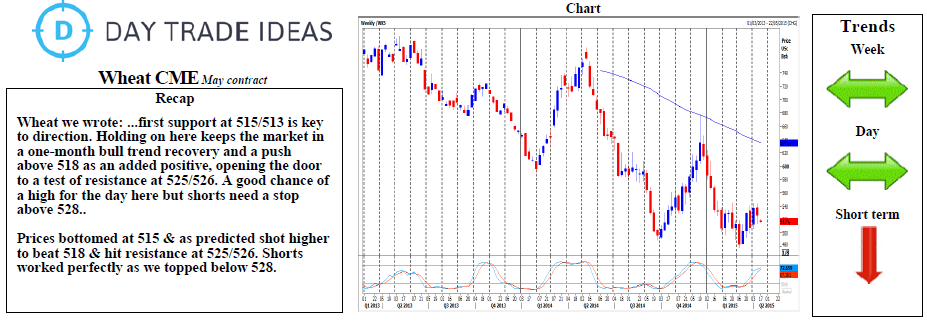

Wheat has gapped open lower this morning for a profit taking opportunity on our shorts. First support at 515/514 is key to direction and should be worth trying longs with stops below 512. Holding on here keeps the market in a one-month bull trend recovery and a push above 518 once again today re-targets resistance at 525/526. A good chance of a high for the second day here but shorts need a stop above 528. A close above 528 is more pod for this week and targets 530/531 then resistance at 534.

Failure to hold above 514 however is a negative signal. A resumption of the longer-term negative trend then targets 509/508 and 506. If this does not hold the downside look for 503 then 501/500.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.