Editorial Note: For this special edition of “Chart of the Week,” we asked our senior research analyst to look into the implications of Wednesday’s rate hike. We’ve been following this story for quite some time, and we think it’s essential that you pay close attention as well. By the time you finish this week’s article, we’re confident you’ll understand why.

It finally happened…

After seven years of holding the federal funds rate a whisker’s distance from zero, Yellen and her compatriots have officially called for a hike.

So are rates going to take off from here? I wouldn’t buckle your seatbelt just yet.

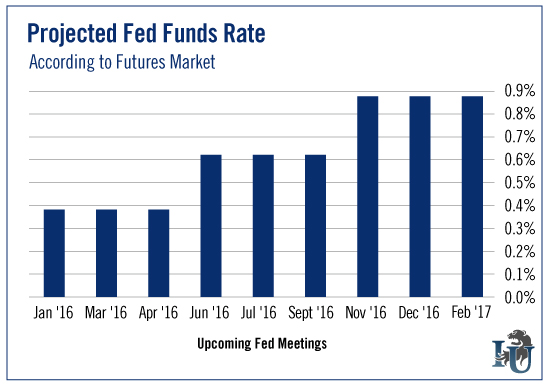

As you can see in the chart above, over the next year, rates aren’t even projected to break 1%. This is what the futures market is whispering to us, anyway.

Now investors are wondering if it’s time to jump off the mechanical bull they’ve been riding since 2008.

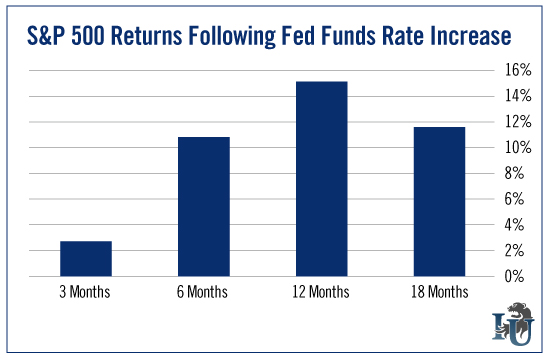

We’ve said it before, and we’ll say it again... in the short term, rate hikes are a positive thing. This time, our chart below will do the talking.

As you can see, history tells us the current bull market has more room to run. Following a rate hike, the S&P 500 averages a 15.66% return (including dividends) in the next year. So get ready to pop the champagne in 2016.

That said...

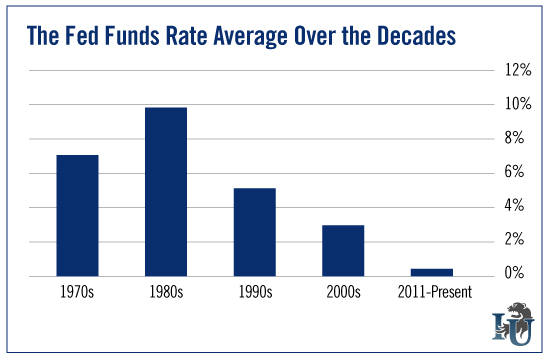

While a rate hike is good news in the short term, we worry about the long term. The reason we say that has to do with another historic metric: the average fed funds rate.

Over the last 40 years, the fed funds rate has averaged 5.31%.

And when we break it down into decades, the picture becomes very clear.

As you can see, the average fed funds rate has been dropping like a bad cellphone signal over the decades. And over the last five years, you’d need a microscope to look at rates that have averaged 0.25%.

So why should you care? Because low rates affect your life and the economy.

In a closed-door meeting earlier this week, Editorial Director Andrew Snyder reminded everyone at Oxford Club HQ not to panic... that even after a 0.25% increase, now is still a great time to buy a house or refinance.

That’s true. Mortgage rates don’t get much better than this.

But Andrew also touched on a bigger, more concerning idea we have been persistently discussing in Investment U... the death of interest rates.

See, even though the Fed just nudged rates higher, they’re still far lower than they have been historically. And they’re likely to stay that way for the foreseeable future.

We aren’t alone in thinking this, either...

The Wall Street Journal recently surveyed 65 economists on the subject. More than half of them stated that rates will likely be back near zero within five years.