Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

Rates are rising once again. Over 90% of investors focus almost exclusively on stocks. This is a mistake. The reality is that everything happening in stocks since 2008 has been the direct result of Central Banks creating a bubble in bonds.

Because our current financial system is debt-based in nature (meaning sovereign debt, not gold or some other asset is the bedrock of the financial system) when Central Banks did this, they effectively created a bubble in everything (including in stocks).

Put simply, it is BONDS, not stocks, that concern Central Banks the most. If stocks collapse, it’s a big deal for investors. If bonds collapse, it’s a big deal for entire countries/ the financial system.

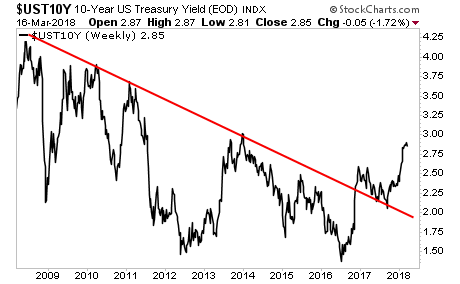

With that in mind, consider that bonds have begun to collapse, with US Treasury bond yields (represented by the US 10-year chart below) rising sharply above their downtrends.

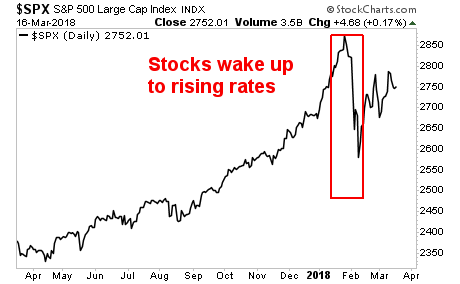

THIS is what triggered the February meltdown of markets, including the S&P 500.

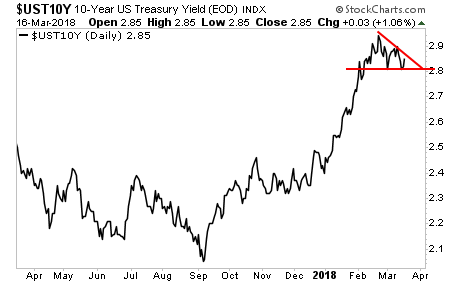

And by the look of things, we’re not done yet. Instead of falling hard, rates have found support and are preparing to break out to the upside again.

This is a MAJOR warning for stocks. Despite spending over $14 TRILLION trying to corner the bond markets, Central Banks are STILL beginning to lose control. The Everything Bubble is beginning to burst.