The plethora of headlines over the past 24 hours has stirred but not shaken markets. While the focus has intensified on the barbarous atrocity in Manchester, the initial market response is subdued on the surface, but concerns about future attacks will remain elevated.

US equity market continued to plod along overnight with the S&P eking out small gains. In the forex markets; the dollar has traded firmer ahead of tonight’s Fed minutes .in what looks to be little more than pre-event position adjustments.

While the FOMC minutes are unlikely to be a game changer and with the market all but fully subscribed in the June rate hike camp, dealers will dial in on any signal that suggests a more aggressive pace of tightening along the curve. Currently, December rate hike probability is running around 60%, so there is significant room for the STIRT curve to shift and the dollar to firm.

There is a high level of cynicism surrounding the dollar, mostly stemming from US political risk surrounding the Trump administration. But if the Feds give a reason for US yields to jump and or the markets to buy dollars, the risk for one of those nasty short dollar squeezes increases ten folds, so dealers are a banking some chips ahead of the event.

However, it is hard not to be bearish the buck as corporeally nothing has changed. Investors’ confidence in the US administration is ebbing with a President under constant attack, and US economic data is middling at best. On the flip side, European economic data continues to encourage and with buy the euro signals being cast by Merkel and Schauble, it’s hard not to like the euro higher in this environment.

China Downgrade

Although presenting some initial headwinds the markets have bounced back given that China’s local markets have a minor exposure to foreign investors so the downgrade is being viewed as less impactful.But the truth of the matter is, credit agency downgrade have little lasting long-term market impact and the SHCOMP has bounced off this morning’s lows rather convincingly.

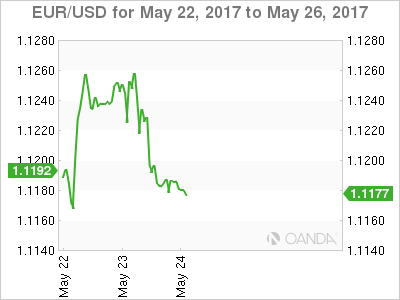

Euro

The market remains very constructive on the euro but realises the anticipated siege on the 1.1300 handle will not fall quickly, more so when short-term positions get stretched when nearing yearly EUR/USD highs. Counter trend price action was evident as the euro continued to trade a tad heavy into yesterday’s critical Eurozone economic data.

Euro zone flash PMIs for May came in slightly better than expected with a beat in manufacturing at 57.0 vs. 56.5 and German Ifo survey results beat on all fronts clocking in at record highs. While there is absolutely nothing that screams sell the euro in this data, the euro bulls were likely looking for a bigger beat on the PMI, so profit taking mode set in. Also, spirits were slightly damped after ECB Executive Board Member Benoit Coeure told a Paris gathering that there was no need to change policy. Overall, we expect the data to speak louder than words for the euro and the continents buoyant economic prints strengthens the case for the Euro higher as we approach the next ECB meeting which will be essential for the Euro’s future direction.

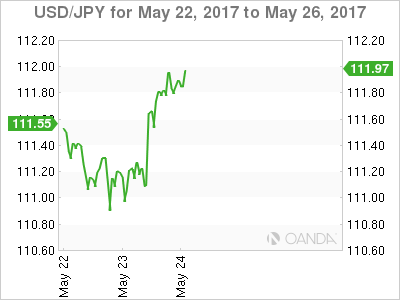

Japanese Yen

Despite headline noise, the tone in US and European markets has been slightly positive as the US equity markets have put in an impressive recovery since last week’s meltdown. In part driven by buoyant sentiment ahead of Thursdays OPEC meeting, but also reality sets in that last week collapse may have been little more than a tempest in a teapot exaggerated by unwinding of low vol carry trades that were prominent

While North Korea fears and US political risk have dealers looking lower on USD/JPY, the struggle to convincingly break the 111 level this week likely has traders heading for cover ahead of the FOMC minutes as unquestionably the market was quite short on USDJPY on the headline risk

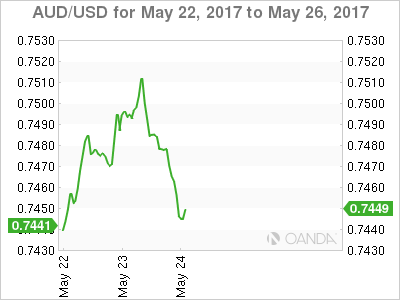

Australian dollar

The Australian dollar has benefited from the recent bounce in the commodity complex of late, and while we can attribute much of the action to Thursday OPEC meeting and the rebound in oil, we can’t overlook that fears of unbridled regulatory tightening in China have significantly diminished and this too has helped commodity sentiment. Despite running into resistance above .7500 and whiffing on its recent attempt to push higher, there appears to be some bullish momentum, but this too may give way as the Aussie which is expected to underperform on the crosses. No easy trade in this environment.

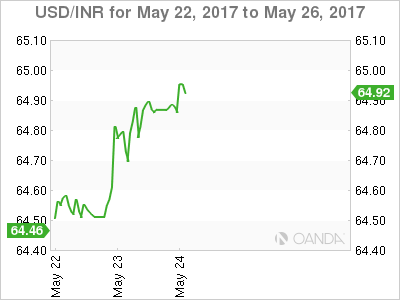

EM Asia FX

Most of the USD/Asia complex is notably higher today with USD KRW and USD/INR (both crowded trades) bearing the brunt of the move after a drone incident connected to North Korea and military escalation across the LOC. The regional flare-ups have dampened local EM positivity that ensued after a rapid dip in volatility post-Wednesday’s mini crash had investors flocking back to EM Asia. Also with the US dollar trading firmer ahead of tonight’s FOMC minutes, that may be part in parcel to investors reluctance to re-engage short $/Asia this morning. But heading into month’s end, we should expect exporter flow at these levels with traders ready to tactically engage long ASIA on any US dollar rallies.