Markets will be eyeing the outcome of a meeting between U.S. President Donald Trump and his Russian counterpart Vladimir Putin on Monday amid heightened geopolitical tensions. Investors will also be looking ahead to Federal Reserve Chairman Jerome Powell’s testimony on the economy and monetary policy to a Senate committee on Tuesday. The dollar dipped against a currency basket on Friday, pulling away from two week highs, but still notched up a weekly gain and prospects for a stronger dollar remain intact for now. Demand for the dollar has been underpinned as recent economic data indicated that the Federal Reserve is likely to remain on track to raise interest rates twice more this year. China, the biggest consumer of everything from copper to coal, has warned the proliferation of tariffs could cause a global recession. On the other hand, the U.S. import prices fell the most in more than two years in June. On July 20th, 2018 the G20 group of nations is going to hold the first day of a summit meeting in Buenos Aires. All these important events are evident enough to bring small tremors in crumbling commodities but may be liable to shake global equity markets too.

Now, let us see who will press the trigger first. Will it be Trump-Putin meet, Jerome Powell’s testimony, crude price, dollar strength/weakness? Of course, nobody knows well about the future directional move. But one little unexpected tilt in geopolitical moves is likely to result in expansion of tremor waves in global economy due to chain reactions of one factor leading to many more reactionary moves.

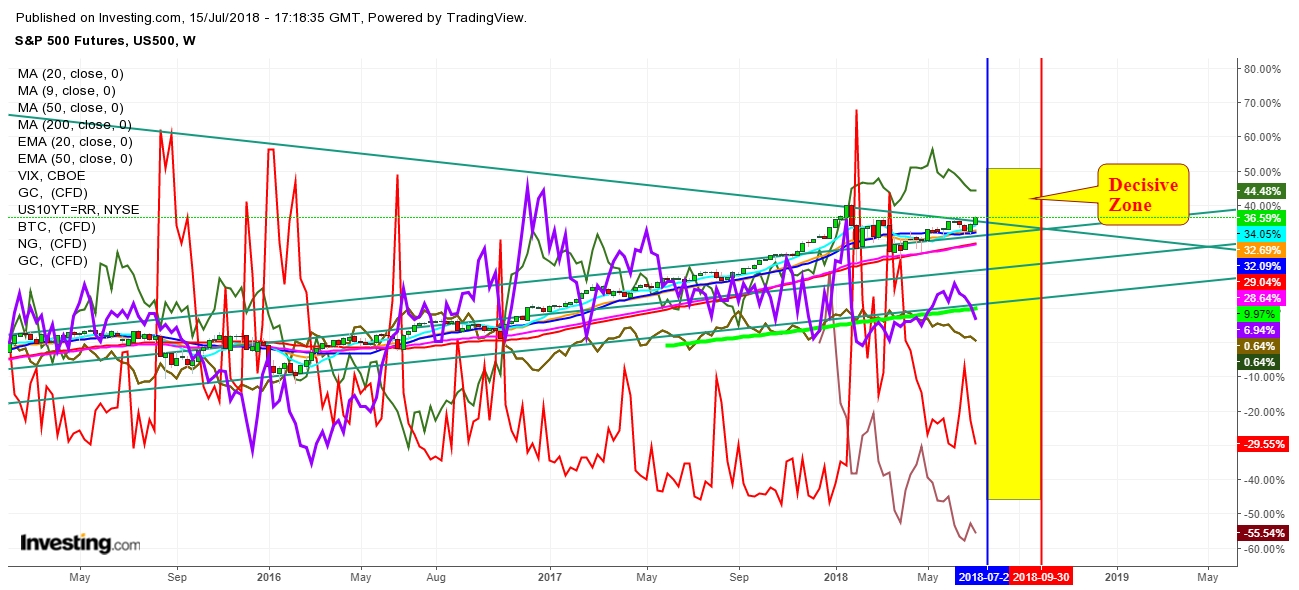

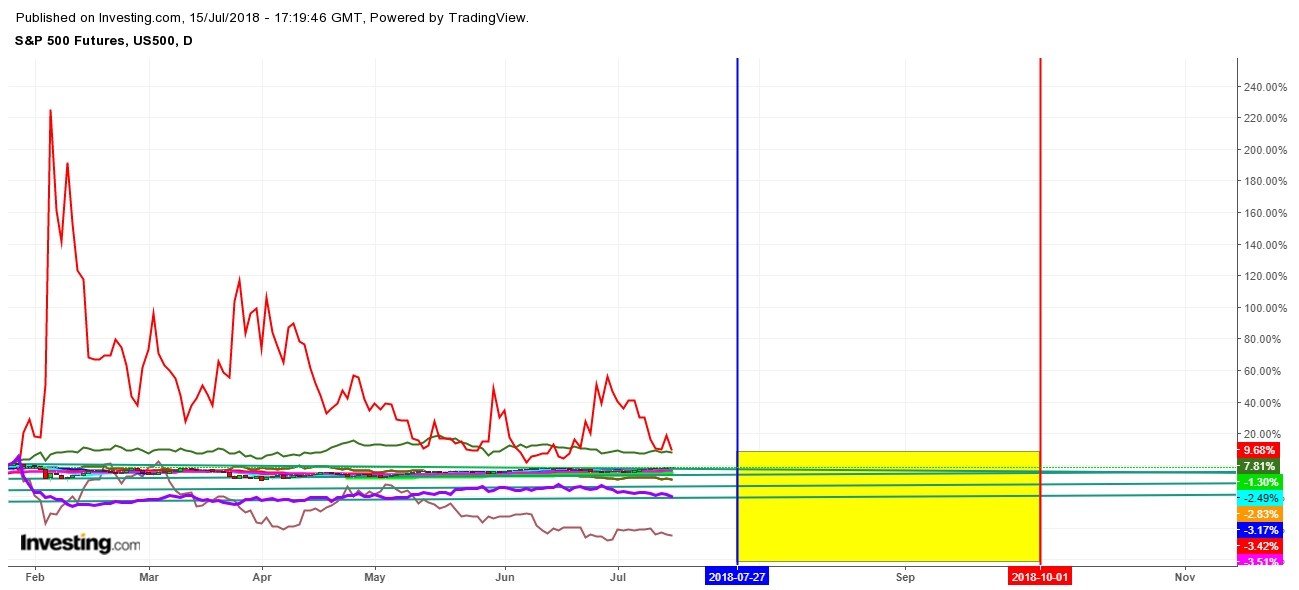

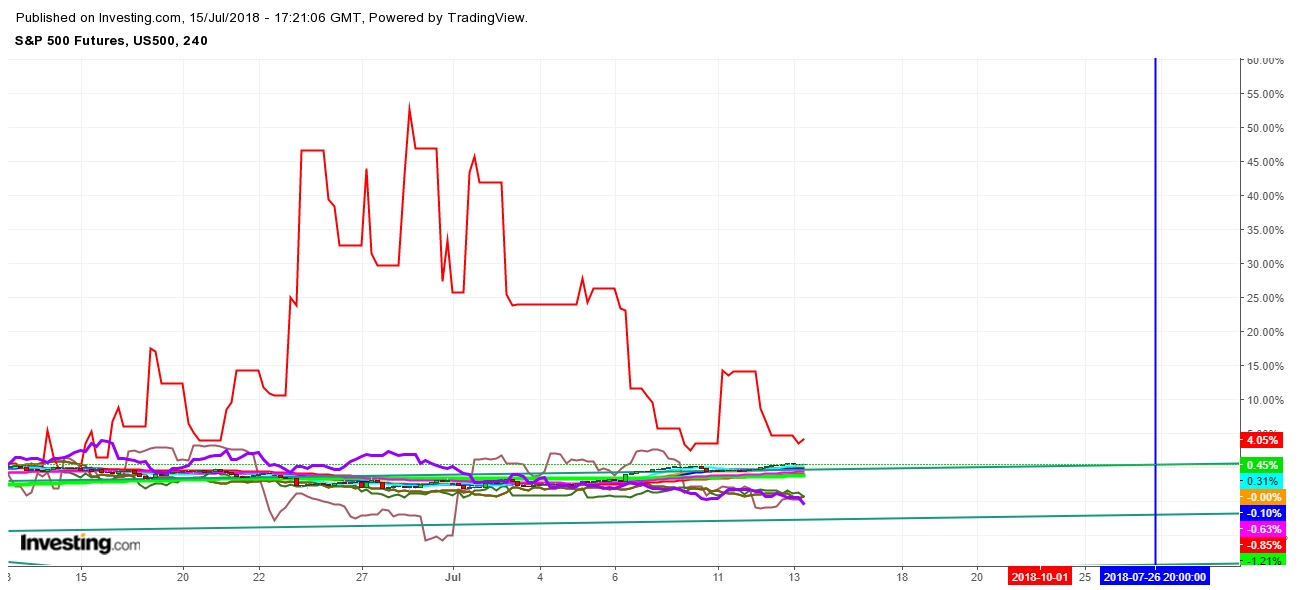

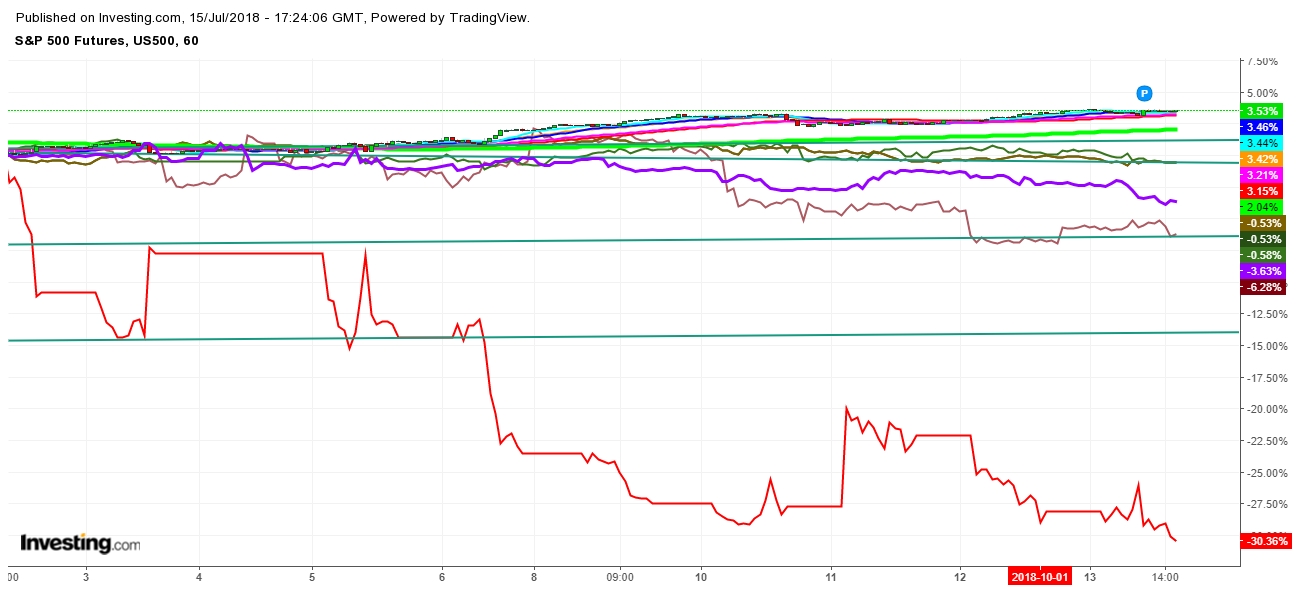

Amid such indecisive scenario, I find it the necessary to keep an eye over the smaller to smallest directional change in all commodities, indexes and forex futures. On analysis of the movement of natural gas, WTI crude oil, the USD, 10-year T-bill yields, S&P 500, as well as gold and silver on July 15th, 2018, I’ve found that most of the commodities look to wait for the next news, which may be too influencing to shake the global equity markets. I expect the following directional moves in natural gas WTI crude oil, the USD, 10-year T-bill yields, S&P 500, as well as gold and silver.

To understand the following analysis in detail subscribe my YouTube channel.

Disclosure

1. This content is for information and educational purposes only and should not be considered as an investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital be involved which you are prepared to lose.

2. Remember, YOU push the buy button and the sell button. Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from an investment and/or tax professional before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.