Apart from the still-resilient consumer and tight labor market, there haven’t been many bright spots for the economy in 2022. Inflation is the highest in over four decades; supply chains have been disrupted by Covid and the Ukraine war; Stocks dropped into a bear market in the first half of the year; U.S. GDP fell for two consecutive quarters, meeting the technical definition for a recession; And last, but not least, the Fed is aggressively raising rates to curb inflation, threatening to make a bad situation even worse.

Yet, instead of falling even more on this gloomy backdrop, the S&P 500 has been surging in recent weeks. In fact, stocks climbed the most on the very news that common sense dictates should’ve caused them to plunge. The Fed hiked rates by 75 bps for the second consecutive time on July 27. The S&P rose over 72 points that day. GDP data showed the economy contracted by 0.9% in Q2 on July 28. The stock market benchmark added another 46 points in response.

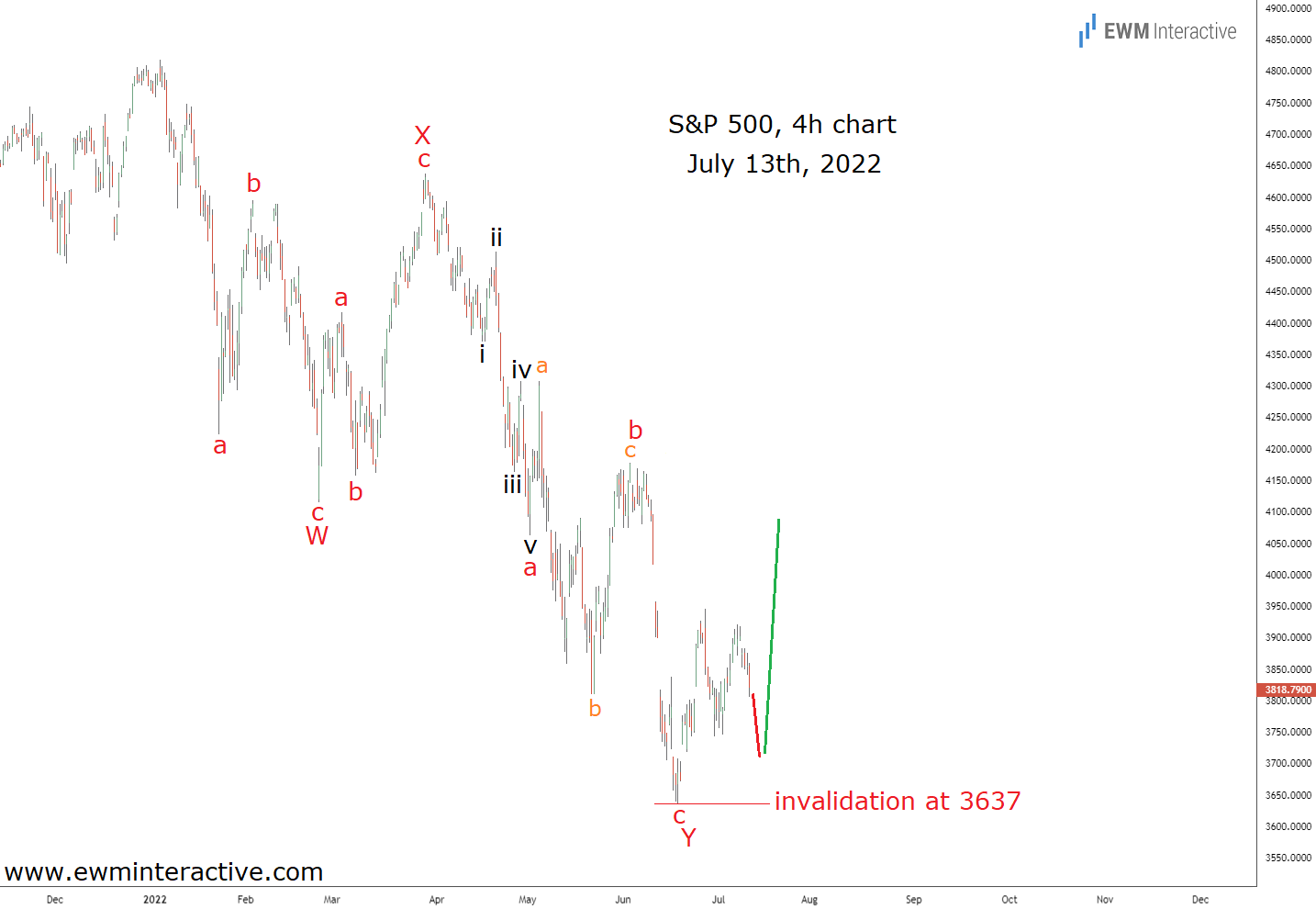

Apparently, in the new uncertain normal we live in, bad news is suddenly good news to the markets. The really good news, however, is that Elliott Wave analysis actually put us ahead of the recent rally in stocks. The S&P 500 chart below was published as an Elliott Wave PRO update on July 13, two full weeks prior to the current recovery.

The S&P 500’s 4-hour chart allowed us to focus on the structure of the H1 2022 bear market. We labeled it as a complete W-X-Y double zigzag correction, where each wave is a simple a-b-c zigzag. The most interesting part of this sequence is the running flat correction in wave ‘b’ of Y.

Stocks Turned Bullish Despite the Doom and Gloom

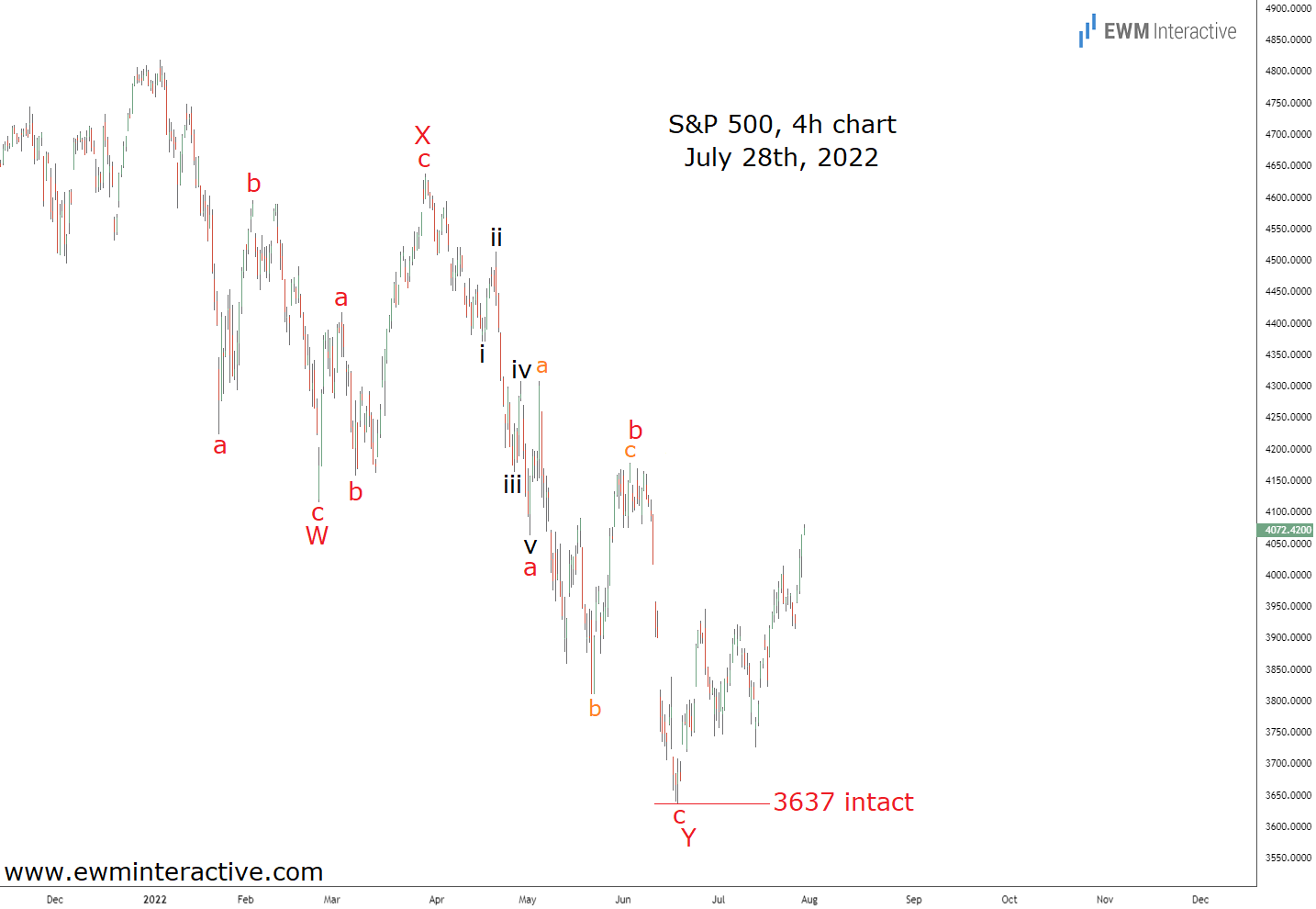

A complete W-X-Y correction between 4819 and 3637 meant the bear market was most likely over. In other words, higher levels could be expected as long as the bottom of wave Y at 3637 remained intact. Two weeks later now, that invalidation level is not only far from danger, but stocks have risen relentlessly, ignoring all the bad news.

3637 was never breached and futures point to an open near 4100 for the S&P 500 today. While it is still to early to declare the end of the 2022 bear market, history tells us stocks turn up long before a crisis is actually over. World War Two ended in 1945, but stocks bottomed three years earlier, in 1942. The Covid pandemic is still in full swing, yet the markets started climbing as early as late-March, 2020. Could it be that the S&P 500 is already in an uptrend, despite rampant inflation and a war in eastern Europe? Only time will tell. What we do know, however, is that we’re going to continue to rely on Elliott Wave analysis for guidance in these scary times. It’s put us ahead of the news more than just a few times.