Some of you might have already heard us speak about the monthly moving averages or have read our commentary about their significance.

Monday, we asked,

“What if the trading range top at 4200 we have been calling for in the S&P 500 turns out as—the top?”

Then, on Fox Business, Making Money with Charles Payne, I discussed the 2-year business cycle.

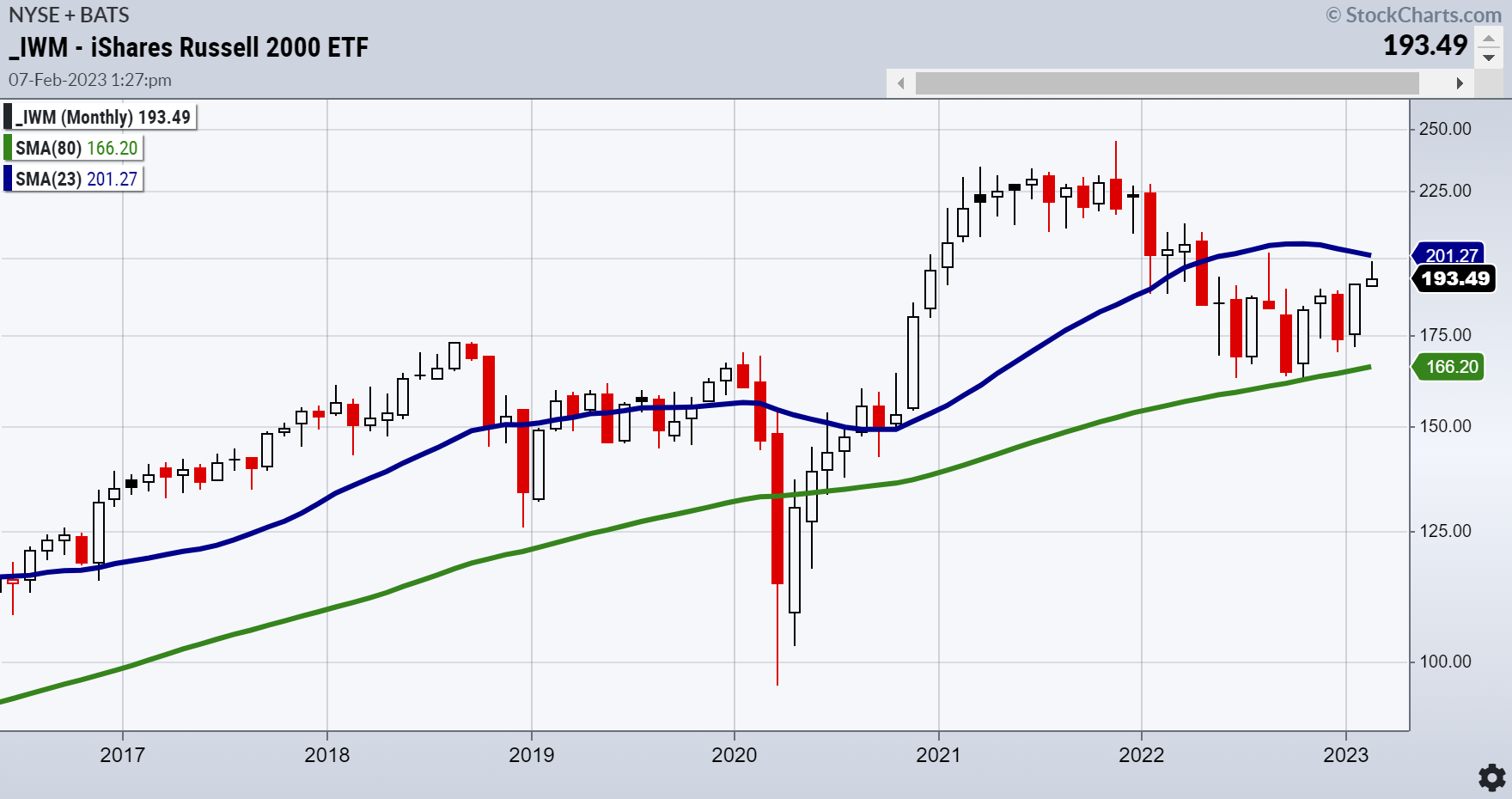

Today, we show you the charts on how that business cycle looks. At the very least, a 2-year or 23-month moving average in blue is interesting.

What has happened in the last 2 years? A bullish run in 2021 based on easy money. Inflation running hotter than most expected.

The banks were caught off guard, and by 2022, the party was over.

So, that begs the question of why this year’s 23-month moving average is one of the most important indicators for equities.

Here is the Russell 2000 (IWM). Even cleaner, perhaps.

As Granddad of the Economic Modern Family, a break and close over the 23-month MA would be enough evidence to believe soft landing and good news for the economy and market.

A failure to pierce that MA means to chop. A break of the also majorly important 80-month MA (green) that represents a 6-7 year business cycle-bad..very bad.

In October, IWM held the 80-month and convinced us that a recession would be averted.

Now, the market literally hangs in the balance between a longer-term and a shorter-term business cycle. Trust the charts and know your timeframe.

ETF Summary

- S&P 500 (NYSE:SPY): 420 resistance with 390-400 support.

- iShares Russell 2000 ETF (NYSE:IWM): 190 now support and 202 major resistance.

- Dow Jones Industrial Average ETF Trust (NYSE:DIA): 343.50 resistance and the 6-month calendar range high.

- Invesco QQQ Trust (NASDAQ:QQQ): 300 is now the pivotal area.

- S&P Regional Banking ETF (NYSE:KRE): 65.00 resistance.

- VanEck Semiconductor ETF (NASDAQ:SMH): 248 is the 23-month moving average key.

- iShares Transportation Average ETF (NYSE:IYT): The 23-month MA is 244-now resistance.

- iShares Biotechnology ETF (NASDAQ:IBB): Sideways action.

- S&P Retail ETF (NYSE:XRT): 78.00, the 23-month MA resistance, and nearest support 68.00.