I often look for strong stocks in strong sectors by looking at the Zacks Industry Rank page. The semiconductor equipment stocks has been at the top for some time now, as those stocks have seen plenty of positive earnings estimate revisions.

One industry that is seeing some negative revisions to earnings estimates but has seen stock price increases is the home builder industry. On a YTD basis, the home builders are crushing it, up 27% compared to about 10% for the IVV (S&P 500). The industry rank for the home builders is 48 of 256 so that puts it in the top 19%.

Only One #1

The group has only one stock that is a Zacks Rank #1 (Strong Buy) and that is M/I Homes (MHO) which saw a huge move on the earnings release back in late April. The company posted a 44% positive earnings surprise and has traded over $29 following the report as was stuck under $25 before the release.

That report drove the lone positive earnings estimate revision, but it was a big one. The 2017 Zacks Consensus Estimate moved from $2.60 to $3.05 and the 2018 number kicked higher to $3.27 from $2.90.

Four #2’s

Lennar (LEN) just reported good earnings so there is a chance that this Zacks Rank #2 (Buy) could see estimates move even higher and that would help to push the Zacks Rank up to a Zacks Rank #1 (Strong Buy).

LEN is joined by KB Home (KBH), Lyon William Homes (WLH) and M.D.C. Holdings (MDC) as Zacks Rank #2 (Buy) stocks from this industry.

One More Report

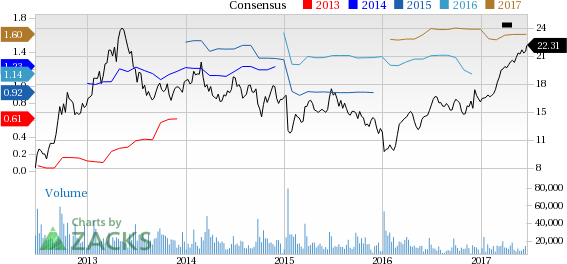

About a week from today we have KB Home (KBH) reporting earnings. The company is slated to share the May 2017 quarter on June 27 after the close. The Zacks Consensus Estimate is calling for revenue of $922M and EPS of $0.26.

The previous quarter was a beat of $0.01 and a 2% positive revenue surprise and that helped push the stock higher by 2.6% in the session following the release.

KBH has a 13.9x forward multiple which is basically in line with the industry average of 13.4x. The 1.1x book multiple is just slightly below the 1.7x industry average. The 0.5x sales multiple is also below the 0.8x industry average.

Looking for Ideas with Even Greater Upside?

Today's investment ideas are short-term, directly based on our proven 1 to 3 month indicator. In addition, I invite you to consider our long-term opportunities. These rare trades look to start fast with strong Zacks Ranks, but carry through with double and triple-digit profit potential. Starting now, you can look inside our home run, value, and stocks under $10 portfolios, plus more.

Click here for a peek at this private information>>

Lyon William Homes (WLH): Free Stock Analysis Report

M/I Homes, Inc. (MHO): Free Stock Analysis Report

M.D.C. Holdings, Inc. (MDC): Free Stock Analysis Report

Lennar Corporation (NYSE:LEN): Free Stock Analysis Report

KB Home (KBH): Free Stock Analysis Report

Original post

Zacks Investment Research