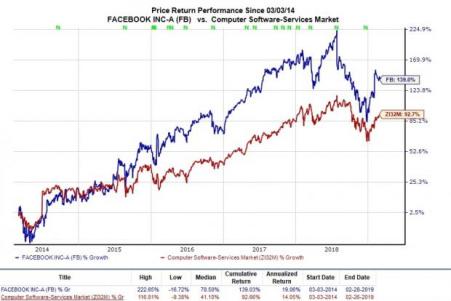

Shares of Facebook (NASDAQ:FB) have surged 23% since the start of the year, along with fellow FAANG powers such as Netflix (NASDAQ:NFLX) and much of the rest of the market. Despite this climb, FB stock closed regular trading Thursday down more than 26% from its 52-week high, which gives the stock plenty of room to run. And this is hardly the only reason that the embattled social media company looks like a buy at the moment.

Overview

Facebook faces nearly constant backlash about its user data practices and privacy missteps, yet its global monthly active user based popped 9% in Q4 to reach 2.32 billion. This marked only a slight downturn from Q3’s 10% MAU expansion. Plus, Facebook’s revenues in the U.S. and Canada, which account for roughly 50% of total revenues, climbed 32% to $8.43 billion.

Meanwhile, European MAUs jumped by 6 million sequentially in Q4 to close at 381 million. This was a positive sign after three straight quarters of sequential drops in the region that accounts for 25% of revenues.

Overall, Facebook’s fourth quarter revenues grew by 30.4% to reach $16.91 billion and top the Zacks Consensus Estimate. This, however, represented a slowdown from Q3’s 33% top-line expansion, which at the time broke FB’s 12-quarter streak of 40% or higher revenue expansion. It is of course always worth remembering that the law of large numbers makes it increasingly difficult for companies to post huge year over year gains on a percentage basis, just ask Amazon (NASDAQ:AMZN) .

Nonetheless, Facebook’s advertising dominance, along with Google (NASDAQ:GOOGL) , is unlikely to end any time soon. The company’s importance to marketers might become even more important as non-ad supported platforms from Netflix, Amazon, and soon enough Disney (NYSE:DIS) , Apple (NASDAQ:AAPL) , AT&T (NYSE:T) , and more, make consumers harder to reach.

Outlook

Mobile advertising revenues accounted for 93% of Facebook’s ad business in the fourth quarter—which is essentially the only way the company makes money—up from approximately 89% a year ago. This helps showcase the growth of FB’s photo and video sharing platform Instagram, which is used almost exclusively as a mobile app.

Going forward, Instagram seems set to become more vital. In fact, Facebook announced that it will soon stop breaking out numbers for its namesake platform and instead report metrics for its “Family” of services. “We believe these numbers better reflect the size of our community and the fact that many people are using more than one of our services,” CFO David Wehner said on the firm’s Q4 earnings call.

On top of that, Facebook has invested in its Marketplace platform as it tries to compete with the likes of eBay (NASDAQ:EBAY) . This could help it capture more of the digital and mobile retail industry, which is only set to expand. For instance, mobile accounted for over 50% of Nike’s (NYSE:NKE) digital commerce revenue last quarter. And Nike’s CFO expects the company’s digital division will make up 30% of the sportswear firm’s total business by 2023—compared to roughly 15% now. Meanwhile, Mark Zuckerberg’s company has spent heavily on and rolled out more offerings on its dedicated video platform known as Facebook Watch.

Looking ahead, Facebook’s first quarter revenues are projected to jump 25% to reach $14.96 billion, based on our current Zacks Consensus Estimate. FB’s full-year 2019 revenues are expected to pop over 23% to touch $68.89 billion.

At the bottom end of the income statement, we can see that Facebook’s 2019 earnings are expected to fall. But the company warned Wall Street of this downturn when it said it would spend billions on security upgrades and much more. With that said, Facebook’s 2020 earnings are projected to come in strong and its earnings estimate revisions have trended solidly in the right direction over the last 30 days.

Bottom Line

Facebook said last quarter that roughly 2.7 billion people—or around 35% of the world’s population—now use Facebook, Instagram, WhatsApp, or Messenger every month. This number alone is likely to help Facebook remain a strong and steady company for years to come, especially as the media business becomes more decentralized and traditional powers fade.

FB stock is also trading at just 21.1X forward Zacks earnings estimates. This marks a huge discount compared to its industry’s 30.3X average and Facebook’s three-year median of 27.9X. Facebook stock closed regular trading Thursday down 0.84% to $161.45 a share, which represented a 26% downturn from its 52-week high of $218.62 per share.

Facebook’s recent positive earnings estimate revision activity helps it sport a Zacks Rank #2 (Buy) at the moment. The company also rocks a “B” grade for Growth and an “A” for Momentum in our Style Scores system.

Zacks' Top 10 Stocks for 2019

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-holds for the year?

Who wouldn't? Our annual Top 10s have beaten the market with amazing regularity. In 2018, while the market dropped -5.2%, the portfolio scored well into double-digits overall with individual stocks rising as high as +61.5%. And from 2012-2017, while the market boomed +126.3, Zacks' Top 10s reached an even more sensational +181.9%.

See Latest Stocks Today >>

The Walt Disney Company (DIS): Free Stock Analysis Report

Netflix, Inc. (NFLX): Free Stock Analysis Report

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

eBay Inc. (EBAY): Free Stock Analysis Report

Facebook, Inc. (FB): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

AT&T Inc. (T): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

NIKE, Inc. (NKE): Free Stock Analysis Report

Original post

Zacks Investment Research