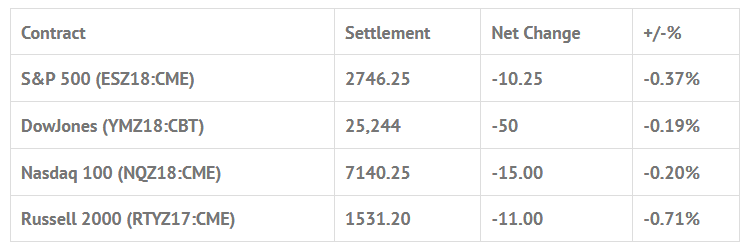

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 8 out of 11 markets closed lower: Shanghai Comp +0.33%, Hang Seng -0.38%, Nikkei +0.37%

- In Europe 13 out of 13 markets are trading higher: CAC +1.40%, DAX +1.01%, FTSE +1.24%

- Fair Value: S&P +1.39, NASDAQ +11.83, Dow -16.51

- Total Volume: 2.82mil ESZ & 1,347 SPZ traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes MBA Mortgage Applications 7:00 AM ET, FHFA House Price Index 9:00 AM ET, PMI Composite FLASH 9:45 AM ET, New Home Sales 10:00 AM ET, Raphael Bostic Speaks 10:00 AM ET, EIA Petroleum Status Report 10:30 AM ET, James Bullard Speaks 11:30 AM ET, 2-Yr FRN Note Auction 11:30 AM ET, Loretta Mester Speaks 12:30 PM ET, a 5-Yr Note Auction 1:00 PM ET, Raphael Bostic Speaks 2:00 PM ET, Beige Book 2:00 PM ET, and Lael Brainard Speaks 7:00 PM ET.

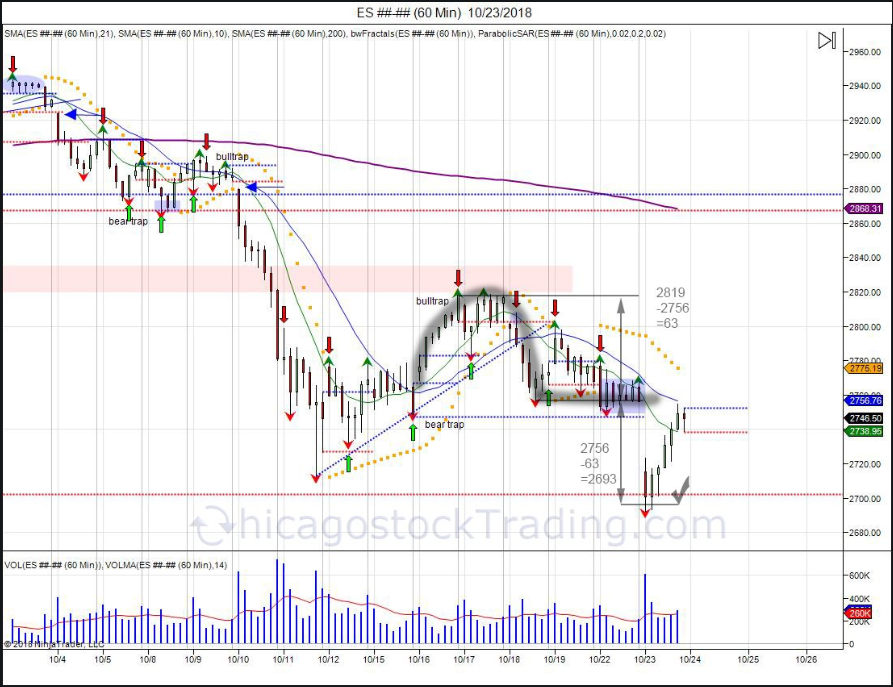

S&P 500 Futures: #ES #NQ Star Wars Bingo

Cont. from yesterday: Cup and handle pattern completed. Chart courtesy of @Chistock

After dumping early in the Asian session, and then more on the Euro session, the S&P 500 futures opened yesterday’s 8:30 CT cash session at 2715.50, up +7.25 handles from the low. The first move was a rally up to an early morning high at 2723.50. At 9:00, strong sell programs pulled the benchmark index future down to 2692.25, then the ES started to rally into the end of the first hour, and continued the push higher through the morning, printing 2717.00 just ahead of the Euro close. After dropping down to a high low at 2701.25, the futures continued the late morning rally, making a high of 2724.50.

The afternoon saw stronger buy programs pushing the ES up to 2736.25, then after a pullback to 2721.25, the futures pushed up to 2754.75 in a grinding consistent fashion, printing the high of day in the final hour before turning lower into the close on a MOC of $150 million to sell. The ES printed 2741.25 on the 3:00 cash close, and after making a late afternoon low of 2738.75, went on to settle the day at 2746.50, down -10.00 handles, or -0.36%.

In the end, it was a down hard early, up big late, and all mish mash inbetween. In terms of the days overall trade, the markets could not have acted worse early, and then acted great on the way back up. In terms of the days overall trade, volume was high, but so was the level of buy and sell programs.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.