Free After-Hours Analysis

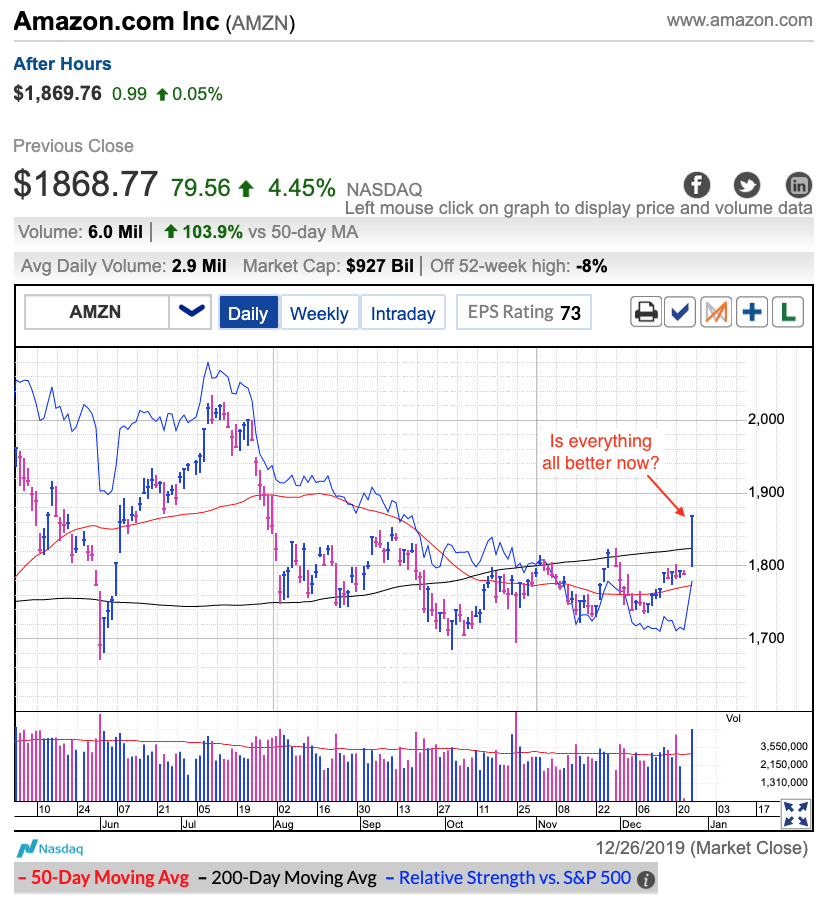

Two weeks ago I wrote a cautious post about Amazon (NASDAQ:AMZN) I explained how I was leery of this stock’s latest rebound because the prior dip lacked a compelling capitulation point. And while this remains the case, that didn’t deter traders from piling into the stock Friday. The company reported record holiday sales and that sent the stock surging nearly 5%.

Clearly I missed Friday's move and I have no problem admitting that. That’s the way this goes sometimes. Successful trading does not come from being right about everything all the time, it is based on finding the best setups and profiting from those exemplary opportunities. This often means passing on something that ends up working simply because the odds of success were lower than what we typically look for. I wasn’t bearish on AMZN, I just didn’t see the latest dip as compelling enough to be worth buying.

While Friday's performance was impressive, I wouldn’t chase AMZN at these levels. Friday’s gains could easily fizzle over the next few weeks if this demand proves fleeting. It takes more than one day to reverse a downtrend and as impressive as Friday looked, it was just a single day. I would like to see the stock hold this level for several weeks before concluding this rebound is the real deal.

There are a few reasons to be wary of Friday’s strength. First, it came during a holiday affected period. That means most institutional investors are on vacation and not participating in Friday’s buying. Second, if big money wasn’t buying, then demand was coming from retail investors and bears covering their shorts. This more impulsive based buying was evident in Friday’s one-way price action that started with smaller gains and rallied strongly all day long. That told us people were desperately chasing prices higher, not making intelligent and informed investment decisions.

Why this matters is because retail investors have shallow pockets and short-covering is a fleeting phenomenon. Until we see institutional investors support these prices by buying at these levels when they return in January, I would be leery of chasing Friday’s gains. That said, I could be wrong about AMZN again and prices could continue surging higher. But if I miss another move in AMZN, I don’t mind because trading opportunities with higher odds come along all the time.