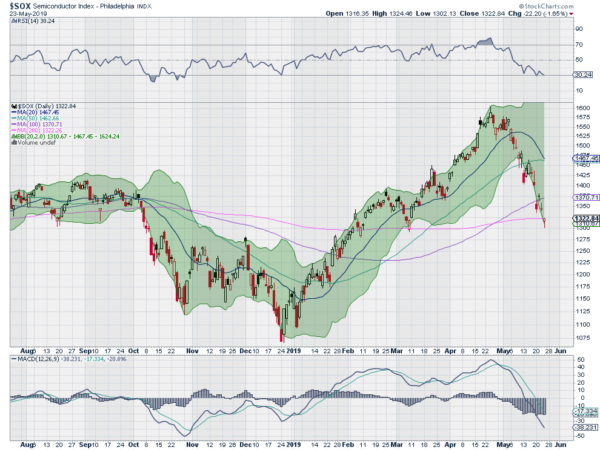

The Semiconductor Index, or SOX, was on fire until recently. It had moved up 50% off of the December low when it broke above 1600 at the end of April. The market was roaring and chip stocks were leading the charge. There was joy and euphoria everywhere.

And then it ended. The SOX started to move lower. It broke below the 50 day SMA in mid-May and then below the 100 day SMA Monday. It had not touched these moving averages since January. Thursday the SOX fell below its 200 day SMA. It recovered by the end of the day, printing a Hammer candle. This is a possible reversal candle if confirmed Friday.

And this would be a good place for it to reverse. The 200 day SMA has acted as support twice before this year. Also momentum indicators have reset, with the RSI now on the edge of being oversold and the MACD near the late October low. The SOX has also retraced more that 50% of the move to the upside.

None of these indicators guarantee a reversal will occur at this level. The SOX could easily continue back to the December lows. But it is worth noting these conditions make for a good place to start watching.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.