Earlier this week, Japan announced that its gross domestic product had declined again, pushing the country into recession -- the definition of which is two consecutive quarters of negative GDP. Most economists were expecting Japan's economy to show positive growth since it has been devaluing the yen at an alarming rate. Unfortunately, the Japanese economy sank by 1.6 percent instead of growing by the 3 percent expected by most economists.

Very Bearish

That news is not encouraging for Japan and it should be viewed as a very bearish indicator for the global economy as well.

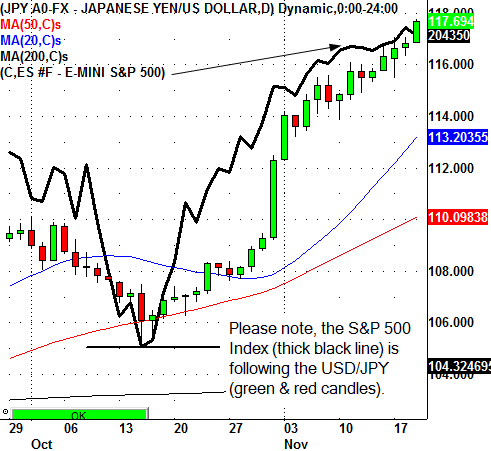

One of the main catalysts for the strong stock market in the United States has been a weak yen. You see, large financial institutions short (bet against) the yen by buying U.S. dollars against it -- a move known as the 'yen carry trade'. Those large financial institutions then take the leveraged proceeds from their short trades and buy the S&P 500 Index. Which is why the market will often rise when the U.S. dollar trades higher. Remember, a weak yen is one of the key reasons why the U.S. dollar has been strengthening over the past couple of years. Prior to the Japanese money-printing experiment, the S&P 500 would only rally when the U.S. dollar declined in value against the other leading currencies. The devaluing of the yen has actually allowed the U.S. dollar and the S&P 500 to strengthen and trade higher simultaneously.

Right now it seems that the stock market can continue to rally until USD/JPY starts to decline. Last week, the Bank of Japan announced that it was increasing its stimulus -- more money printing, which drove JPY to fresh, multi-year lows against the USD. And that news rallied U.S. markets to new highs. It seems that the stock market only cares about a weak and falling yen; even news of Japan's recession did not affect the U.S. markets.

Remember The Free Fall?

Japan's debt-to-GDP is now over 240 percent -- more than double any European nation. We all remember what happened when Greece reported debt-to-GDP of more than 120 percent. Its stock market went into free fall. We now have to look at Japan as the country that could send the global stock market into a free fall if an outright collapse happens.

Now understand that this could still be several years away. But when leading Japanese ADR's (American Depository Receipts) such as Toyota (NYSE:TM), Honda (NYSE:HMC) and Sony (NYSE:SNE) are making lower highs on the charts instead of new highs, it should be very alarming. After all, Japan is printing more money than any other central bank and the desired results are just not there.

Bottom Line

Brace yourselves. When the Japanese financial system goes, the entire global financial system is likely to go with it.