I recently wrote about a trend that’s making income investors excited: After years of failing to produce decent returns, bonds are back.

Media outlets, including Bloomberg, have picked up on this. And my friends who work on Wall Street are talking about bonds more than I’ve ever heard them do so before.

That makes sense, given how strong stocks have been lately. With the S&P 500 up 21% since January as I write this, many folks feel they’re overpriced. That, in turn, makes bonds look more attractive as an alternative.

This is especially true if you’re looking for income; the Federal Reserve has started cutting interest rates and has said it plans to keep doing so. That means savings accounts will pay less and less, likely falling far below 3% in the coming years. Some banks are getting ahead of that trend and cutting the rates they offer savers.

So for investors looking for a reasonable income stream, savings accounts are out and stocks are looking pricey (and low-yielding, with the average S&P 500 stock paying just 1.2% today).

That leaves bonds. But which bonds are our best play here?

Not All Bonds Are Set to Soar

One issue with bonds is that they’re more complicated than stocks. The bond market is also much larger than the stock market (which might surprise you—but it’s true!), and there are details about bonds that make it hard to compare them to one another. As a result, not all bond funds offer the same kinds of returns.

“Safer” Bonds Can Actually Cost You Money

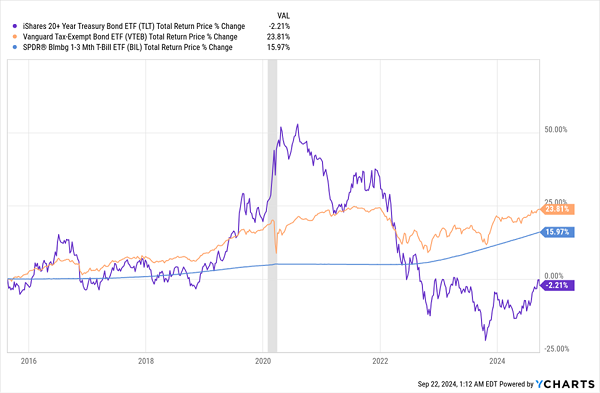

Above we see the performance of a variety of bond funds that focus on Treasury notes: the iShares 20+ Year Treasury Bond ETF (NASDAQ:TLT), in purple, for long-term Treasuries; the SPDR® Bloomberg 1-3 Month T-Bill ETF (NYSE:BIL), in blue, for short-term Treasuries; and the Vanguard Tax-Exempt Bond Index Fund (NYSE:VTEB), in orange, for municipal bonds.

Government bonds should be safe, so it’s no surprise that VTEB and TLT have earned just around 2% on average per year, between the two of them, over the last nine years (that’s the furthest back these funds can be compared, since VTEB’s IPO was on August 21, 2015).

But long-term Treasuries actually lost money over that full time period while having a lot of volatility. Not great! And when we shift to corporate-bond funds, the performance is better, but still not fantastic.

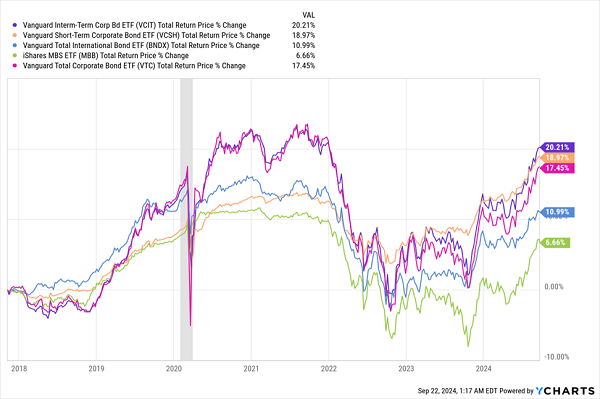

Corporate Bonds A Better Play Than Treasuries

I know there’s a lot going on in this chart, so I’ll cut to the chase: The best profit we’re getting here is 2.7% average annualized from the investment–grade focused Vanguard Intermediate Term Corporate Bond ETF (NASDAQ:VCIT), in purple. That’s about half of what you can get from a savings account now.

“Junk” Bonds Are Actually Treasures for Income-Seekers

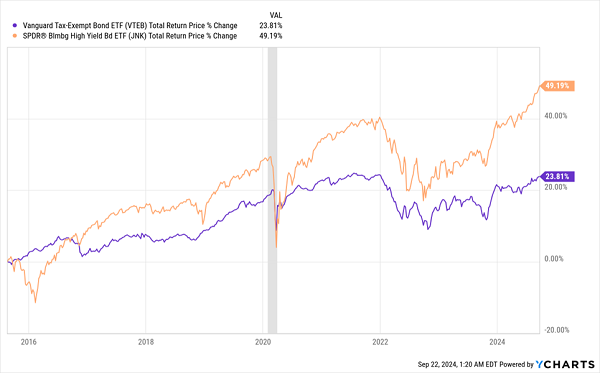

So what if we up the risk a little bit and go for high-yield corporate bonds—you know, the so-called “junk” bonds, where, at least according to common “wisdom,” defaults and bankruptcies are high and there’s a bigger risk of losing money?

Well, something surprising happens: Returns get better—and surprisingly less volatile.

“Junk” Bonds Shine

Tracing the SPDR Bloomberg High Yield Bond ETF (NYSE:JNK) back to when VTEB, our best-performing Treasury ETF from above, went IPO, we see that it posted an annualized total return of 4.5% per year, so quite a bit better. That’s the result of taking on extra risk.

And remember, that this return is just from investing in an ETF. Because bonds are more complex than stocks, we’re likely to get an even better return when we invest in an actively managed fund.

I know that also sounds counterintuitive—the ETF industry has pounded it into investors’ heads that it’s pretty much impossible for us (or, by extension, a human fund manager) to beat an index.

But in the world of actively managed closed-end funds (CEFs), it happens all the time, especially in alternative markets like bonds, real estate investment trusts (REITs), preferred shares and the like.

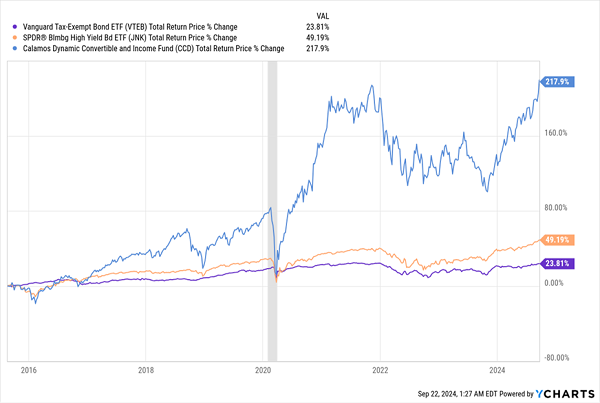

Consider the Calamos Dynamic Convertible & Income Fund (NASDAQ:CCD), which has more than tripled the return on the junk-bond index fund:

CCD Crushes the Competition

Obviously, a 217.9% total return is much better than 43.9% and 23.8%. And its 13.7% annualized total return is frankly incredible. That isn’t just more than you’d expect from a bond fund—it’s more than you’d expect from growth stocks like, say, those in the tech sector, too.

And here’s the kicker: CCD currently yields 9.4%, meaning every $100k you put in gets you about $780 per month in income.

That might sound unsustainable, but remember that CCD has earned 9.4% in profits on a NAV basis (or the performance of its underlying portfolio, rather than its market price) per year, which is much higher than its payout, so it’s generating more than enough to cover it.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."