The S&P 500 finished Tuesday sharply higher as air continues coming out of Reddit’s GameStop (NYSE:GME), AMC Entertainment (NYSE:AMC), and iShares Silver Trust (NYSE:SLV) trades.

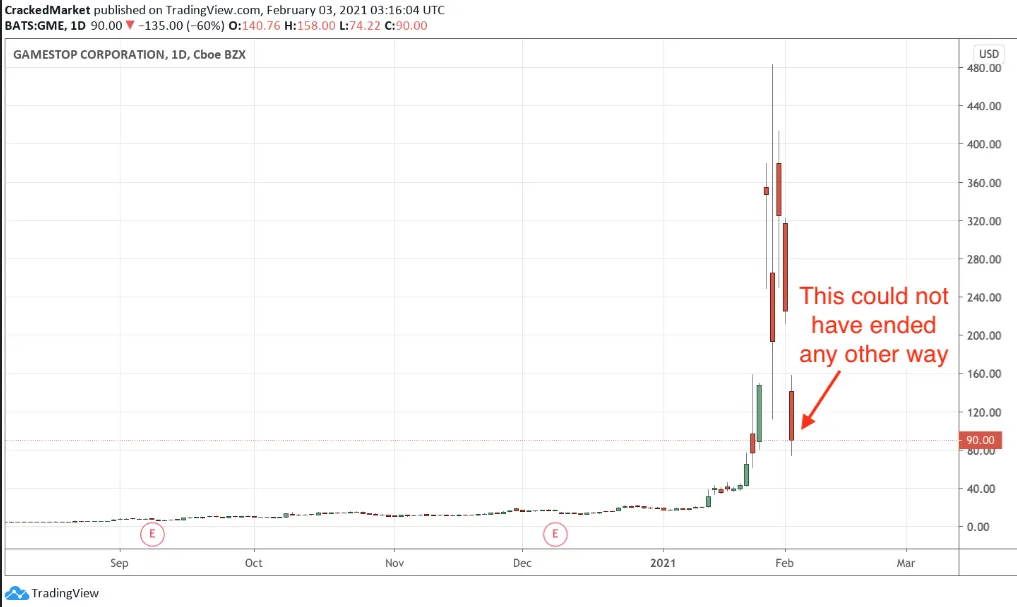

AMC tumbled 62% in just a few days. GME is down 82% from last week’s intraday highs. And even silver took it on the chin, falling 12% from Monday’s early levels.

Easy come easy go. But everyone with even a rudimentary understanding of market mechanics knew this outcome was inevitable. It didn’t take a “Wall Street conspiracy” to kill this frenzied buying. Instead, these small millennial buyers simply ran out of cash and there was no greater fool left to buy a struggling retailer up nearly 10,000%.

The broad market is clearly relieved the old rules still apply. Every day GME rallied last week, the indexes fell. And this week, every day GME fell, the indexes rallied. This Reddit thing is quickly turning into nothing more than a flash in the pan. Rather than upend the entire market and send it into chaos, this is turning out to be little more than a novelty that is fading as quickly as it came.

That said, these ripples will be felt for a while. GME already bounce 100% off yesterday's morning lows. Between another wave of gullible buyers rushing in to “buy the dip” and shorts closing positions with spectacular profits, there will be a good amount of buying in these names for a while and they will continue trading at elevated levels. (Far off the silly highs, but well above where they started.)

But from the index’s point of view, this was a minor sideshow and the bull market is ready to proceed after last week’s brief dip and reset.

Remember, bull markets bounce countless times, but they reverse only once. So far, this looks like nothing more than another one of those momentary stepbacks on our way higher.