The S&P 500 is racing to record levels, yet Amazon (NASDAQ:AMZN) is stuck in reverse, down 13% from July’s highs. What gives?

I’m not a fundamental investor and will leave the financial report crunching to someone else, but this dramatic price divergence tells us something is definitely not right with this stock, and there's a reason it lost its darling status.

If there was one thing that could have saved AMZN, it would have been a blowout holiday shopping season. But rather than cheer Black Friday’s sales numbers, investors sent the stock down 3% since Black Friday. That pretty much dashed any hope of this stock rebounding before the end of the year.

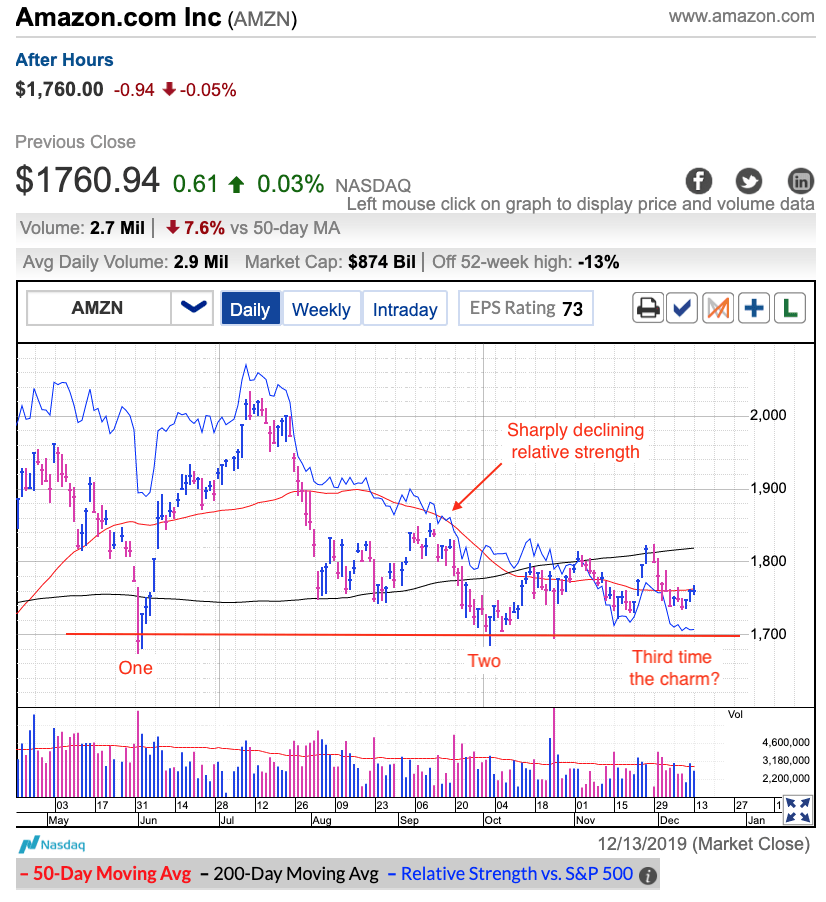

The biggest challenge facing Amazon is it is struggling to find its footing just above $1,700 support. This is a key technical level stretching back a couple of years, but more importantly, it provided critical support during the June and October dips. Unfortunately for the stock, double-bottoms are a thing, triple-bottoms, not so much. And right now the stock is threatening to challenge $1,700 support for the third time in six months.

The very fact we returned to this level for the third time is a huge red flag and should make investors nervous. But more than that are these feeble rebound attempts since the October bounce. There just isn’t any life left in this stock. If people were going to buy this rebound, they would have done it already. Slipping back to these levels again tells me the worst is still ahead of us.

But not to give up all hope, a sharp crash under $1700 could actually be a good thing for the stock. That could be the capitulation the stock needs to recover its mojo. While I wouldn’t touch Amazon right now, if it slices through $1700 support in a fantastically ugly way, but then bounces back days or weeks later, that would be a compelling signal the stock is finally buyable again.