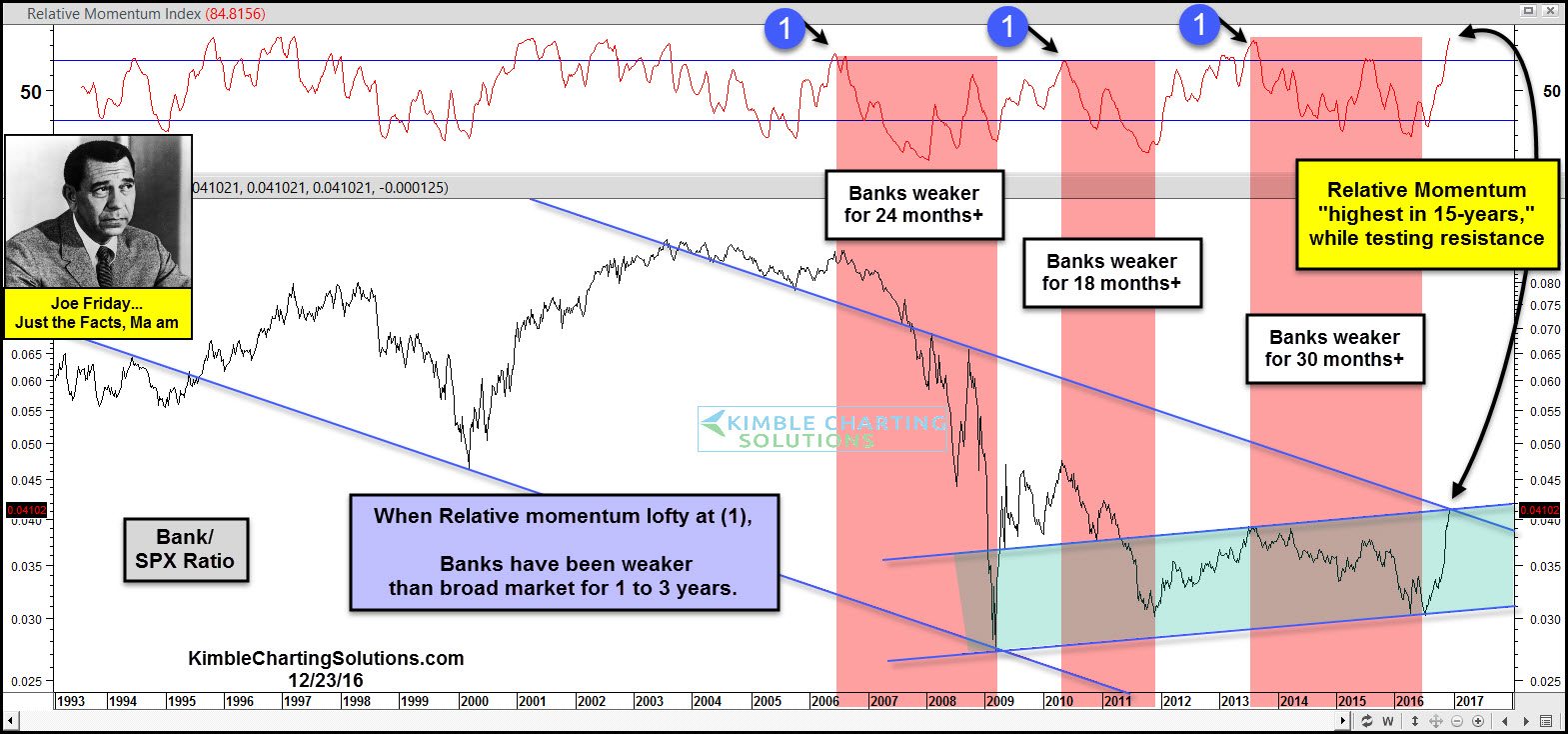

Ninety days ago, I said that if history is a guide, banks could underperform the broad market going forward. The chart below was shared on 12/23/16. It highlighted that since the highs in 2007, when the Bank/SPY ratio became very over bought, banks lagged the broad market for a good while thereafter.

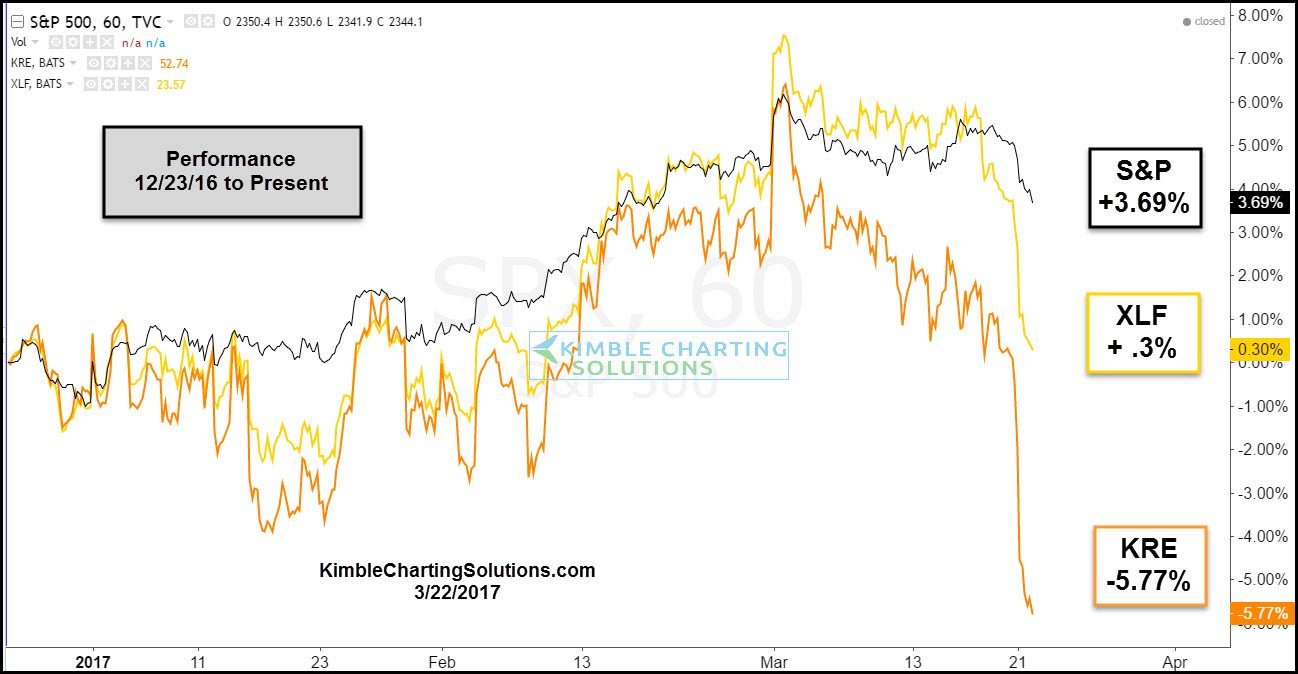

Since the highs in the financial crisis, each time banks have attempted to out perform the S&P 500 when momentum was high, banks struggled and the broad market wasn't that much better off. Below looks at the performance of the S&P 500, Banks (NYSE:XLF) and Regional Banks (NYSE:KRE) since last December.

The post-election “reflation theme” needs banks to keep up with or outperform the S&P 500. If banks continue to flounder or decline in price, it could call the whole reflation theme into question.

Bottom Line?

Keep a close eye on the banks. The reflation theme wants the Bank/SPX ratio (top chart) to breakout. If it does, it would send a positive price message for banks and be bullish for stocks.