Nearing the end of 2019, our research team continues to attempt to dissect the market rally in an effort to present credible research and timely insights to skilled technical traders. We recently authored a research article discussing the potential that the US Stock market is less than 2.5% away from a major resistance level that could prompt a massive market top.

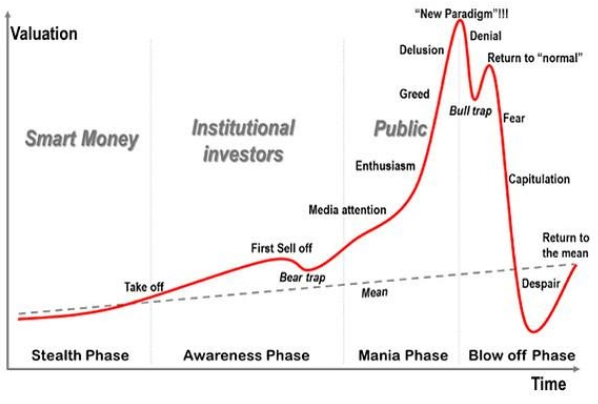

This recent research leads us to revisit the recent blow-off rotation in recent markets. The typical market cycle moves from through these cycles Stealth Phase, the Awareness Phase, the Mania Phase and finally to the Blow-Off Phase. The Stealth Phase is where the smart money pours into the market taking advantage of undervalued assets/equities. The Awareness phase is where more traditional and retail investors pile into assets that have formed traditional bottom formation and started to rally. The Mania Phase is when enthusiasm and greed take over and when the market moves higher in a parabolic price mode – ultimately reaching a massive top. Then, we start the Blow-Off Phase which usually starts with a deep “R” type price rotation – followed by extended selling.

Source: Dr. Jean-Paul Rodrigue Dept. of Global Studies & Geography Hofstra University

We've seen these types of market phases play out over the past 20+ years multiple times. The Dot-com market breakdown, the 2009 credit market crisis and the 2017 BITCOIN breakdown. One of the clearest examples in history was the 1929 Stock Market Crash.

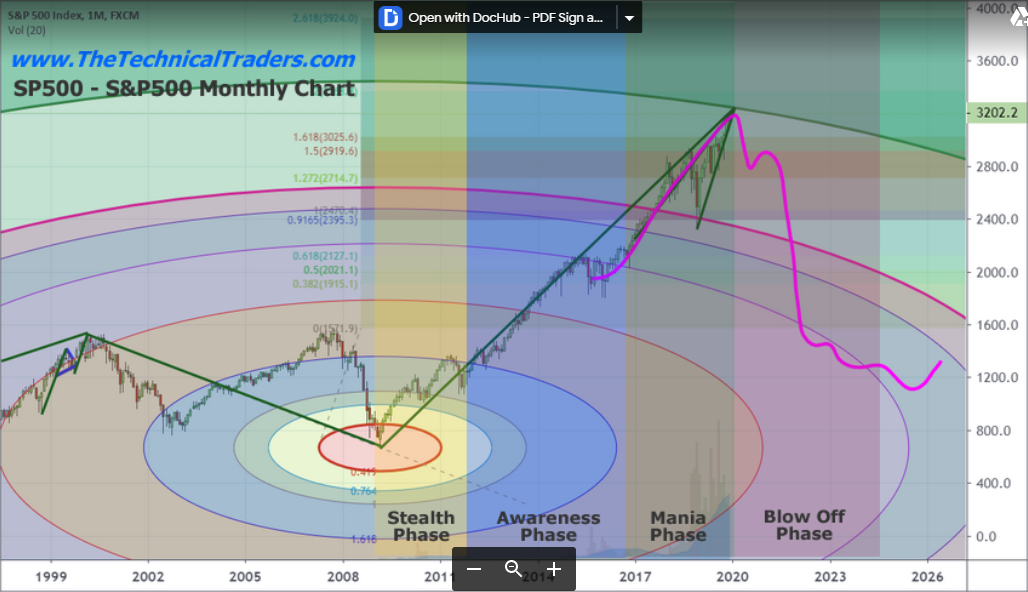

The effort of our research team is to highlight the recent rally mode in the US stock market after the 2018 US Stock Market rotation (January 2018 and August 2018). If you pay very close attention to the details of these actual price rotations in the examples below, you'll notice that every ultimate peak happened after a period of moderately deep price rotation and an extended upside price rally (an exhaustion rally). In every example, this rotation setup the exhaustion rally, which ultimately set up the massive price peak/top.

Source: Dr. Jean-Paul Rodrigue Dept. of Global Studies & Geography Hofstra University Cole Garner: https://medium.com/hackernoon/marketcycle-4e5407d0c68

We believe the rotation in the US stock market in 2018 exhibited the exact same price setup and the current upside price rally is the exhaustion rally that will ultimately set up a massive price peak/top. We've highlighted our research team's expectations in the S&P 500 chart below.

The fact that this potential price peak aligns with our GREEN Fibonacci price amplitude arc presents another clear example that massive resistance exists near 3200 in the S&P. The phases of the extended market rally, lasting just over 10 years now, align nearly perfectly with the previous examples of major market tops and a Blow-Off Phase.

Our research team believes the resistance level near 3200 on the S&P will likely result in a downside price rotation setting up an “R” type price move. Once this completes, a Blow-Off phase could begin rather quickly. We believe the expansion of the markets has reached a point well past a euphoric phase and the rotation in 2018 setup the perfect exhaustion rally phase. We believe it is just a matter of time at this point before the Blow-Off phase begins.

We would be surprised if the S&P rallied far beyond the 3200 price level before setting up the “R” price rotation. We believe the first 3 to 5 months of 2020 will create the “R” price setup before broader market concerns take hold – potentially bursting investor enthusiasm.