With few hawkish surprises in the FOMC minutes, other than some more extensive than expected discussion around the balance sheet, the US dollar sold off as pre-event USD supportive positioning unwound.

The Fed continued to downplay the listless Q1 US economic activity and softer inflation metrics as transitory, which now accentuates the importance of next week’s economic calendar. While, the market continues to view the Federal Reserve on track for a June lift off, this decision may come down to the wire, with next Friday’s payrolls, and specifically the wages growth component, providing a gentle nudge one way or another.

While we maintain our base case for a June hike, the picture is a bit murky down the road and could continue to weigh negatively on the greenback. There’s still much ground to be covered, and despite the increased chance of a September balance sheet broadcast, if the Feds can’t convincingly guide us to an interest rate hike one month before the market event, one can only imagine the indecision and market gyrations leading up to a possible taper.

In the meantime, price action remains “passive” and “stable” amidst growing “ uncertainty”, words we seldom use in the same sentence when describing the market, but such is the reality of current market conditions.

The China downgrade has had a minimal initial impact on the markets, as it wasn’t too unexpected given the burdening debt load and in reality, China has negligible vulnerability or exposure to foreign investors, so the market quickly shrugged off the downgrade.

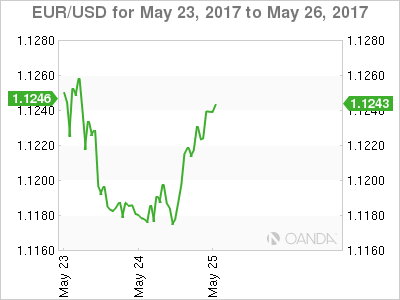

Euro

The euro moved higher despite passive comments from ECB members this week, which brings into question the recent build-up of short-term euro longs post the French election. However, it’s more likely the market views the solid performance in eurozone economic activity as speaking louder than words at this stage, and the EUR tone remains guardedly confident on expectations of shifting ECB language. While we’re seeing an early buy into the euro this morning, if ECB headlines continue to reinforce a dovish stance, long positioning could evaporate quickly.

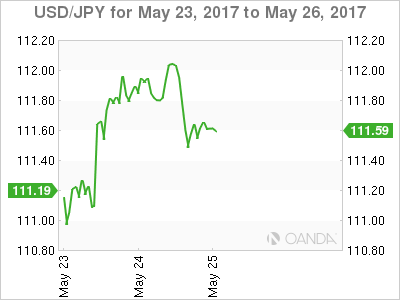

Japanese Yen

Dollar-yen movements are suggestive of position overhang from the near-term, short dollar view on the back of US political uncertainty and geopolitical risk in the Korean peninsula. The market may be stretched long JPY as a guard against a potential escalation of event risk; now dealers find themselves reluctant to add to those positions and at the same time remain pessimistic on the USD.

With few catalysts to buy dollars from the Fed minutes, dealers remain in a state of limbo, eyeing headline risk on one screen while tracking US bond yields on the other.

While USDJPY has recovered well from the 111.00 level as US yields continue to provide surprising motivation rising following a soft Treasury Bill auction, but without the needed kick from the Feds or a rebound in sagging US economic data, the pair will continue to struggle above 112.00

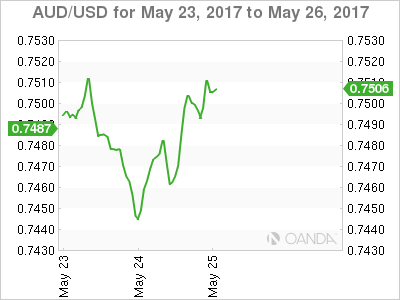

Australian dollar

The Aussie came temporarily unhinged on the China downgrade as G10 dealers use AUD as a proxy for China risk, but the move was really all about the drop in iron ore prices. Iron ore futures are struggling amidst reports that mainland steelmakers are retooling to make better use of scrap and when combined with iron ore inventories rising at 45 Chinese ports, the current view for iron ore prices doesn’t present a rosy picture.

AUD has rebounded on less hawkish Fed minutes and a bounce in WTI as we approach the OPEC meeting. But the currency will likely struggle, as it has so often of late, to gain any momentum above the .7500 handle more so as the iron ore glut remains in focus.

Asia FX

Following up on the relatively quiet Asia session yesterday when, outside the PHP which broke the 50.00 level in the NDF markets on aggressive buying after the martial law declaration, trading was dead. However, overnight activity saw decent dollar selling interest on USDKRW and USDTWD, in part driven by exporter flow but magnified by a less hawkish Fed retort.

The Ringgit broke through the critical 4.29 level as oil prices continue to move higher ahead of the OPEC meeting. The bullish momentum keeps the MYR in favour for a catch-up play to regional currencies.