Editorial Note: With the passing of the JOBS Act, the pool of opportunities available to investors has greatly expanded. In this special edition of Chart of the Week, Early Investing co-founder Andrew Gordon shares his valuable insight on how startups are changing the investment game. We hope you enjoy his thoughts below.

Ride-hailing startup Uber made headlines (again) recently when it graciously accepted a $3.5 billion investment from the Saudi government.

That’s a lot of money, even for Uber. So far, it has raised $12.5 billion from the private markets.

What’s interesting is that the company could have chosen another route. It could have raised that amount - or more - via an IPO.

But it chose not to... and it’s not alone.

IPOs have dried up. Almost completely. This is a historically extreme drought. The first quarter of this year saw zero tech IPOs. The last time that happened? Way back in the early 1990s.

The trend is frustrating a lot of startup investors. They can’t cash out on their lucrative investments until an IPO happens.

Fred Wilson, co-founder and managing partner of Union Square Ventures, isn’t hiding his annoyance. He recently blogged, “Man up! Woman up! F------ do it! Don't be chicken!"

Wilson isn’t invested in Uber, by the way. But he definitely had it in mind. He said CEO Travis Kalanick is “wimping out.” And he added: “That should be a publicly traded company.”

It’s an open secret that private companies are staying private longer. My partner Adam Sharp and I talk about this often in our free e-letter, Early Investing.

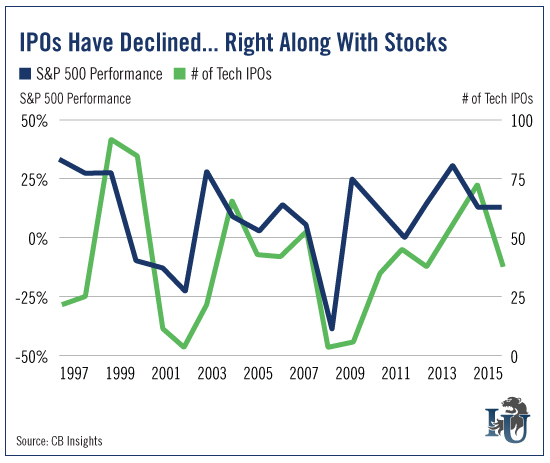

It suggests that Wilson’s anger shouldn’t be directed at CEOs... but rather at public markets. As you see, tech IPOs lag the S&P by a quarter or two.

IPOs followed the market down in 2007 and 2008. Then, after stocks bottomed in February 2009, IPOs quadrupled on the heels of the market’s recovery.

Flash-forward to 2013. We see the market surging. IPOs dutifully followed. In 2014, 73 were launched.

But in 2015, the S&P 500 stalled again, gaining just 1.4%. And, as I’m sure you recall, 2016 started off dismally. By February 11, the S&P 500 had already lost 10.5%.

Once again, IPOs followed suit. As I mentioned, the first quarter saw none. So far in the second quarter - only two.

What has changed in the past couple of decades can’t be blamed on startup founders. They’re behaving the same now as they did 20 years ago. They see a scuffling market, they hold off on their IPO plans.

When they see the market rebounding, they’ll be more willing to IPO.

What has really changed is the behavior of certain early investors (sorry, Fred). More specifically, the ones who invested in the early rounds and are sitting on hundreds of millions of dollars in profits. They’d like to cash out sooner rather than later.

Then there’s the other camp of investors - from the private equity firms, mutual funds, hedge funds and sovereign wealth funds. They’ve mostly invested in the later rounds at much higher prices. In some cases, they invested when valuations were going through the roof.

These investors would rather wait than see their startups IPO when the public markets are down. That would mean lower IPO prices that would cut into their already thin profit margin.

Early investors aren’t exactly speaking in one voice these days. But they will soon... because the markets are now recovering.

In a quarter or two, we’ll see more IPOs. And at prices most early investors will be happy with.

This is not a game of chicken. IPOs are all about timing. Always have been. Always will be.