Do you hear the military march? The world’s largest economies are flexing their muscles and preparing for war. Will gold win the trade conflict between the United States and China?

So It Begins

Trade war. This topic dominated the recent days. Last week, President Trump announced plans for tariffs on about $60 billion of Chinese imports. In response, Liu He, China’s vice-prime minister, told Steven Mnuchin, U.S. Treasury Secretary, that China is ready to defend its interests. Indeed, on Friday the country announced plans to impose tariffs on about $3 billion of U.S. imports. So are we at war?

Markets Believe So

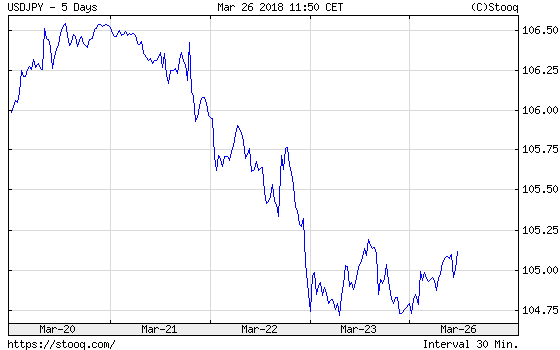

Investors worry that we are. As one can see in the chart below, the U.S. dollar plunged against the Japanese yen to the lowest level in 16 months.

Chart 1: USD/JPY exchange rate over the last five days.

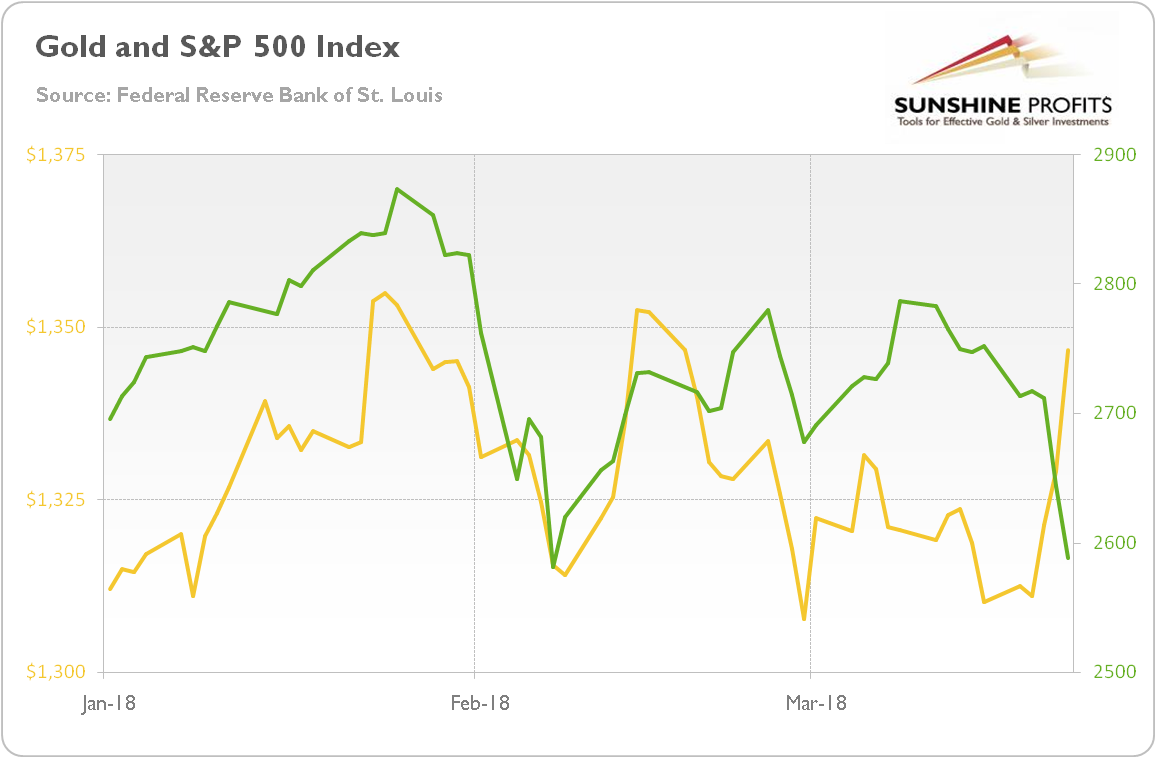

The trade dispute has also shaken the stock markets. The S&P 500 Index fell like a stone at the end of last week, as the chart below shows. As investors turned on the “risk off” mode, they escaped into safe assets, such as the Japanese yen – and gold. The price of the yellow metal hit a 5-week high on Friday, almost reaching $1,350.

Chart 2: Gold prices (yellow line, left axis, London P.M. Fix, in $) and the S&P 500 Index (green line, right axis) in 2018.

But Are We Really at War?

The narrative about a trade war and the end of the liberal world order is really scary. No wonder that the media like it so much. There is something in it, that’s for sure. But let’s step back and take a look at cold facts.

First, Trump has signed a memorandum so far. It opened a 30-day consultation period to discuss tariffs and gave the Treasury Department 60 days to develop investment restrictions to prevent Chinese companies from purchasing U.S. companies with sensitive technologies. During that waiting period, Trump’s proposal may be watered down. The upcoming days may also create space for negotiations – investors shouldn’t forget that Trump is a great negotiator and some of his craziest initiatives may be just a way to increase his leverage in negotiations. The bluster is often more impressive than the following action.

Second, the damage to China should be very modest. We strongly oppose any protectionism, but the discussed tariffs may account for only about 0.1 percent of China GDP. The world will not collapse, not yet.

Third, China’s response was rather muted. The country targeted only $3 billion in additional tariffs on U.S. goods. And, what is crucial here, it didn’t put in the key U.S. export items, such as soybeans or Boeing (NYSE:BA), on the list. Hence, the fears of a total trade war may be a bit overblown.

Implications for Gold

The concerns about global trade wars are fundamentally positive for the gold market. You see, gold behaves like a currency. You can think about the yellow metal as a bet against the current monetary system based on fiat currencies, in particular the U.S. dollar. When it weakens, gold shines. And what determines the investors’ confidence in the greenback? Well, there are several factors, but government policy is crucial here. Not only monetary and fiscal policy, but trade policy as well.

As we explained in the February edition of the Market Overview, the rising protectionist rhetoric deteriorated the perception of the U.S. as a reliable ally. You see, the U.S. was the principal architect and backer of the liberal world order. Investors worry that this order is fading now. Even if this is not completely true, it’s quite reasonable to buy some gold as insurance, isn’t? Hence, the worries about trade wars should support gold prices. However, because they seem to be a bit overblown, we could see some correction on the way.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.