July nonfarm payrolls came in line with expectations, confirming the strength of the U.S. labor market. So far so good. With the markets more focused now on the escalation of the trade war triggered by Trump's tweet last Thursday, the stock market plunged while gold rallied. Can the upcoming news take gold higher still?

Payrolls In Line With Expectations

The U.S. created 164,000 jobs in July, following a strong increase of 193,000 in June (after a downward revision). The nonfarm payrolls were in line with expectations and widespread, but with a leading role by education, health services (+66,000) and professional and business services (+38,000). Retail trade, mining, utilities and information also cut jobs.

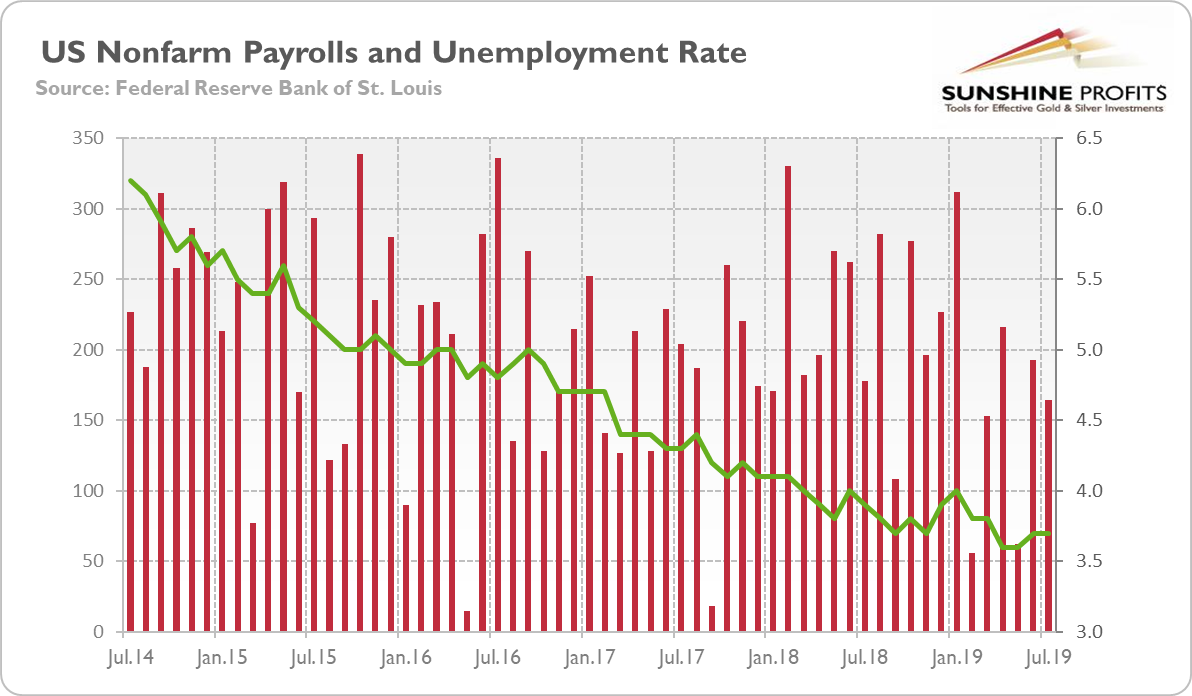

However, the headline number was accompanied by downward revisions in June and May. Counting those revisions, employment gains in those two months combined were 41,000 lower than previously reported. Consequently, job gains have averaged 140,000 per month over the last three months, which is lower than several months ago (in 2018, the average gain was 223,000 per month). Although the pace of hiring has slowed (see the chart below), the U.S. economy is still creating jobs at a reasonable pace. That job creation kept the unemployment rate at 3.7 percent, near a 50-year low. Simultaneously, more people entered the labor force in search of work, while wage inflation increased from 3.1 to 3.2 percent. Hence, the U.S. labor market is strong and fuels the record-long expansion. From the macroeconomic point of view, the domestic economy is still doing reasonably well.

And that's bad for gold prices.

Chart 1: U.S. nonfarm payrolls (red bars, left axis, change in thousands of persons) and the unemployment rate (green line, right axis, %) from July 2014 to July 2019.

Who Cares about the Labor Market during Currency Wars?

However, investors focus now on the concern over weak global growth and trade policy. On Thursday, Trump threatened to apply more tariffs to Chinese goods amid a stalemate in talks over trade rules. President tweeted that "small" additional tariff of 10 percent on the on the remaining US$300 billion in Chinese imports will be imposed from September 1:

(...) We thought we had a deal with China three months ago, but sadly, China decided to renegotiate the deal prior to signing. More recently, China agreed to buy agriculture product[s] from the US in large quantities, but did not do so (...) Trade talks are continuing, and during the talks the US will start, on September 1st, putting a small additional tariff of 10 percent on the remaining 300 billion dollars of goods and products coming from China into our Country. This does not include the 250 Billion Dollars already Tariffed at 25%...

The stock market plunged, as investors repriced the risk to the economy from the trade war. Yesterday, the S&P 500 fell further, after the decline in the value of yuan against the U.S. dollar. The exchange rate tumbled below 7-per-dollar, the lowest level in more than a decade. In response, the U.S. government has designated China as currency manipulator for the first time since 1994. Adding to the tensions, China's Commerce Ministry said Chinese companies have stopped buying U.S. agricultural products and that China will not rule out imposing import tariffs on U.S. farm products that were bought after August 3. It will hurt Trump, who counts on the farmers' votes.

Implications For Gold

The escalating trade tensions between the U.S. and China added fuel to gold's rally, which shouldn't be surprising as the trade war has entered a new phase. The fact that the People's Bank of China allowed the yuan to depreciate is a sign that China has thrown in the towel on any trade agreement with the U.S. coming anytime soon. As trade wars have just transformed into currency wars, investors turned toward safe havens. In a world of negative bond yields, gold looks relatively attractive.

Moreover, the renewed conflict with China increases the odds of more rate cuts from the Fed. Indeed, the markets now see the dovish move as certain (with an almost 25 percent chance of 50-basis points cut) compared to 67.5 percent one week ago. These expectations may be slightly exaggerated, but they should support gold prices in the very short term. Our view remains that the Fed will cut interest rates only once more this year, in December, if at all. That would make for a decline in gold prices later on. Fundamentally, though, the escalating trade war provides support to gold.