No less an authority than Tom McClellan went onto CNBC (“The Network That Never Knew a Bear Market”) yesterday to declare that the bull market would just keep rip-roaring away another year. Maybe. Maybe not. I wanted to show a couple of ETFs which I’m short that suggest otherwise, at least for the short-term.

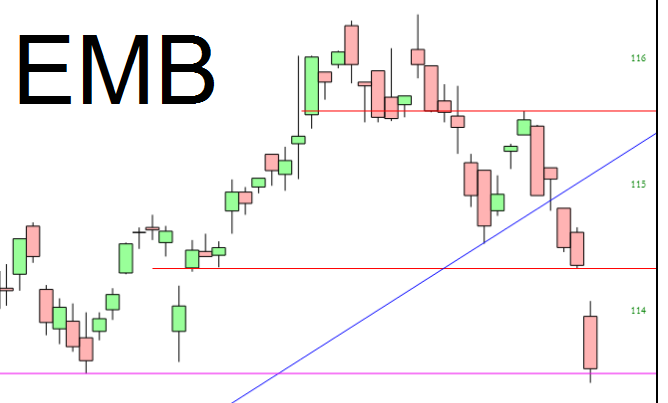

The first one is the emerging markets bond fund. Doesn’t exactly look healthy, does it? This is by far (by an order of 10 times) my biggest positions, and I’m cheerfully holding onto it.

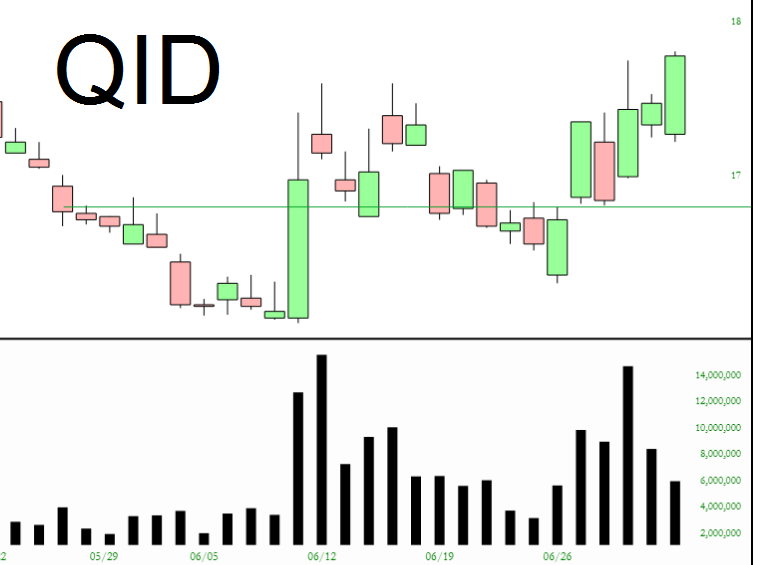

The other is a long, but since it’s an ultrashort it’s bearish – – my principal ETF position, the ProShares UltraShort QQQ (NYSE:QID), which is the double-inverse on the NASDAQ. It’s been doing well for obvious reasons, and I want to particularly point out the sensational increase in volume lately.

Famous luminaries with technical studies named after them don’t scare me. History is littered with brilliant minds that have been proved wrong. We shall see.