For a very clear example of why dividends matter, consider the case of Prospect Capital (NASDAQ:PSEC). I first purchased Prospect in late 2014, believing it to be cheap at the time and that the risk of a dividend cut was overstated.

Well, it turns out I was wrong about the dividend. Shortly after I bought it, Prospect slashed its dividend by 25%. Predictably, the price took a tumble, but I decided to give the position a little more time. The yield was high even after the cut, and the stock traded below book value.

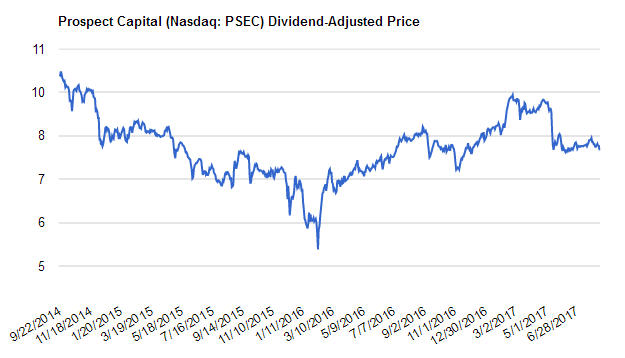

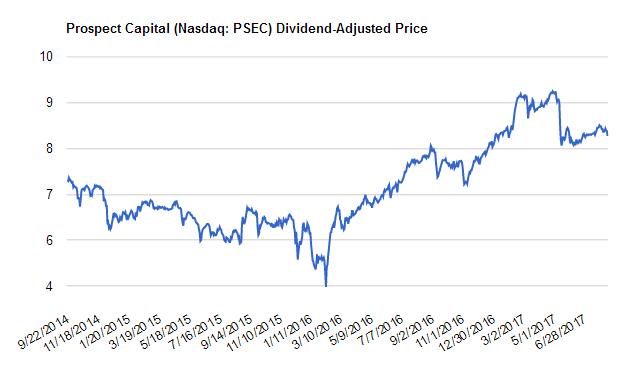

I should have been more disciplined and sold the stock after the dividend cut, as it continued to drop for the next year. Even now, that initial position is down over 20% on a price basis. But when you adjust the price for dividends paid, you get a much different picture.

Adjusted for dividends paid, Prospect Capital is up about 15% from my original purchase price. That’s by no means a great return (the S&P 500 is up about 22% over the same period). And I haven’t taken into account tax effects. But it does make the power of dividends abundantly clear. After dividends paid, a disappointing loser becomes a respectable winner.

Disclosures: Long PSEC.

Disclaimer: This material is provided for informational purposes only, as of the date hereof, and is subject to change without notice. This material may not be suitable for all investors and is not intended to be an offer, or the solicitation of any offer, to buy or sell any securities nor is it intended to be investment advice. You should speak to a financial advisor before attempting to implement any of the strategies discussed in this material. There is risk in any investment in traded securities, and all investment strategies discussed in this material have the possibility of loss. Past performance is no guarantee of future results. The author of the material or a related party will often have an interest in the securities discussed. Please see Full Disclaimer for a full