consistency of operating results that the company has generated. The following F.A.S.T. Graph plots the company’s earnings and dividends since 2000 through 2015. Note that I chose this timeframe because it includes both of our most recent recessions. It is very rare to find a company that has so consistently grown its earnings and dividends over time. Moreover, in addition to consistent growth, CVS’s growth rate has also been significantly above average.

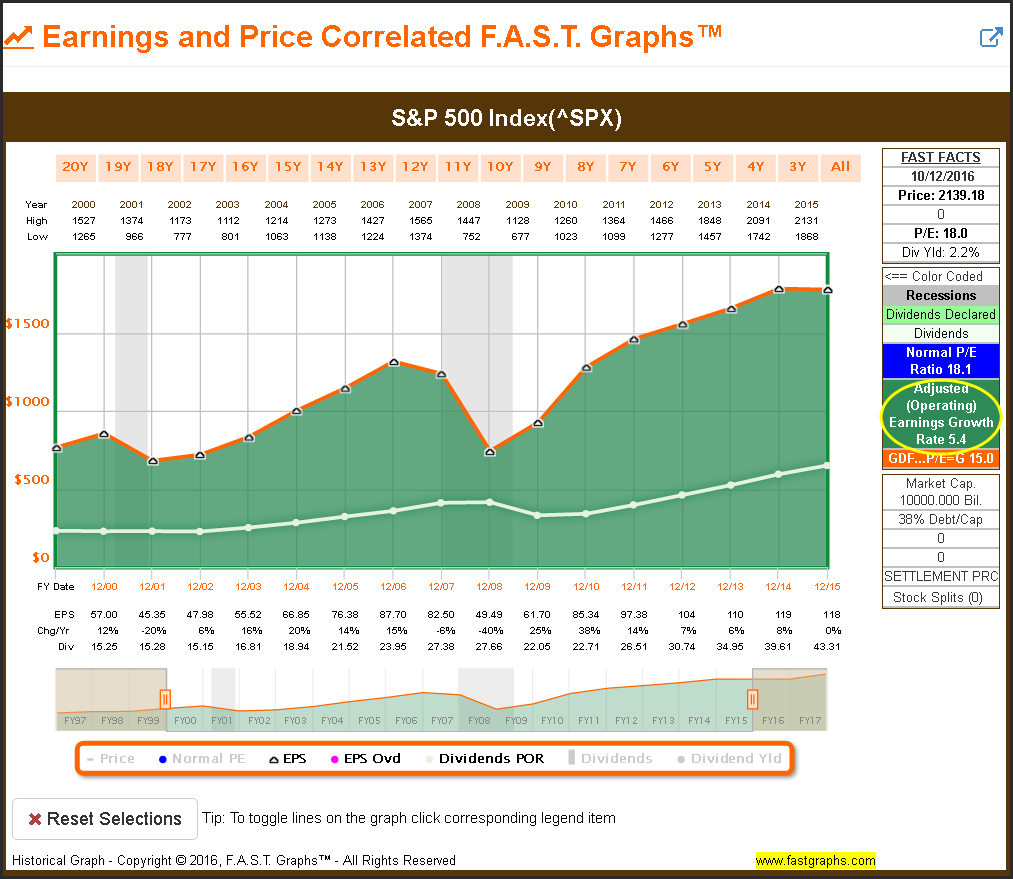

CVS has grown earnings at the compound annual rate of 12.5% since 2000 versus the S&P 500 which has only grown earnings at the rate of 5.4%. As I will later illustrate, CVS’s stronger earnings and dividend growth has led to significantly higher returns than the market over this timeframe. Importantly, both capital appreciation and cumulative total dividend income have been superior with CVS. This illustrates my basic definition of a great business. A great business is one that has proven itself to grow faster and more consistently than the average company. CVS represents a quintessential example of that standard, as illustrated by the following earnings and dividend graph.

To further clarify this distinction, I also offer a similar graph on the S&P 500 plotting earnings and dividends over the time frame 2000-2015. Not only have the S&P 500’s earnings grown at less than half the rate of CVS’s earnings, the overall market’s earnings has also been significantly more cyclical. The market’s dividend record is a little better, but dividends were cut in 2009. When stacked up against the average company, I consider CVS a great business.

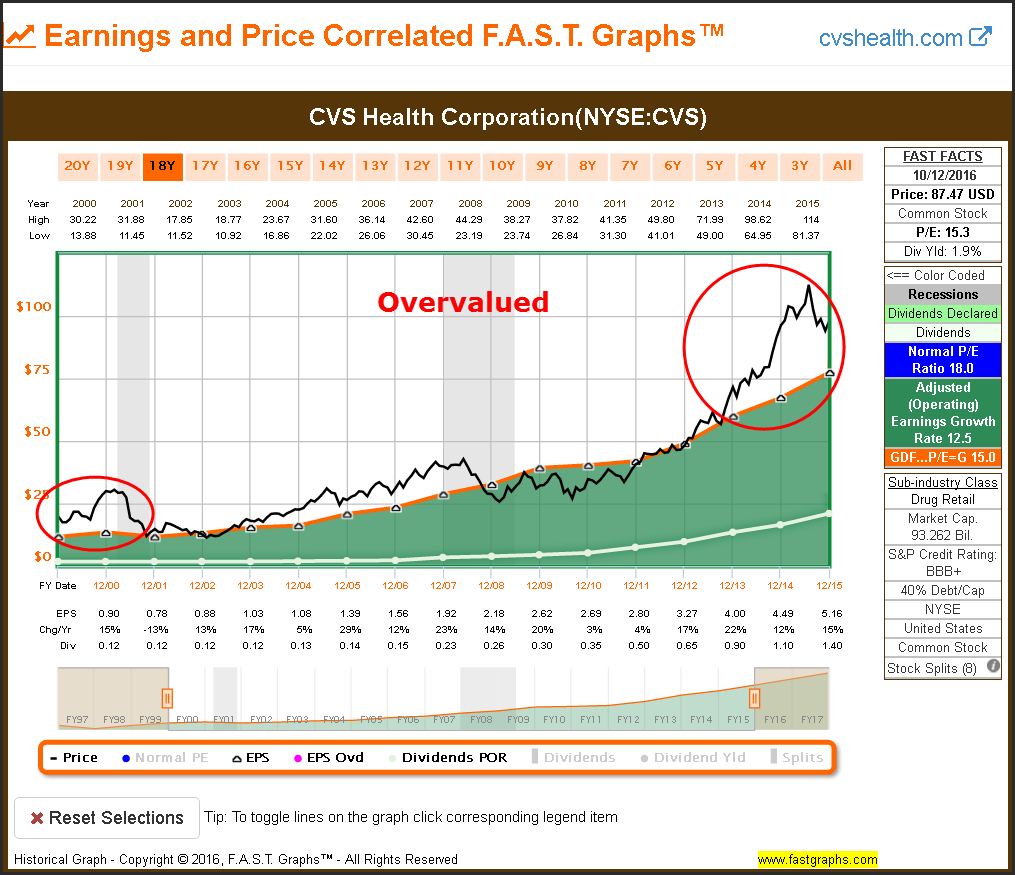

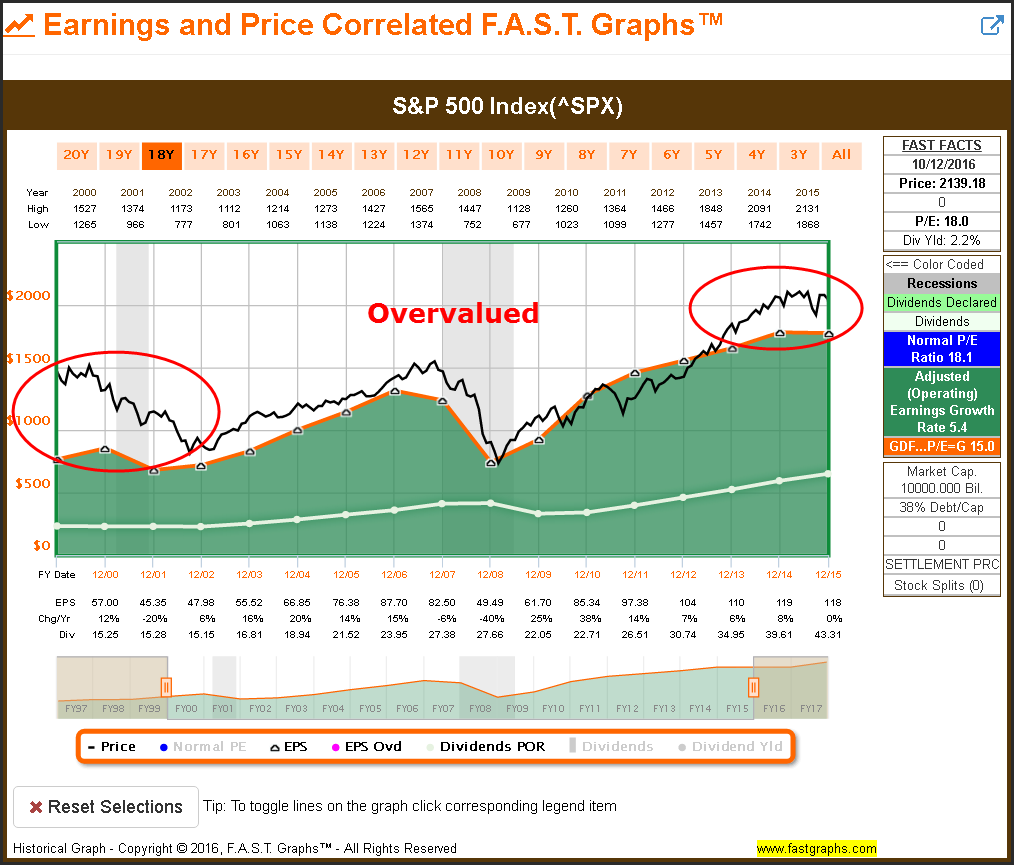

As I indicated in the introduction, in addition to identifying a great business, I also want to see it at an attractive price. On these next two graphs I bring in monthly closing stock prices for both CVS and the S&P 500. It’s important that the reader recognizes that both CVS and the S&P 500 were overvalued in 2000. For those that recall, calendar year 2000 represented the coming to the end of what was dubbed the “irrational exuberant period” in the stock market. Consequently, I would’ve had no interest in investing in either at this time.

Furthermore, the reader should also note that both of these entities were also overvalued at the end of calendar year 2015. Consequently, I had no interest in investing in either of these entities during calendar year 2015. CVS continued to perform strongly on an operating basis, but stock price was so disconnected from fair value (the orange line on the graph) that I had no interest in spite of its impeccable operating record.

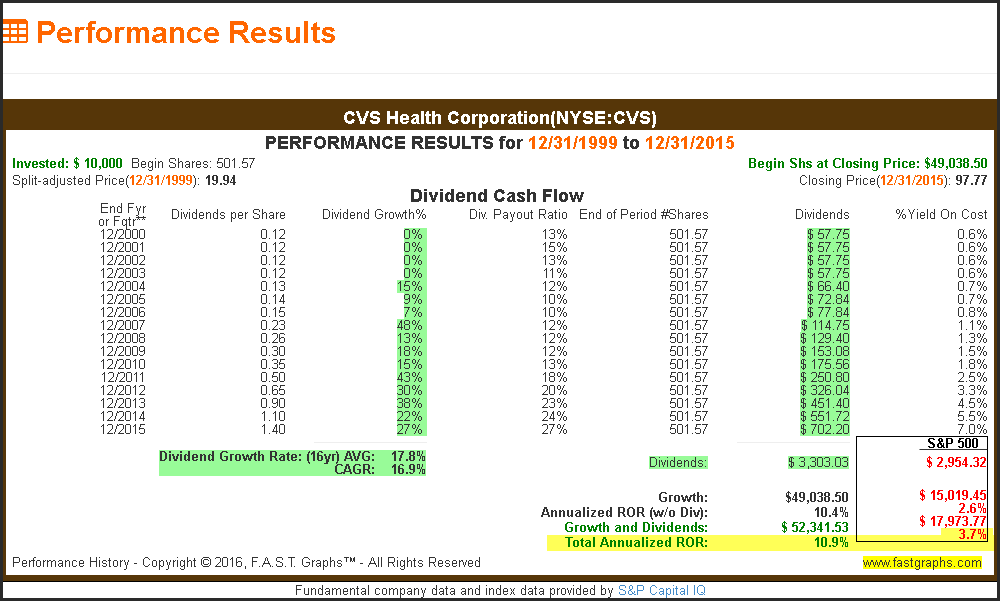

The following performance report compares CVS versus the S&P 500 over this time frame. What I found interesting is how both CVS and the S&P 500 produced capital appreciation returns that were lower than their respective earnings growth achievements. This is the effect that overvaluation had on both.

On the other hand, the great business CVS was still able to produce very attractive double-digit total returns thanks for the most part to its high and consistent growth. In contrast, the S&P 500 produced positive results but they pale in comparison to CVS. The simple lesson here is that valuation matters, and it matters a lot.

Now let’s fast-forward to current time and evaluate what CVS looks like today from a valuation perspective. Since the summer of 2015, and for most of 2016, CVS’s stock price has been in a free fall. The net result is an approximately 23% drop off from its 2015 summer high. Investors hate it when a stock’s price drops, and as a result it typically conjures up a lot of negativity.

In doing my research on CVS I have come across several recent articles on the company, most of them positive. However, some of the comments made in these articles illustrate my previous point about negative investor sentiment. Reasonable questions start to be asked such as - if the stock is so good, why does it keep dropping? But more importantly, answers to those questions are also offered. Some of those answers are relevant; some are rationalizations - and some even cynical laments with political overtones.

I support the proposition that everyone is entitled to their own opinions and views. However, to me, the answer to the question of why is the stock dropping seems quite obvious. It is quite clear to me that starting in the fall of 2014 the company’s stock price began separating from its fundamental value and support. In my experience, when valuation gets extreme, a company’s stock price becomes highly vulnerable to even a whiff of bad news. Furthermore, the more overvalued a stock is, the more vulnerable.

For example, in the case of retail pharmacy chain and pharmacy benefit management businesses such as CVS Health Corporation and Walgreens Boots Alliance, Inc. (NASDAQ:WBA) the threat of rising pressure to reduce reimbursement fees for generic drugs is seen as a potential threat to future profitability. Additionally, stiff competition is also a challenge that must be met. Nevertheless, demographics suggest a bright future for well-managed companies within this sector. Consequently, expectations for continued growth remain strong.

With all that said, I contend that the biggest headwind that CVS has faced in recent years has been significant overvaluation. A quick glance at the following graph makes it clear to me that the biggest reason that the stock price has dropped is because it was ridiculously overvalued. And as the title of this article suggested, the fact that it has now moved down to a fair valuation level is precisely why I have become interested in it at this time.

CVS Health Corporation: Attractive Dividend Growth and Total Return Opportunity

Since CVS has recently moved into fair valuation territory, I have become interested in conducting a comprehensive research and due diligence process. That is not the same as saying I am recommending it as a strong buy. On the other hand, I am reasonably confident that a purchase made today would generate attractive long-term future returns. It is possible that the stock could drop further based on negative investor sentiment. But, it is also possible that the price has bottomed out.

As investors, we must accept the reality that finding perfect tops or bottoms is rarely possible notwithstanding luck. But more importantly, you don’t have to find the perfect bottom in order to make attractive long-term returns. Potential short-term pain can easily lead to exceptional long-term gain as long as your original purchase is made at a sound valuation. Personally, I believe that CVS’s stock price is currently at a sound level.

As a result, I have started a comprehensive research and due diligence process and so far I like what I see. With the remainder of this article, I will share much of what I found thus far, but also caution that this is still a work-in-progress. However, before I attempt to dig too deep into the workings of the company, I like to review important financial metrics such as the balance sheet, cash flow statement, profitability, and income statement.

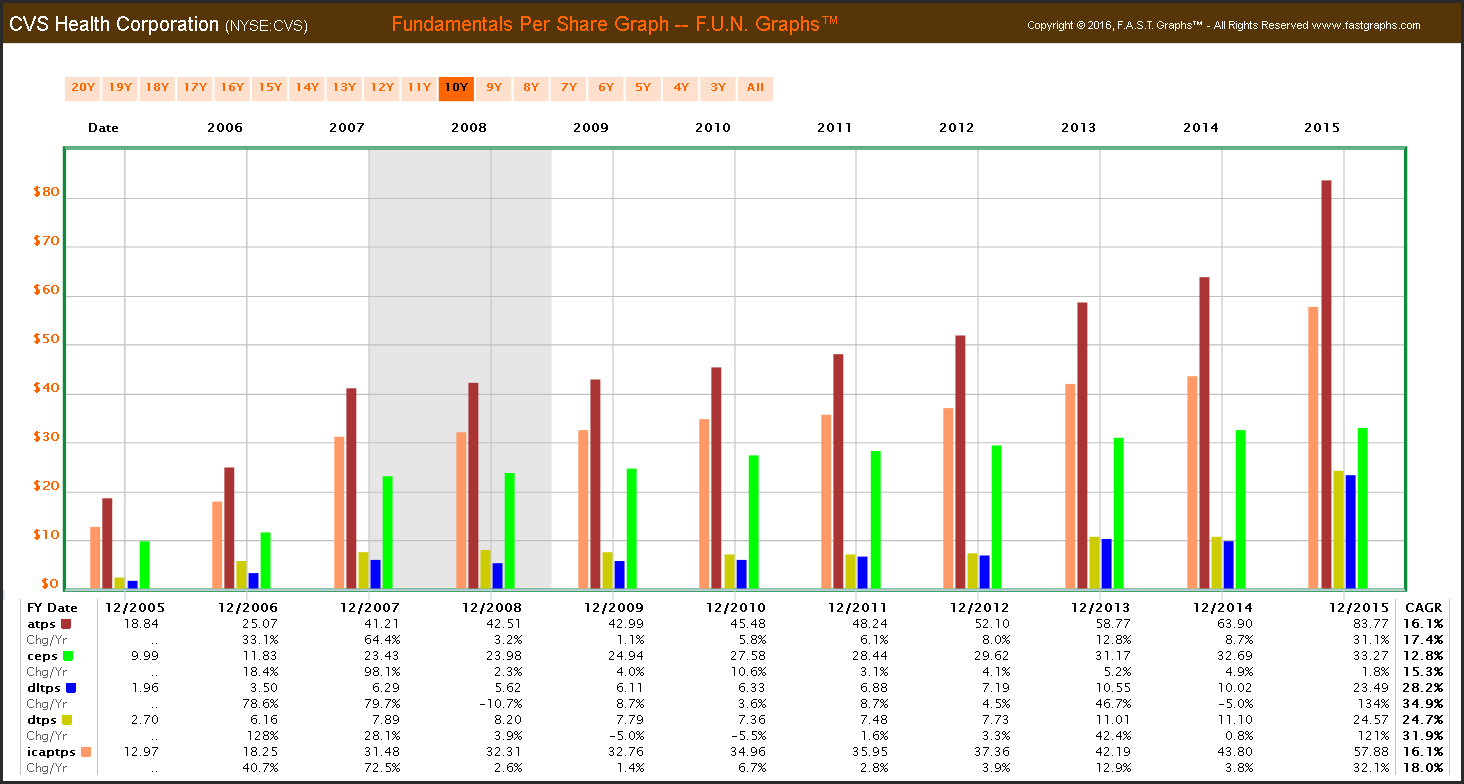

The Balance Sheet

I believe that CVS’s balance sheet is strong and healthy. Assets per share (atps) and book value or common equity per share (ceps) are both steadily increasing. Long-term debt per share (dltps) and total debt per share (dtps) are at reasonable levels. Furthermore, the company’s increase in debt in 2015 is primarily attributable to their acquisitions of Omnicare and Target’s pharmacy and clinical businesses. Both of these acquisitions hold the promise to expand CVS’s customer base and retail channels going forward.

Cash Flow Statement

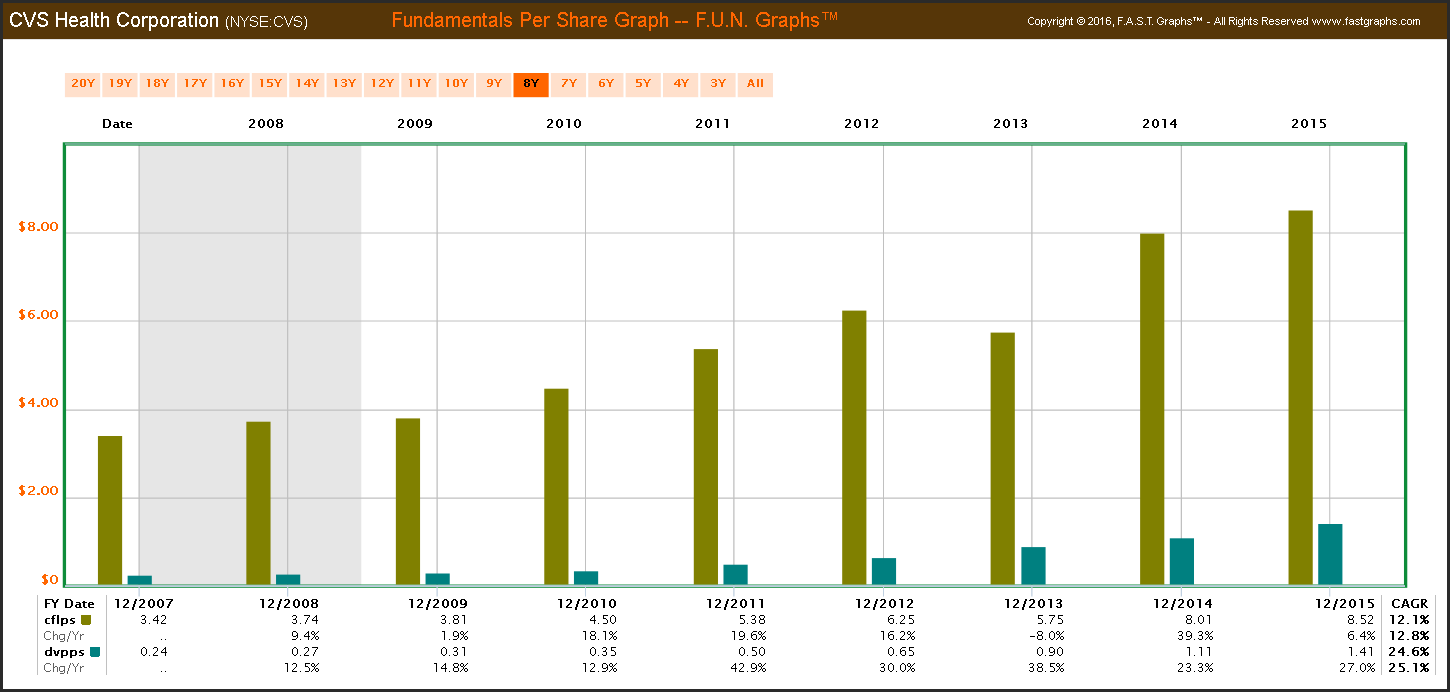

Since dividends represent an important component of the allure for investing in CVS, I was gratified to see that cash flow per share (cflps) more than adequately covers their dividends.

Profitability

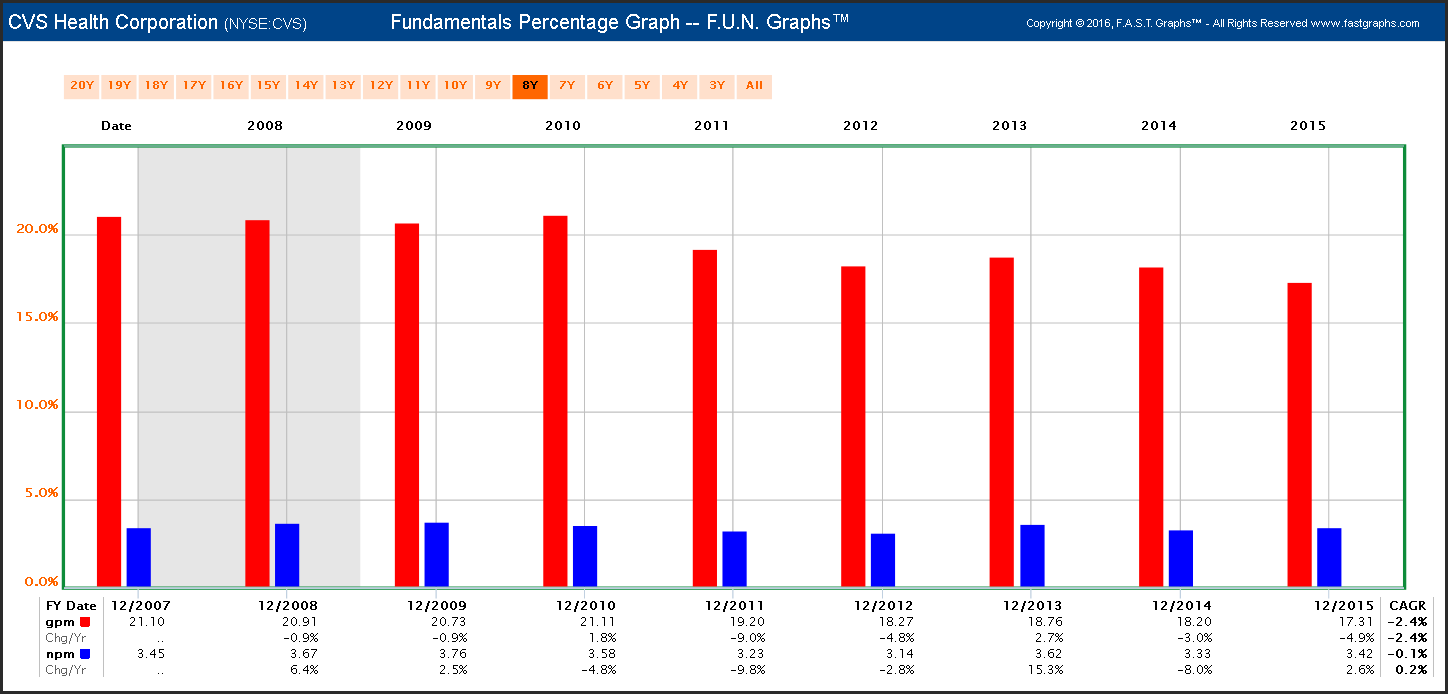

The retail pharmacy chain and pharmacy benefit management businesses do not produce exceptionally high gross profit margins (gpm) or net profit margins (npm). However, the consistency and predictability of these businesses still allows for high rates of bottom line growth. Gross profit margins for CVS have weakened slightly in recent years, but net profit margins have remained consistent. Moreover, I consider these reasonable margins a plausible defense against political onslaught considering the important nature of the business.

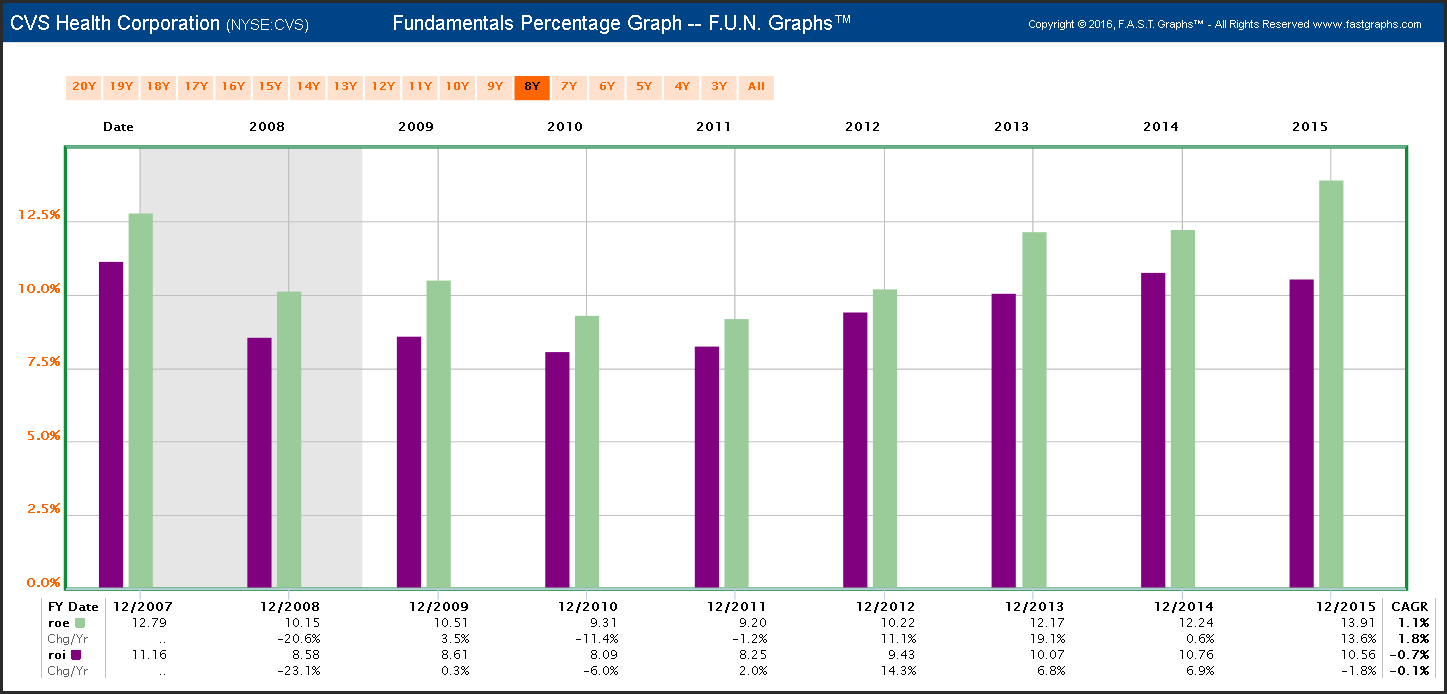

On the other hand, return on equity (roe) and return on invested capital (roi) have been improving in recent years.

The Income Statement

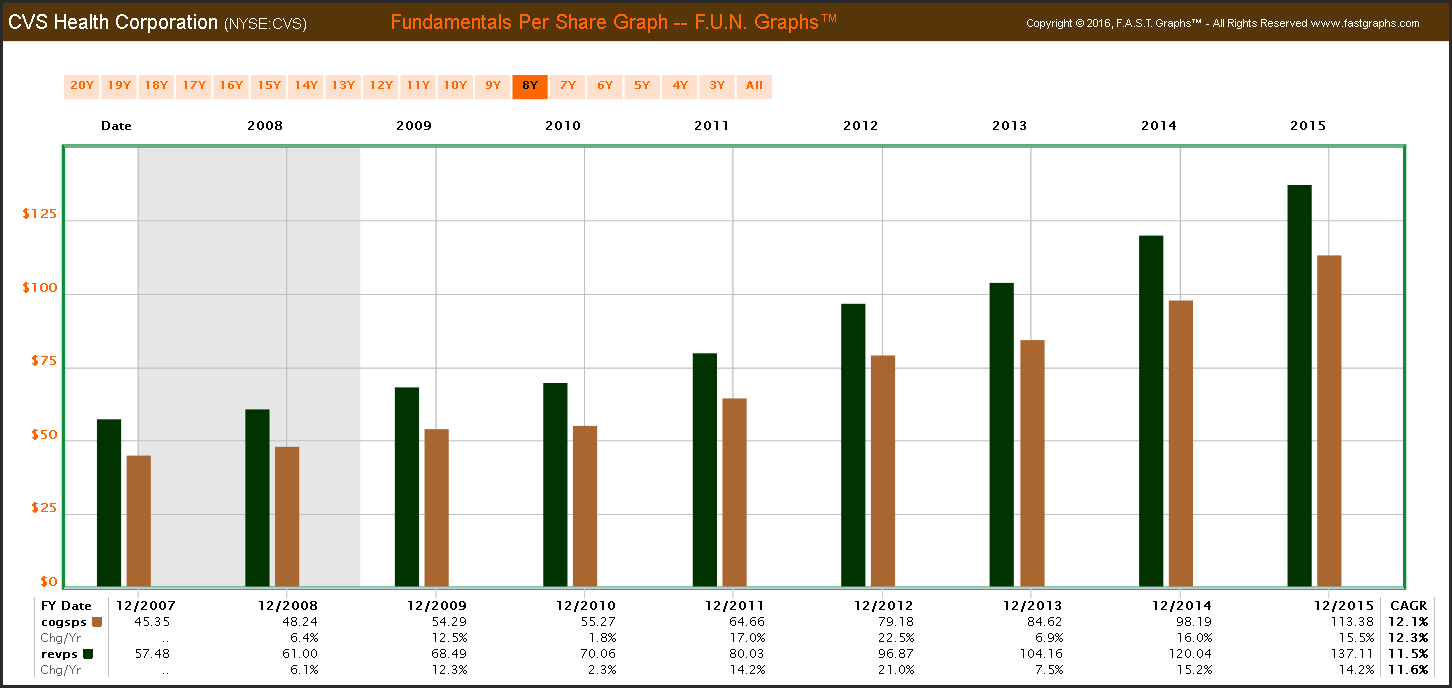

From the income statement perspective, I have previously covered CVS’s consistent and high earnings growth. Additionally, cost of goods sold (cogsps) has also been rising, but revenue growth (revps) has been following suit.

Shareholder-Friendly Management

Generally speaking, I consider the CVS management team as very shareholder friendly. Since fiscal year 2000, the company’s dividend has grown at an average rate of 17.8% translating to a compound annual growth rate of 16.9%. However, the dividend was frozen from fiscal year 2000 through 2003 -- which included the recession of 2001. On the other hand, the company did raise their dividend throughout the Great Recession at double-digit rates.

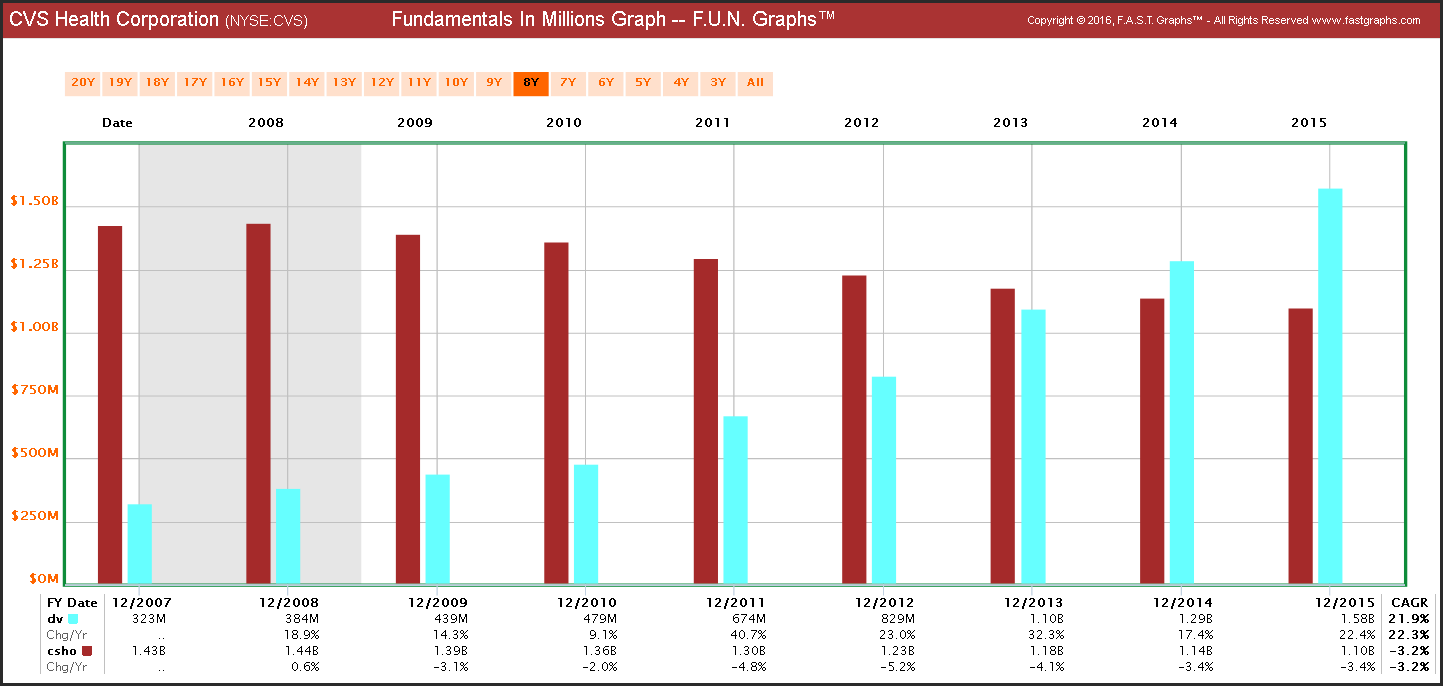

In addition to increasing their dividend, the company has also been buying back their shares since 2007. On this count I would give them a B- grade because I do not consider share buybacks in 2014, 2015 and 2016 as an especially good use of shareholder capital. On the other hand, now that the stock is reasonably valued I would favor a continuation of share buybacks.

CVS Health Corporation: The Businesses

The following short business description provided courtesy of S&P Capital IQ:

“CVS Health Corporation, together with its subsidiaries, provides integrated pharmacy health care services. It operates through Pharmacy Services and Retail/LTC segments.

The Pharmacy Services segment offers pharmacy benefit management solutions, such as plan design and administration, formulary management, Medicare Part D services, mail order and specialty pharmacy services, retail pharmacy network management services, prescription management systems, clinical services, disease management programs, and medical pharmacy management services. This segment serves employers, insurance companies, unions, government employee groups, health plans, managed Medicaid plans and plans offered on public and private exchanges, other sponsors of health benefit plans, and individuals under the CVS Caremark Pharmacy Services, Caremark, CVS Caremark, CarePlus CVS Pharmacy, CVS Specialty, Accordant, SilverScript, NovoLogix, Coram, Navarro Health Services, and Advanced Care Scripts names.

As of December 31, 2015, it operated 24 retail specialty pharmacy stores, 11 specialty mail order pharmacies and 5 mail order dispensing pharmacies, and 83 branches for infusion and enteral services.

The Retail/LTC segment sells prescription drugs, over-the-counter drugs, beauty products and cosmetics, personal care products, convenience foods, seasonal merchandise, and greeting cards, as well as provides photo finishing services.

It operates 9,655 retail stores in 49 states, the District of Columbia, Puerto Rico, and Brazil primarily under the CVS Pharmacy, CVS, Longs Drugs, Navarro Discount Pharmacy, and Drogaria Onofre names; online retail pharmacy Websites; and 32 onsite pharmacy stores, long-term care pharmacy operations, and retail health care clinics.

The company was formerly known as CVS Caremark Corporation and changed its name to CVS Health Corporation in September 2014. CVS Health Corporation was founded in 1892 and is headquartered in Woonsocket, Rhode Island.”

CVS Health Corporation: Thesis for Growth

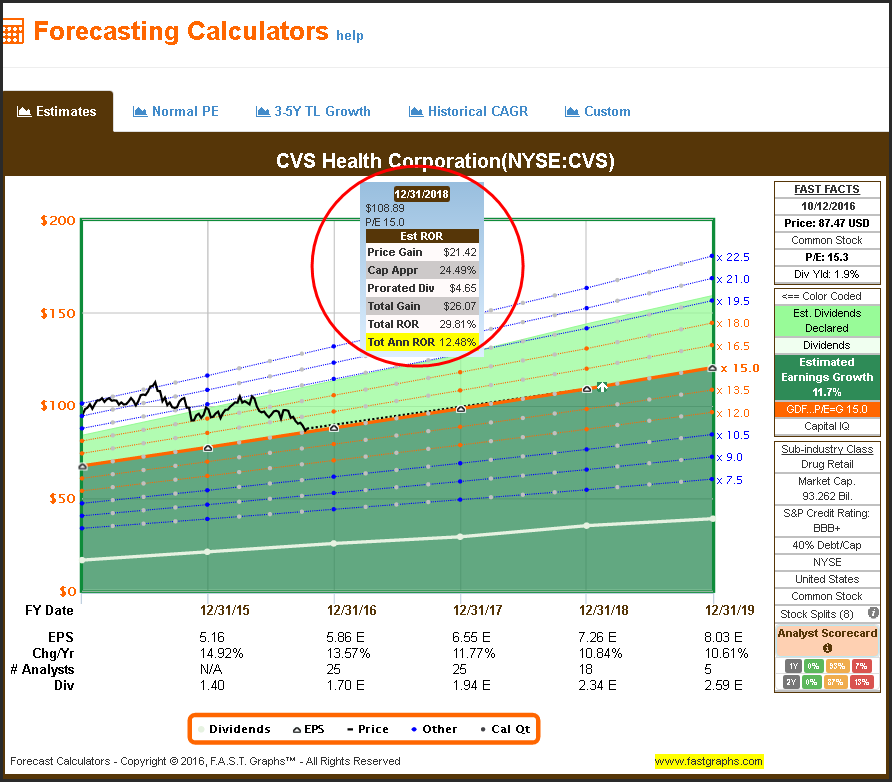

The consensus of 25 analysts reporting to S&P Capital IQ expect CVS to grow earnings by 13.57% for this fiscal year end followed by an 11.77% for fiscal year ending December 31, 2017, and 18 analysts expect earnings to grow 10.84% for fiscal year-end December 31, 2018. If these analysts are correct, that would suggest double-digit rates of return over the next couple of years. Additionally, these analysts’ earnings estimates are consistent with CVS management’s guidance range for adjusted earnings of $5.81 to $5.89 for this fiscal year end.

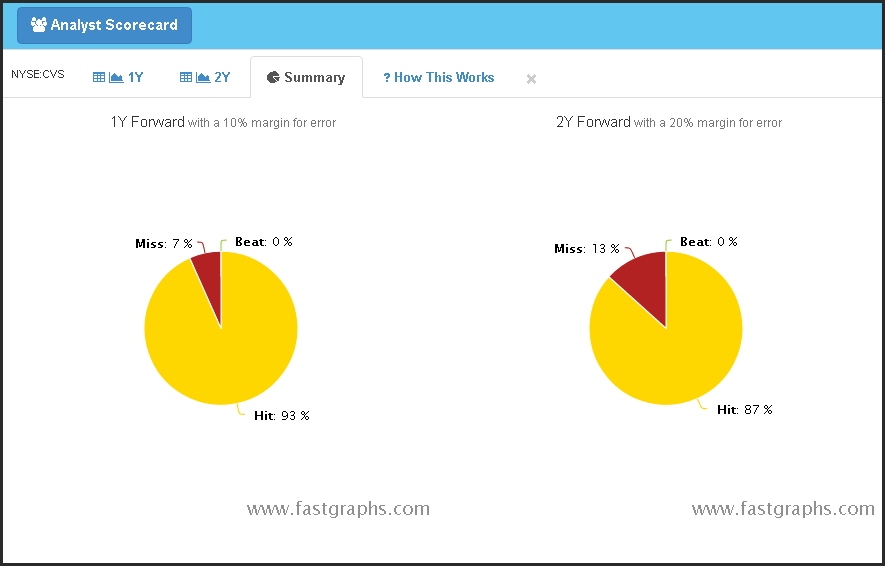

I have a reasonably high level of confidence in those forecasts based on the excellent historical track record of analyst estimates when made one year and two years forward as evidenced by the following Analyst Scorecard:

Additionally, Morningstar believes that CVS possesses a wide economic moat and that their large claim volume affords them the opportunity to take advantage of two key industry drivers: “supplier pricing leverage and centralized cost scale.”

The following excerpt from their analyst report speaks to CVS’s strong returns on invested capital and their long-term growth opportunity:

“CVS Health has pursued a vertically integrated strategy to try and capture as much value as possible from the retail pharmacy industry. The firm has established itself as a top-tier pharmacy benefit manager and one of the largest U.S. pharmacy retailers. Its stalwart competitive advantages have churned out outstanding returns on invested capital and have given it a wide economic moat. We anticipate robust growth for the pharmaceutical industry over the long term, which should provide CVS with a solid platform for continued success.”

In the most recent report provided by Zacks they highlight the recent Omnicare acquisition and suggest that it will contribute to future growth opportunities. They also believe that the recent Target Pharmacy purchase represents a strategic fit, and reports a positive view that the PBM business is gaining traction. Zacks also considers CVS’s specialty pharmacy business to be a high-growth driver. And they cite the opportunity regarding domestic demographic trends as a result of our aging population.

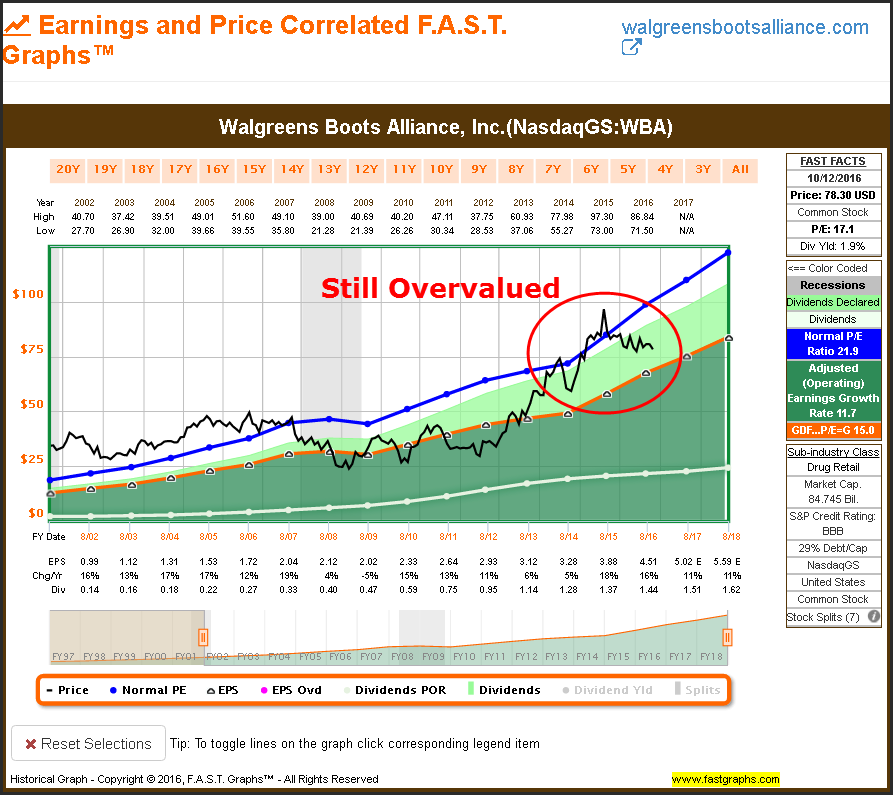

On the other hand, Zacks also points out CVS’s vulnerability to federal and state reimbursement laws due to their high dependence on Medicare, Medicaid and other government-sponsored health programs. They also address the potential competitive threat from the Walgreens Boots Alliance and Rite Aid pending merger. However, that merger is currently facing FTC scrutiny. Personally, I believe that there is room for both powerhouses to flourish in the future. Moreover, although I consider both WBA and CVS to be excellent businesses, I currently favor CVS based on a more attractive current valuation. For perspective, here is the earnings and price correlated F.A.S.T. Graph on WBA:

Summary and Conclusions

I suggest that CVS Health Corporation currently provides the opportunity for above-average long-term total returns over the next several years. I base my position on the company’s exceptional historical operating results, its growing dividend, and most importantly its current attractive valuation. In my opinion, the company’s recent stock price weakness is primarily attributed to the past overvaluation. Consequently, now that the company’s price has returned to fair value, I have become interested in learning more about this great business. Moreover, I would consider any further price weakness an opportunity to invest in a great business at a very attractive valuation.

Disclosure: Long CVS

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.