Energy major Whiting Petroleum Corporation (NYSE:WLL) expects to incur an impairment charge of $800-$900 million in the fourth quarter of 2017. The charges are connected to the partial write-down of the Redtail field assets located in the Denver-Julesburg Basin, or the DJ Basin.

Per the regulatory filing, the write-down of the assets will not cost the company any cash expenditures.

The partial write-down of the Redtail field assets follows its earlier decision to focus on the Williston Basin's development activities next year. This move was backed by the comparative performance of the two basins. Whiting Petroleum’s reserves in the Williston Basin have increased by 59 million barrels of oil equivalent.

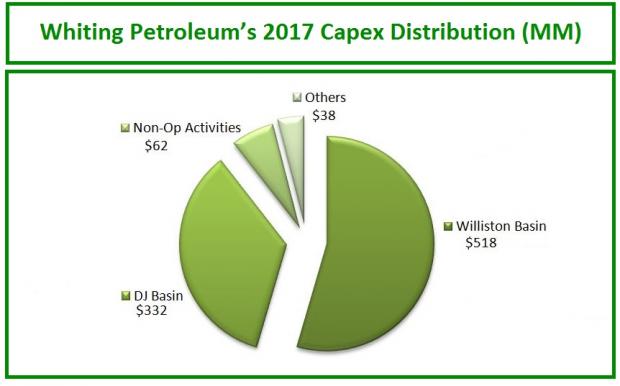

Notably, the company had planned to use 54.5% of 2017 budget for the development of Williston Basin. Redtail Basin was supposed to receive around 35% of the budget.

About the Company

Whiting Petroleum is based in Denver, CO. It is independent oil and gas company that acquires, exploits, develops and explores for crude oil, natural gas and natural gas liquids primarily in the U.S. Rocky Mountains region.

The company’s sales for 2017 are expected to increase 27.6% year over year. In the past two months, 12 estimates have gone higher for Whiting Petroleum compared to one lower for 2017. However, Whiting Petroleum has lost 46.8% year to date compared with 22.5% decline of its industry.

Zacks Rank and Stocks to Consider

Whiting Petroleum has a Zacks Rank #3 (Hold). Some better-ranked stocks in the oil and energy sector are ConocoPhillips (NYSE:COP) , Northern Oil and Gas, Inc. (NYSE:NOG) and Holly Energy Partners, L.P. (NYSE:HEP) , all sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Houston, TX-based ConocoPhillips is a major global exploration and production company. The company’s sales for 2017 are expected to increase 24.4% year over year. The company delivered an average positive earnings surprise of 152.3% in the last four quarters.

Minnetonka, MN-based Northern Oil and Gas is an independent energy company. The company’s sales for the fourth quarter of 2017 are expected to grow 51.9% year over year. The company pulled off an average beat of 175% in the last four quarters.

Dallas, TX-based Holly Energy is a production pipeline company. The company’s sales for 2017 are expected to climb 10.4% year over year. The company came up with a positive earnings surprise of 57.1% in the third quarter of 2017.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Holly Energy Partners, L.P. (HEP): Free Stock Analysis Report

Whiting Petroleum Corporation (WLL): Free Stock Analysis Report

Northern Oil and Gas, Inc. (NOG): Free Stock Analysis Report

ConocoPhillips (COP): Free Stock Analysis Report

Original post

Zacks Investment Research