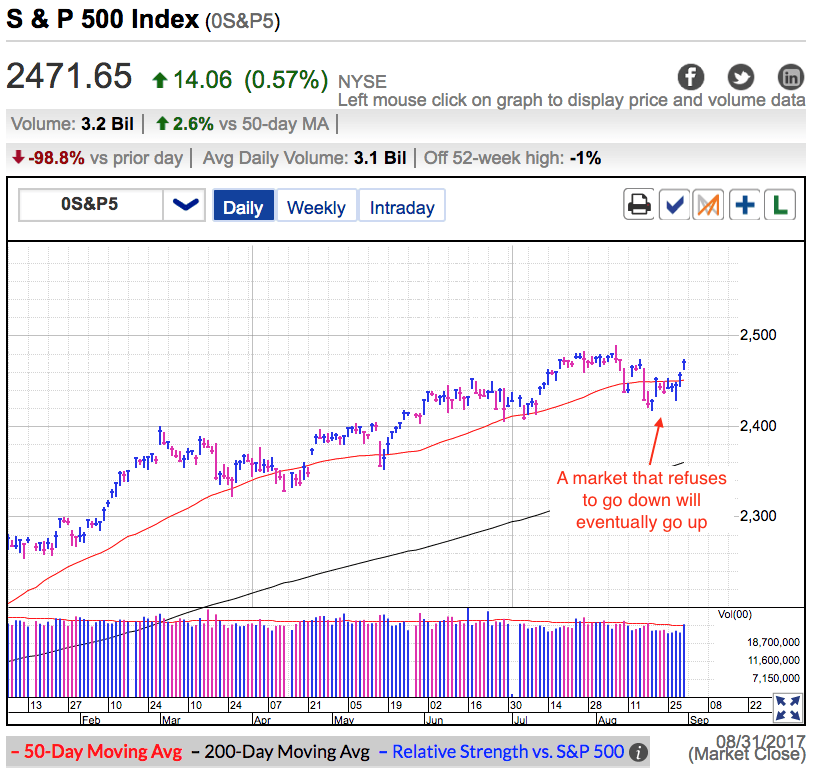

On Thursday the S&P 500 extended Wednesday’s breakout above the 50 dma. Despite escalating tension with North Korea and a category four hurricane, stocks continue trading near all-time highs. As I’ve been saying all month, a market that refuses to go down will eventually go up. That is exactly what is happening here.

Even though the news flow has been overwhelmingly bearish this month, stocks have barely budged from record highs. At our deepest and darkest period in August, we were down a whole 2% from all-time highs. Bears were giddy with excitement and kept telling us to wait for it. But the crash never happened. That shouldn’t come as a surprise to anyone who reads this blog. Market crashes are breathtakingly fast, not drawn out affairs. If the initial headlines couldn’t knock us down, the follow-up headlines were even less likely to do so.

It all comes down to simple supply and demand. The first North Korea headlines scared off the traders who fear such a thing. The next time those same headlines popped up, there were fewer people left to sell the recurrence. Instead, these fearful sellers were replaced by confident dip buyers who demonstrated a willingness to hold the risk. This churn in ownership is how news gets priced in and why it stops mattering.

Tuesday North Korea launched a missile over Japan, but paradoxically that was our buy signal. Everyone who feared those headlines had already sold and the market was setting up to bounce on tight supply. We capitulated early Tuesday and have been racing up ever since.

Nervous and fearful traders were wary of what they claimed was a weak market. But they got it exactly wrong. Withstanding the relentless barrage of negative headlines confirmed how strong this market was. If we were vulnerable to a collapse, any one of those headlines would have sent us tumbling. The fact we stood up so well tells us this is a strong market, not a weak one.

In all my years of trading, one of the most reliable trading signals comes from identifying what the market is NOT doing. Despite all the headline uncertainty, this market was not tumbling. That told me there was good support behind these prices and the path of least resistance remained higher. That told us the latest drop in price was still a dip in buying opportunity.

The last few weeks of selling purged many weak owners from the market and replaced them with confident dip buyers. This firmed up support and this bull is even stronger than it was last month. This base building process is setting the stage for the market’s next move to all-time highs. The path of least resistance remains higher and 2,500 is easily within reach. From there we need big money to start buying to keep the rally alive.

The market is up around 10% for the year. While this has been slow this summer, I don’t expect that to last. Volatility is already picking up and that will continue through the fall. While many bears warn about downside volatility, I actually think bigger risk is upside volatility. Many cynical money managers are underweight in this market and they have been patiently waiting for a pullback. The latest 2% dip is about as good as it is going to get. When they realize this market is far more resilient than they thought, they will be forced to chase prices higher or else risk explaining to their investors why they lagged behind the indexes so badly this year. That desperate chase for performance is going to fuel a strong rally into year-end.

While that is the most likely outcome, there is a chance Trump and Republicans fumble tax reform and the market uses that as an excuse to take profits. This could lead to a wave of reactionary selling that drops us near breakeven for the year. That said, this is a low probability event because the fumbling, bumbling Republicans cannot get anything done and expectations for tax reform are already quite low. I doubt many people will be surprised if Trump and the GOP get nothing accomplished this year. That lack of surprise means we won’t see much of a selloff. If we were vulnerable to high expectations, we would have seen a much stronger reaction when the Senate failed to pass healthcare reform.

This is an incredibly strong market that is ignoring every excuse to sell off. Keep doing what is working. Stick with your buy-and-hold positions and buy every dip until further notice.