Duluth Holdings Inc. (NASDAQ:DLTH) is slated to report second-quarter fiscal 2017 results on Sep 5, after the market closes. We note that the company surpassed the Zacks Consensus Estimate in two out of the trailing four quarters, with an average beat of 1.4%.

With this in mind, let’s look into some factors that are likely to have an impact on second-quarter results of this apparel retailer.

Which Way are Estimates Treading?

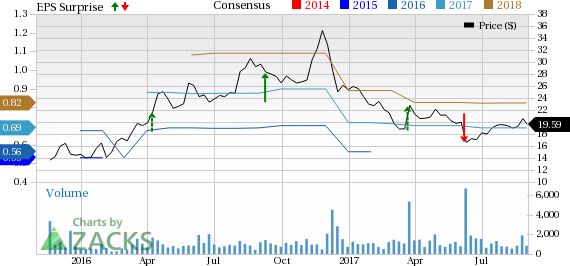

A look into estimate revisions give us an idea of what analysts are thinking about the company right before earnings release. The Zacks Consensus Estimate for the second quarter as well as for fiscal 2017 has remained stable over the past 30 days. Estimated earnings of 10 cents for the second quarter depict a year-over-year decline of 7.6%. However, estimated earnings of 69 cents for fiscal 2017 depict a year-over-year increase of 4.6%. The same is also within the managements guided range of 66-71 cents for fiscal 2017.

Further, analysts polled by Zacks expect revenues of $82.8 million for the second quarter which depicts a growth of 25.9% from the prior-year period. The same for fiscal 2017 are expected to be $462.9 million, up 23% from the previous year. The same is also within management’s guided sales range of $455-$465 million for fiscal 2017.

Duluth Holdings Inc. Price, Consensus and EPS Surprise

What Does the Zacks Model Unveil?

Our proven model does not show that Duluth Holdings is likely to beat earnings estimates this quarter. This is because a stock needs to have both a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) and a positive Earnings ESP for this to happen. Duluth Holdings carries a Zacks Rank #3 but has an Earnings ESP of -1.64%, consequently making surprise prediction difficult. You may uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Factors at Play

Duluth Holdings has been witnessing sturdy year-over-year growth in its revenues for the past 29 consecutive quarters. The company has been gaining from the strong growth in both its direct and retail segment, backed by robust men’s and women’s business lines. A higher product-margin owing to favorable product mix and strong strategic management policies have been boding well for company. Additionally, the company’s stores have also been depicting strong performance, which has further encouraged it to focus to new store openings. During the first quarter of fiscal 2017, it opened four new retail stores. The company has plans to open a total of 12 retail stores and one outlet store in fiscal 2017.

Nevertheless, the company expects selling, general and administrative expense ratio to increase from figures in last year due to retail store pre-opening expenses. An aggressive promotional retail environment has also been raising concerns since it carries the risk of pulling down margins. Moreover, the company has also been experiencing a decline in shipping revenues in its direct business category. These headwinds having been taking a toll on the company’s share price performance. Shares of Duluth Holdings have declined 3.5% compared with the industry’s increase of 5.3% in the past six months.

Stocks with Favorable Combination

Here are some companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

V.F. Corporation (NYSE:VFC) has an Earnings ESP of +0.97% and carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Guess? Inc. (NYSE:GES) has an Earnings ESP of +1.47% and carries a Zacks Rank #2.

Callaway Golf Company (NYSE:ELY) has an Earnings ESP of +5.81% and carries a Zacks Rank #2.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Callaway Golf Company (ELY): Free Stock Analysis Report

V.F. Corporation (VFC): Free Stock Analysis Report

Guess?, Inc. (GES): Free Stock Analysis Report

Duluth Holdings Inc. (DLTH): Free Stock Analysis Report

Original post

Zacks Investment Research