Kirkland's Inc. (NASDAQ:KIRK) is slated to report second-quarter fiscal 2017 results on Aug 22, before the market opens. We note that the company’s earnings have missed the Zacks Consensus Estimate in two of the trailing four quarters, with an average miss of 16.8%.

With this in mind, let’s look into some factors that are likely to impact second-quarter results of this specialty retailer of home decor products.

What Does the Zacks Model Unveil?

Our proven model does not show that Kirkland's is likely to beat estimates this quarter. This is because a stock needs to have a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) as well as a positive Earnings ESP for this to happen. You may uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Kirkland's has an Earnings ESP of 0.00% as both the Most Accurate estimate and the Zacks Consensus Estimate are pegged at a loss of 28 cents. The company carries a Zacks Rank #3, which increases the predictive power of ESP. However, its ESP of 0.00% makes surprise prediction difficult.

Which Way are Estimates Treading?

A look into estimate revisions give us an idea of what analysts are thinking about the company right before earnings release. The Zacks Consensus Estimate for the second quarter as well as for fiscal 2017 has remained stable over the past 30 days. Estimated loss of 28 cents for the second quarter depicts a year-over-year decline of 28.8%. Estimated earnings of 53 cents for fiscal 2017 also depict a year-over-year decrease of 21.6%.

Further, analysts polled by Zacks expect revenues of $126.4 million for the second quarter which depicts a growth of 2.8% from the prior-year period. The same for fiscal 2017 are expected to be $621.1 million, up 4.5% from the previous year.

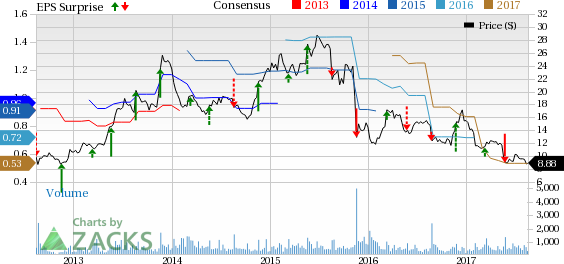

Kirkland's, Inc. Price, Consensus and EPS Surprise

Factors Impacting the Quarter

Kirkland's has been struggling with higher operating expenses for several quarters now, primarily due to an increase in store occupancy costs. The higher costs also resulted from increased shipping, higher store payroll and benefits expenses. Planned increases in advertising costs and packaging expenses have also pressurized margins in the past few quarters. E-Commerce related operating expenses also add to the expenses.

Kirkland’s has been experiencing low traffic over the past few quarters and expects the trend to persist in fiscal 2017 as well. Lower traffic due to tough retail environment has also resulted in lesser comps. Including online sales, comps declined 3.8% in the first quarter of fiscal 2017. Further a difficult consumer spending environment also poses concerns in Kirkland’s’ top-line growth.

Such headwinds are well reflected in the company’s share price performance. The stock has plunged 22.1% over the past six months against the industry’s increase of 12.4%.

In an effort to reduce costs and induce efficiency, Kirkland’s is closing the smaller underperforming stores in the malls and expects to open bigger off-mall stores at popular locations which are likely to boost sales. Moving ahead, the company intends to inaugurate 25 to 30 new stores and close 20 stores in fiscal 2017. Kirkland’s is also focusing on upgrading its information system to maintain growth and momentum in its e-Commerce business. The company has redesigned and leveraged the rollout of new information systems to improve online purchase and planning execution.

Although the company is trying to improve its omni-channel and attract customers to its e-Commerce business, it lags when compared with stronger performers such as Amazon.com (NASDAQ:AMZN) . Further, its e-Commerce and store expansion related expenses are expected to add to the ongoing trend of surged operating expenses. Though the company is taking initiatives to revive itself, we believe it will take time to show sturdy and positive results.

Do Retail Stocks Interest You? Check These

Here are some other retail companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

Wal-Mart Stores, Inc. (NYSE:WMT) has an Earnings ESP of +0.94% and carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Best Buy Co., Inc. (NYSE:BBY) has an Earnings ESP of +1.59% and carries a Zacks Rank #2.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Best Buy Co., Inc. (BBY): Free Stock Analysis Report

Wal-Mart Stores, Inc. (WMT): Free Stock Analysis Report

Kirkland's, Inc. (KIRK): Free Stock Analysis Report

Original post

Zacks Investment Research