Ever since the news of a Chinese delegation heading back to Washington on Aug 21-22 for renewed trade talks broke out during Thursday’s Asian session, fresh bouts of ‘risk appetite’ made its way back to the FX market. By NY 5pm, the Oceanic currencies (AUD, NZD) came on top as the out-performers, followed by a solid recovery in the euro, while sterling’s strength remains unimpressive. The Swiss Franc, the Japanese yen and to a lesser extent the US Dollar all printed losses for the day, with the loonie being an outlier, as it losses nearly as much as the Japanese yen despite a fairly robust ‘risk on’ environment.

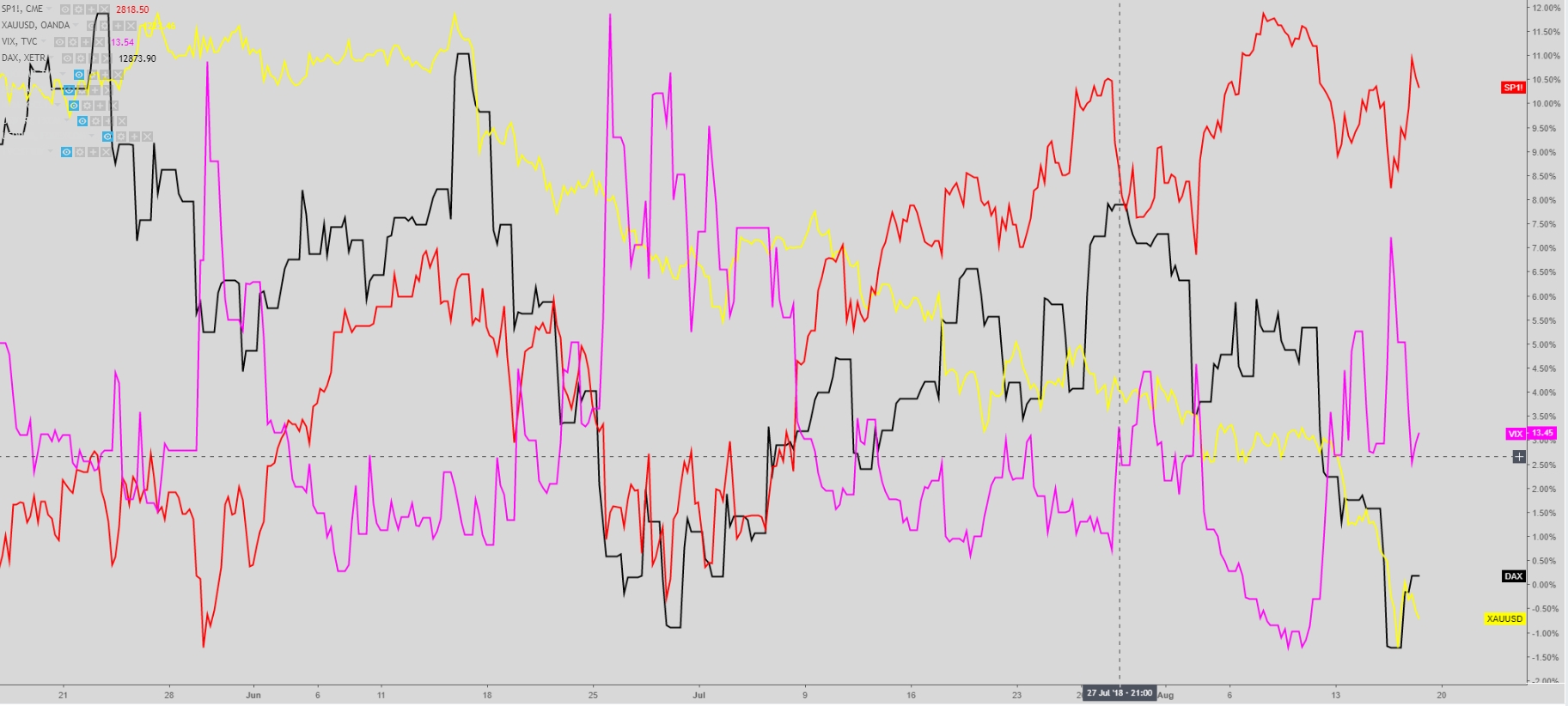

More friendly ‘risk appetite’ environment as shown above

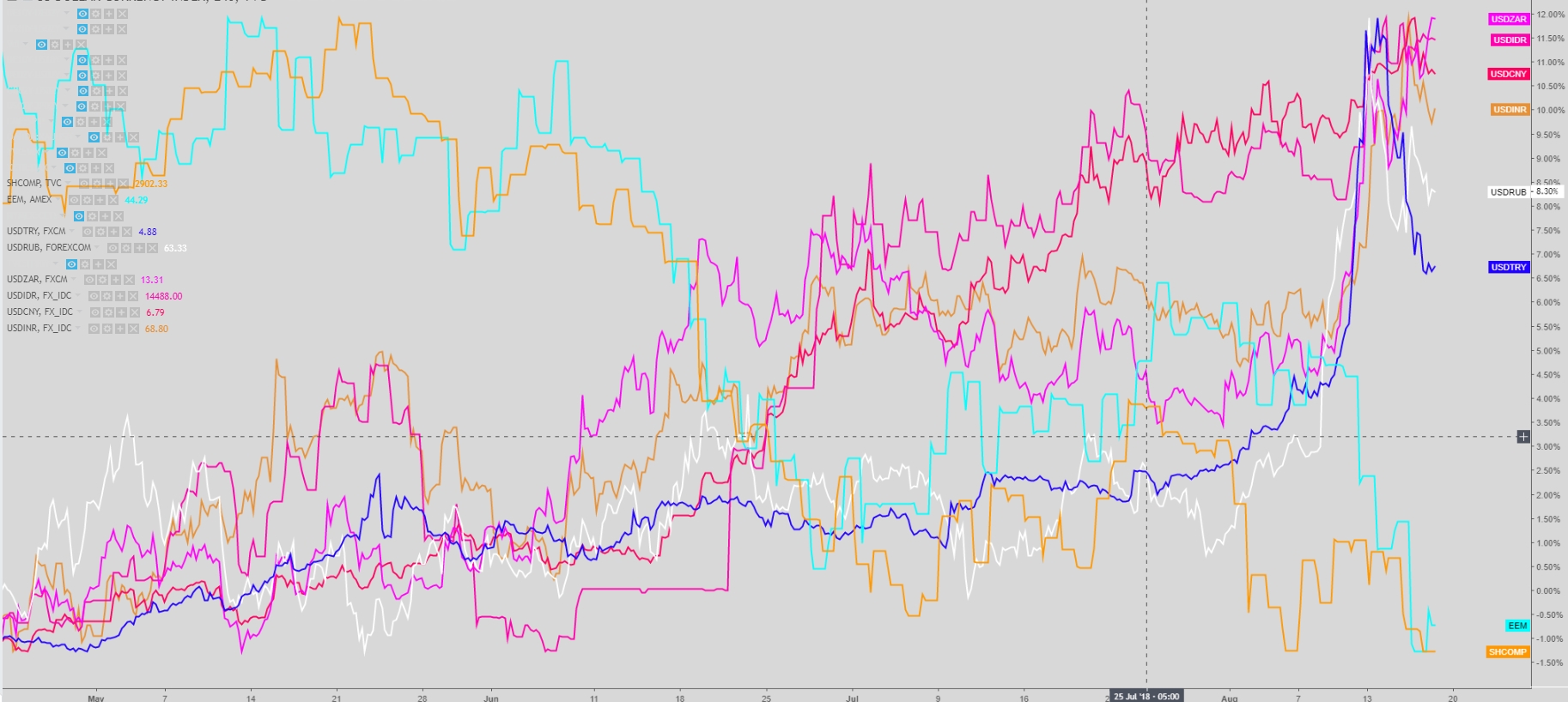

Some of the most vulnerable emerging markets saw a minor recovery, as it’s the case of the Turkish Lira, that continues to pare some of its recent huge losses. We are seeing a temporary reprieve within the context of a situation that still remains dire, judging by the weakness in the MSCI EM index, the Shanghai Composite or the continued weakness in some EM currencies such as the South African Rand, Indonesian Rupiah, to name a few.

EM remains a source of concern, TRY, RUB recovering

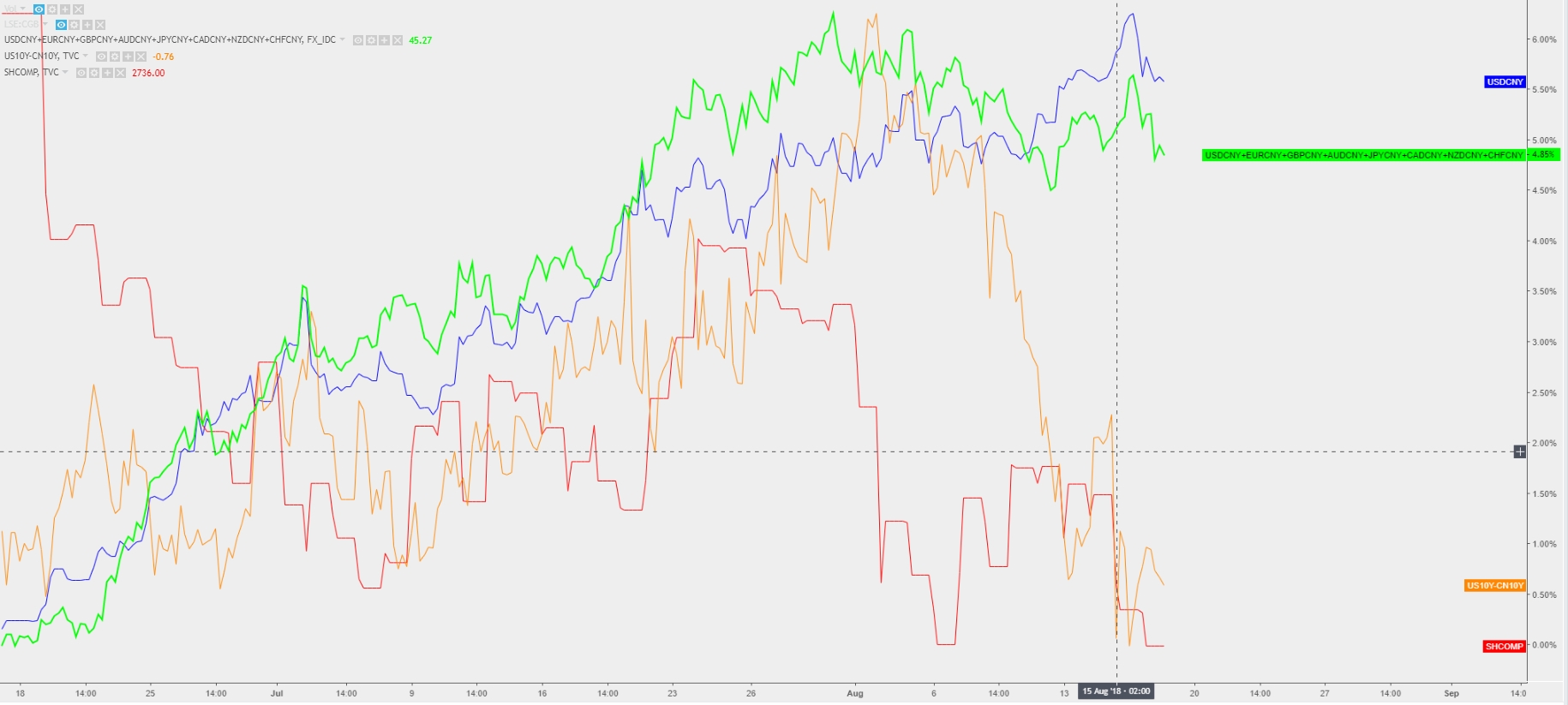

However, for the time being, the gains in the Chinese Yuan, Russian Ruble, Lira, along with buoyant global equities (SP500 near record highs), should be interpreted as a respite, as the market discounts the news of China. The long squeeze in the USD/CNH 1-year forwards helped the recovery in the onshore Yuan, as it makes it even more expensive for speculators to short the Chinese currency as it will now cost more to sell via the offshore market (CNH).

Chinese markets: CNY strengthens, equities under pressure

At the heart of Thursday’s move is the glimmers of hope that China and the US will be able to reconcile some of its current disagreements, however, usual caveats apply, and one should not hold his/her breath as the whole assumption of a recovery in sentiment is just one Trump tweet away from being negated and most likely back to square one and risk aversion to return.

On Thursday, we had an early spoiler of how bumpy the road remains, with White House Economic Advisor blatantly saying that China’s economy “looks terrible”, adding that the story of 2018 is that the US economy is shooting the light out “crushing it”. Not the best approach to build a more constructive narrative towards trade agreements. Besides, the US keeps its hard-line stance on Turkey, suggesting that more sanctions are prepared on Turkey if Pastor Brunson is not released. Meanwhile, Trump entertained himself with tweets over the solid path of the US economy.

In terms of economic data, on Thursday we learned that the Australian labor market is cruising along just fine, after a robust recovery in full-time jobs and a falling unemployment rate, nearing the 5% mark, which is where the RBA projects its headed by next year. The figures managed to offset a disappointing headline number amid lower part-time hires and a participating rate.

In other breaking and surprising news, export growth in Japan is waning, and at a rapid pace it appears, which led to July’s trade balance to come much worse-than-expected at -231bn vs -41.2bn exp. It looks as though the trade war, amid such poor numbers, will only get more tricky, as Japan is heavily reliant on international trade. Not good augurs for the BoJ hawkish case, although that’s a story for probably the next decade, so the market won’t bother at this point.

Meanwhile, with a thin economic calendar in Europe, the main data highlight was the UK retail sales, coming at 0.7% vs 0.2% exp, mainly driven by the World Cup effect as well as improved weather conditions. The Sterling had a paltry 20p reaction in response and strengthen the notion that the current recovery remains a by-product of the USD long liquidation by and large. The main culprit of the soggy Sterling performance is the fact that risks of a no-deal on Brexit have gone up significantly in recent weeks, while inflation and wages in the UK appear well contained.

Shifting gears, in the US/Canada, the US Aug Philly Fed came weak at 11.9 vs 22 exp, which does not bode well for the ISM index going forward, as it’s likely to be fed into it; it’s the lowest level since late 2016 and it suggests that higher rates in the US might be starting to bite. In terms of US housing starts, the number came slightly lower although within familiar ranges. Lastly, the US initial jobless claims w/w stood steady. As per the Canadian economy, the ADP July employment report came upbeat although this is not a report that moves the needle on the CAD, with the Canadian June manuf sales coming at 1.1% vs 1% exp.