I wrote some stuff for CNBC yesterday at the open about the S&P 500. It came out near the close, but was still relevant. Many noted the bearish comments and levels, but there was one point I made toward the end about looking for a bounce. Let me expound on that for a minute here.

First, it does not mean that the S&P 500 will reverse to new highs. Nor does it mean that the bounce will be one day or that it will be tomorrow. All of these things are possible, but no one can predict them. And I am not predicting them. What I am doing is reading an amalgam of data in chart form that paints a mosaic that shows me the possibility is there for a bounce. If it happens, then I will start to look and see if there is data to support a reversal. Step by step.

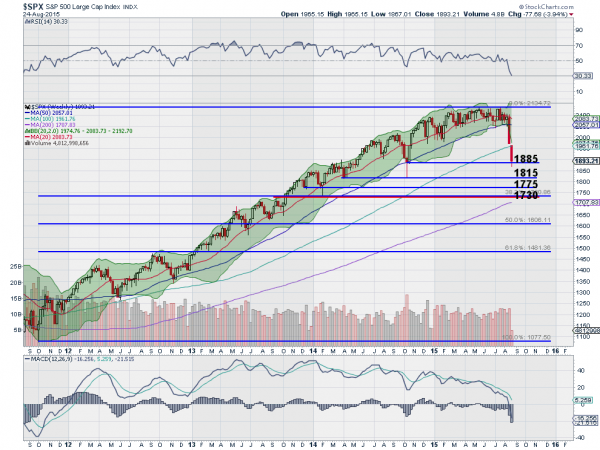

The chart above is the first place to look. The S&P 500 is clearly in pullback mode, but there are a few things to note. The current support level near 1885 is a 23.6% retracement of the move higher from the 2011 lows. Not a bad place to bounce.

The Index is far outside of the Bollinger Bands®. Extreme moves away from this volatility measure often end up in mean reverting price action. Just look at the last several times the index has but touched the Bands. Reversion every time.

Next the RSI, a momentum indicator, is now on the edge of being oversold. This measure can move at extremes for a long time, but also reverts. Look at the full length of the RSI on this chart. It has not been this low over the entire 4 years. There is a technical pattern here as well, should the index not break the October 2014 low before bouncing.

This would create a positive RSI reversal and target new all-time highs. But that is getting ahead of ourselves. The other momentum indicator, MACD, still has more room to the downside until it hits prior extremes, but there are not many instances when it has fallen this low.

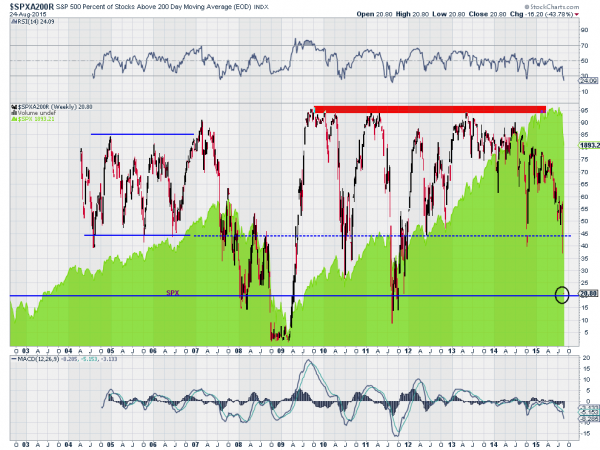

Finally, take a look at the number of stocks that are over their 200-day moving average. It is in that circle in the lower right, 20.8%, 104 names. This, too, is mean reverting in a range, but right now it is well outside of the range. The three prior times it has been this low are 2008, 2009 and 2011.

You can likely come up with a myriad of indicators and statistics that point in the opposite direction. But these have served me well, and when they are all happening together the mosaic suggests a bounce to come soon. What happens from there is a second step.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.