Natural grocery store operator Whole Foods Market (NASDAQ:WFM) late today posted better than expected Q4 earnings, but its comparable sales growth and 2017 outlook fell well short of expectations.

Surprisingly, shares were rising up to 4% in late trading anyway.

The Austin, Texas-based company reported fiscal Q4 EPS of $0.28, which was four cents better than Wall Street’s $0.24 estimate. Revenues rose 1.7% from last year to $3.5 billion, slightly missing forecasts for $3.51 billion.

On a sour note, comparable store sales fell 2.6% from the year-ago period. Comparable sales, also known as same-store sales or simply “comps,” are perhaps the most important measure of a brick-and-mortar retailer’s health, since they gauge the year-over-year performance of stores open at least 12 months.

WFM also noted it saw Q3 EBITDA of $276 million, or 7.9% of sales, along with a 13% return on invested capital.

Looking ahead, Whole Foods issued weaker-than-expected guidance. For the full fiscal year 2017, it forecast EPS of $1.42 or more, while analysts are looking for $1.47 per share for the year. Full-year revenues are seen growing 2.5-4.5% to about $16.12 to 16.43 billion, which would also miss Wall Street’s $16.44 billion estimate. It also issued 2017 comparable store sales growth of -2% to 0%.

Finally, Whole Foods said it will abandon its co-CEO structure, and go with a sole Chief Executive Officer, with co-Founder John Mackey to serve in that capacity very soon.

The company commented via press release:

“In a year that presented many headwinds for food retailers, we made measurable progress on positioning our company for continued success while producing industry-leading sales per gross square foot and healthy returns on invested capital.”

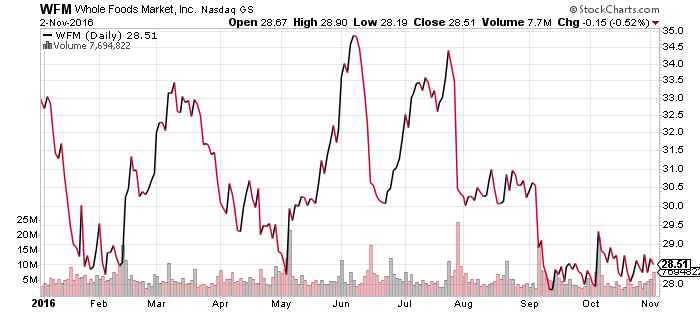

Whole Foods shares in after-hours trading Wednesday. Prior to today’s report, WFM had fallen 14.5% year-to-date, versus a 3.1% rise in the benchmark S&P 500 during the same period.